WIBTA if i asked the parents of someone who owes me a lot of money to pay their kids debt so they dont get sued with huge court costs?

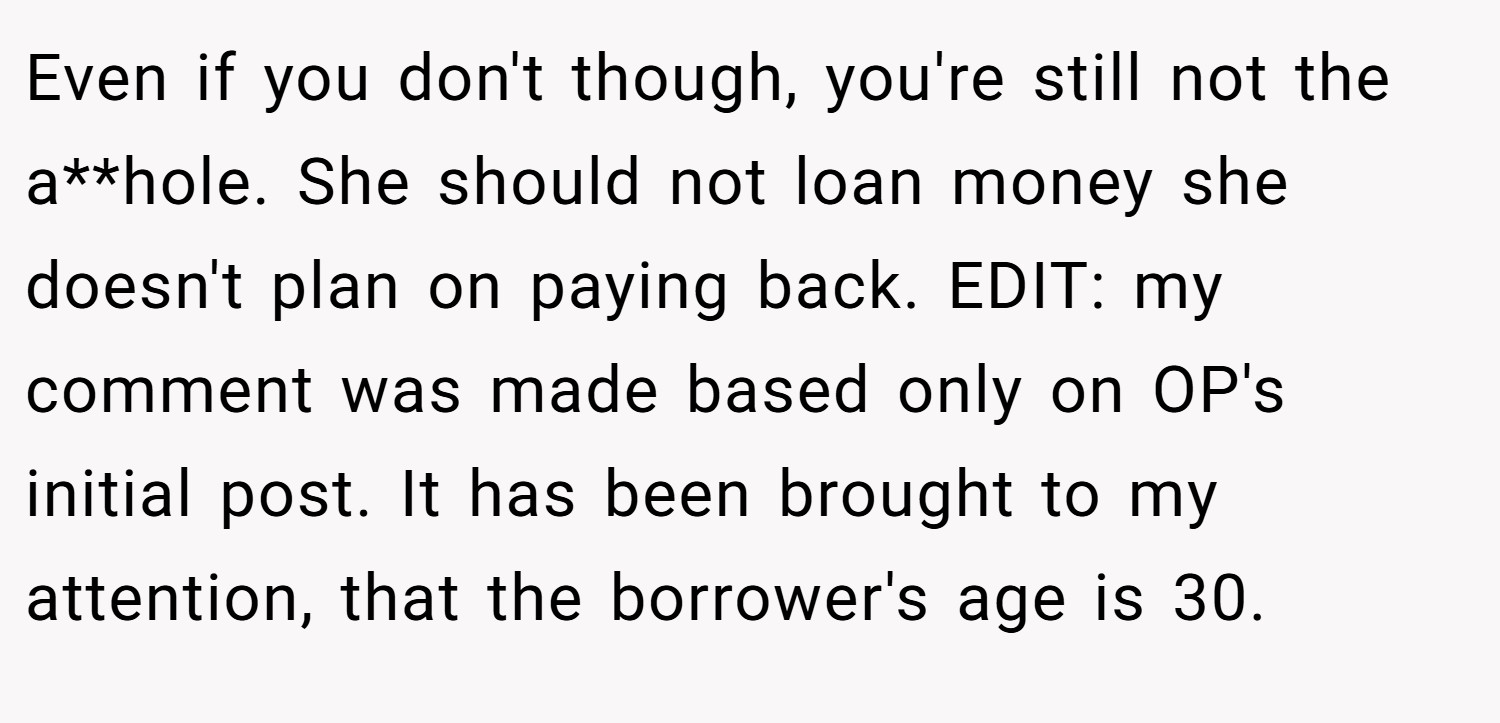

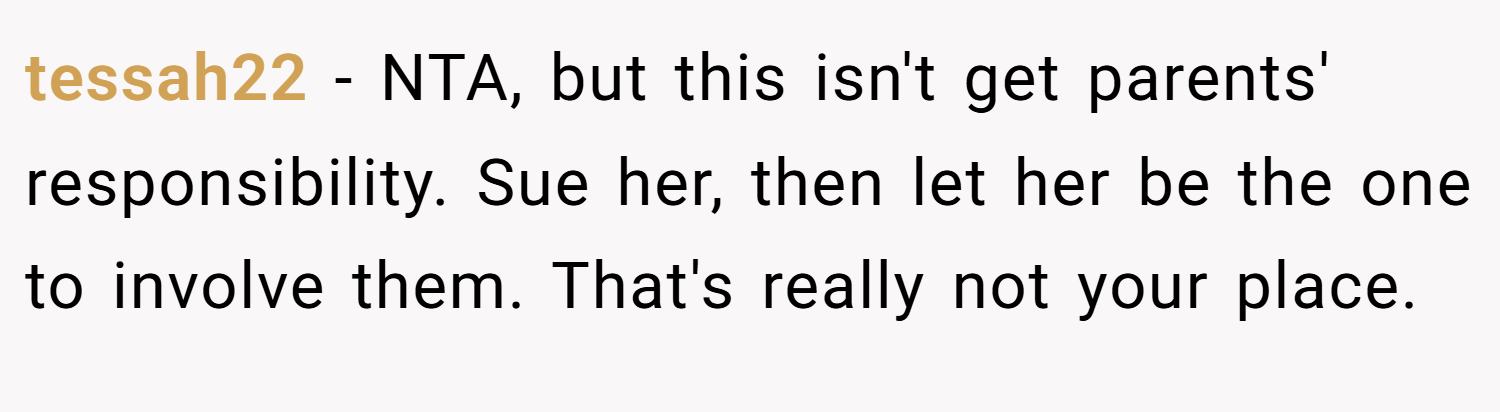

Picture a gut-punch moment: you loan a friend $1500 for her dream dog, trusting her written promise to repay, only to be ghosted. Messages go unread, texts ignored, and now you’re staring at a legal battle to reclaim your money. This person, fed up with their friend’s dodge, drafted a message to the friend’s mom, hoping to avoid court drama but wrestling with whether it’s a step too far.

This tale simmers with betrayal, desperation, and a moral tug-of-war. The lender’s frustration is raw, yet their hesitation to involve parents adds a layer of empathy. Readers are pulled into a drama where friendship, money, and family ties collide, sparking questions about boundaries and justice.

‘WIBTA if i asked the parents of someone who owes me a lot of money to pay their kids debt so they dont get sued with huge court costs?’

This debt dispute is like a friendship gone sour over a bad IOU. Financial expert Suze Orman advises, “Never lend money you can’t afford to lose, and always get it in writing” (Suze Orman). Here, the lender’s written agreement strengthens their case, but the friend’s ghosting turns a personal loan into a legal headache.

The lender’s urge to contact the parents stