WIBTA if I don’t co-sign a mortgage loan with my sister?

Imagine a young woman, juggling rent and responsibilities in her parents’ bustling home, where four disabled cousins need constant care. The air is thick with expectation as her family leans on her steady job and solid credit score to anchor their dreams. But when her older sister demands she co-sign a half-million-dollar mortgage—while barring her from living in the house—the tension boils over. Threats of raised rent and family exile push her to the edge.

This Reddit tale unravels a knot of family loyalty, financial pressure, and personal boundaries. Caught between her sister’s ambitions and her parents’ shaky finances, she faces a choice: sign the loan and risk her future, or stand firm and face their wrath. It’s a story that sparks questions about obligation and self-preservation, pulling readers into a drama that’s all too relatable.

‘WIBTA if I don’t co-sign a mortgage loan with my sister?’

Family dynamics can feel like a tightrope walk, especially when money’s involved. The original poster (OP) is caught in a bind: her sister wants her to co-sign a $500,000 mortgage, but won’t let her live in the house. Dr. Lindsay Gibson, a clinical psychologist, notes, “Enmeshed families often blur boundaries, expecting sacrifices that harm individual well-being” (Lindsay Gibson). OP’s family is leveraging her financial stability while dismissing her needs, creating a toxic dynamic.

The OP’s sister, paired with an unemployed fiancé, expects her to shoulder massive liability without direct benefit. Her parents, drowning in debt, threaten to raise rent or cut ties if she refuses, weaponizing family ties. This reflects a broader issue: financial coercion in families. A 2022 study from the National Financial Educators Council found 65% of young adults feel pressured to financially support family, often at personal cost (NFEC). OP’s steady income and credit make her a target, not a beneficiary.

Gibson advises setting firm boundaries to protect personal goals. Co-signing exposes OP to ruin if her sister defaults—her credit could tank, blocking future loans or rentals. Her parents’ promise of future help feels hollow, given their track record with her car loan. Instead, OP should explore affordable housing options, like shared rentals, to escape this cycle. Asserting her refusal calmly but firmly can preserve her financial health while signaling she’s not a resource to exploit.

For OP, moving forward means prioritizing her future. Financial advisor Suze Orman warns, “Co-signing a loan is like lending your credit score—expect it to take a hit” (Suze Orman). She should lock her credit to prevent unauthorized moves and seek legal advice if threats escalate. Building independence, perhaps through a live-in caregiver role as Reddit suggested, could free her from this trap. Open dialogue with her family might help, but only if they respect her boundaries.

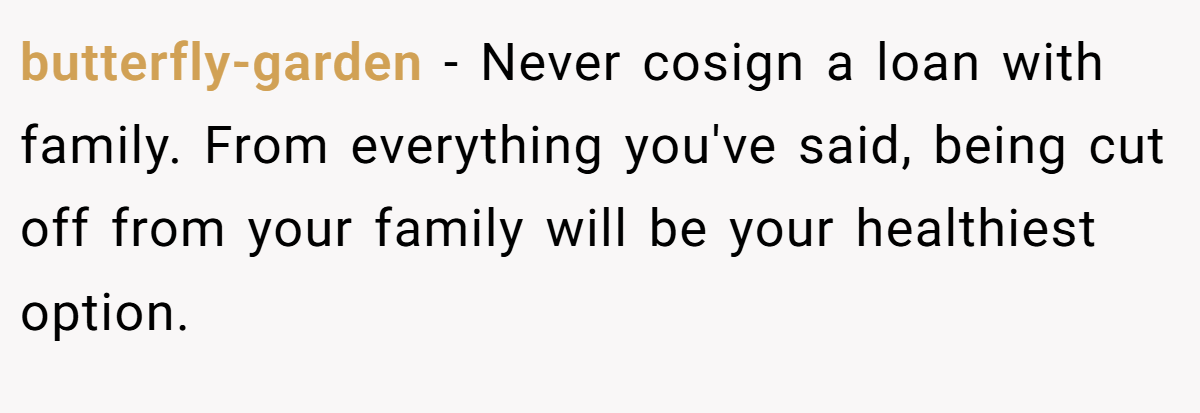

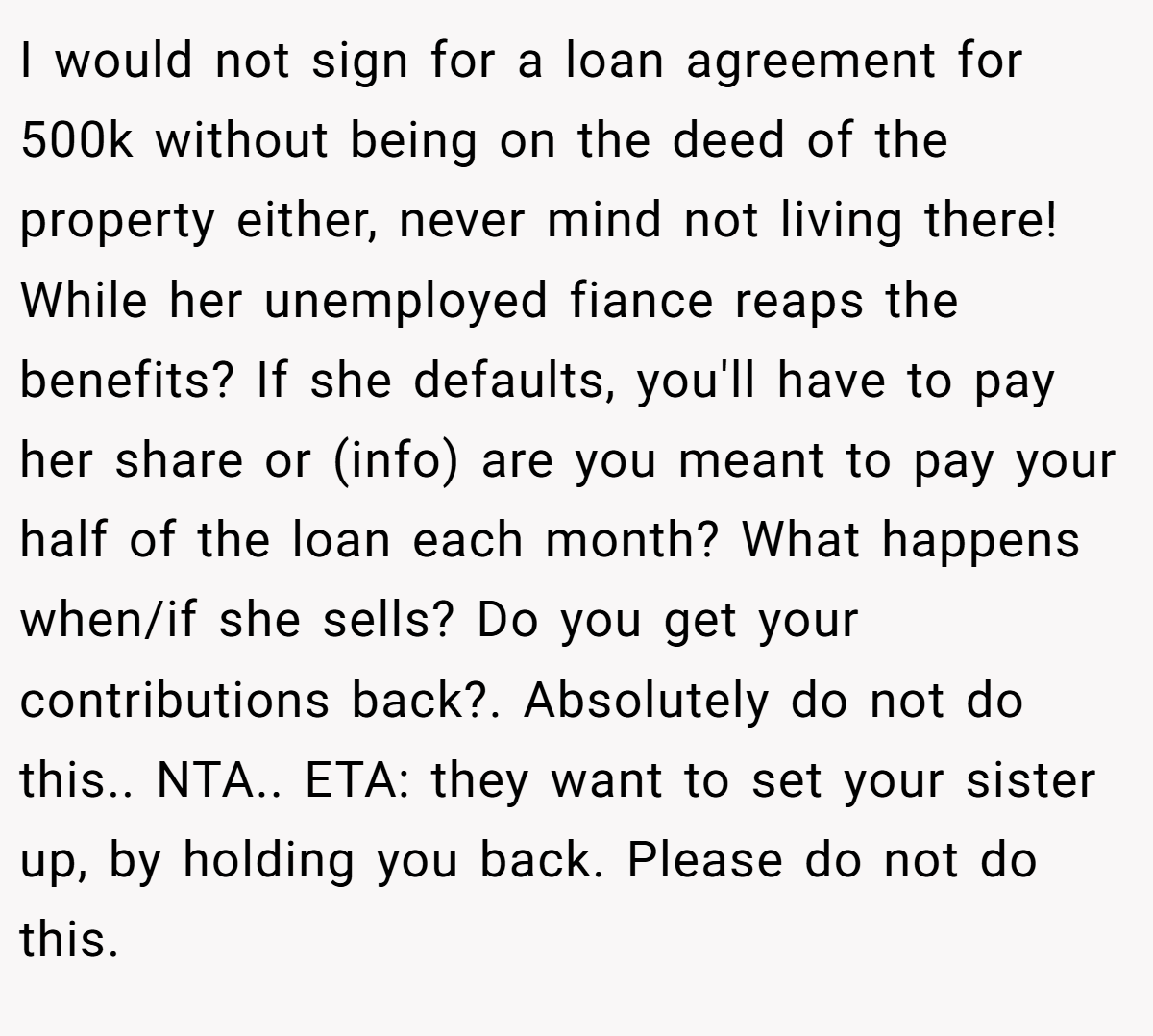

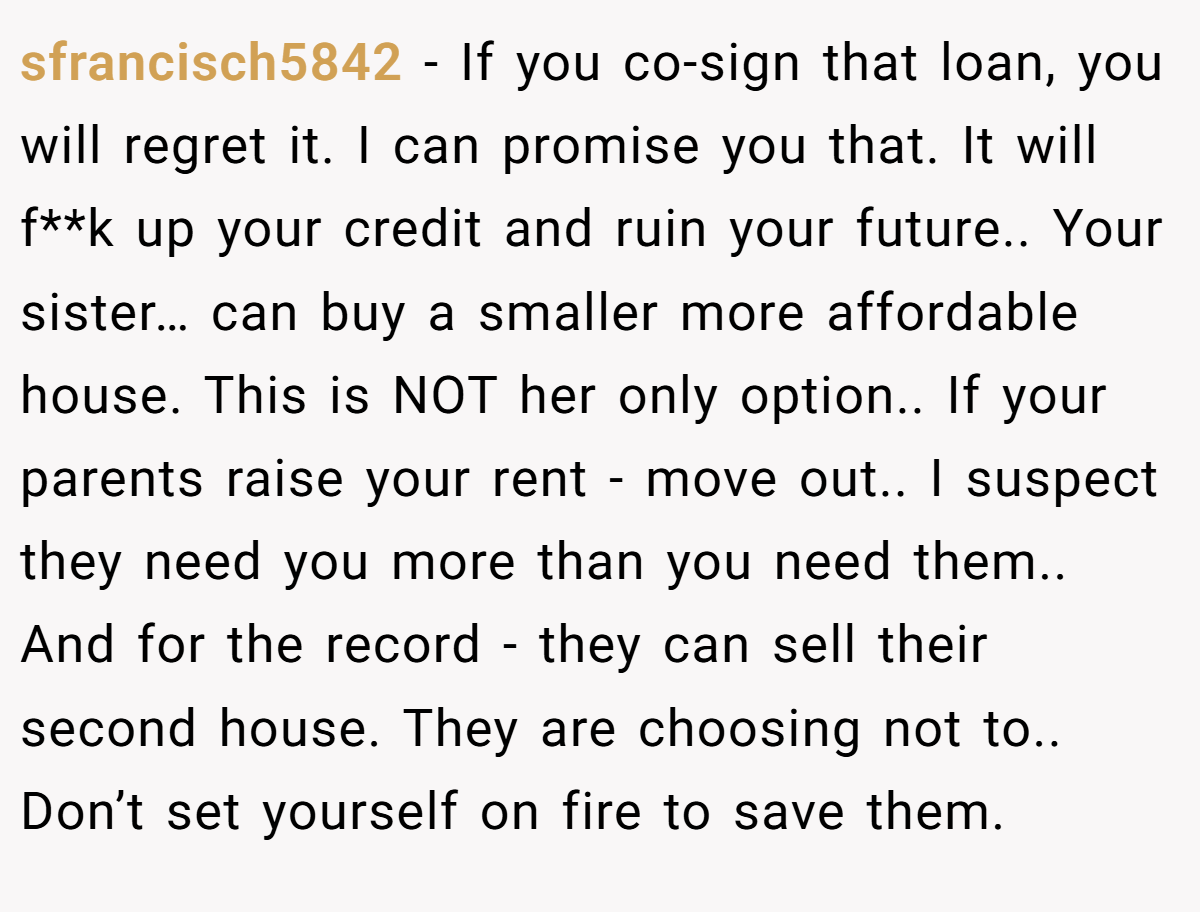

Here’s the comments of Reddit users:

The Reddit squad rolled in with pitchforks and wisdom, dishing out a fiery mix of support and reality checks. Here’s the unfiltered pulse from the crowd, buzzing with indignation and practical advice:

Reddit’s verdict is clear: OP’s family is strong-arming her into a risky deal. Commenters urge her to flee this financial quagmire, warning of credit ruin and toxic ties. Some suggest her family’s threats reveal their true priorities—using her, not supporting her. But do these blunt takes capture the full weight of family loyalty, or are they just fanning the flames of rebellion?

This mortgage mess lays bare the cost of family expectations when they clash with personal boundaries. OP’s refusal to co-sign feels like a stand for her future, despite the looming threat of family fallout. Her parents and sister’s demands blur the line between support and exploitation, leaving her to navigate a high-stakes choice. Financial independence might be her escape hatch, but it’s a tough road. Have you ever faced family pressure to sacrifice your stability? What would you do in OP’s shoes? Share your thoughts below!

![[Reddit User] − Never. Co-sign.. Never.](https://en.aubtu.biz/wp-content/uploads/2025/06/323062cm-01.png)

![[Reddit User] − NTA.. If I don’t sign the loan, I am forever banished from family ties Family who don’t like or respect you enough to grant you access to this house they’re bullying you into financing. Personally, I wouldn’t call that much of a loss. Tell them it’s not happening and lock down anything they might try and do to get access to your money/credit behind your back until you’re able to move out, which you should do ASAP.](https://en.aubtu.biz/wp-content/uploads/2025/06/323062cm-07.png)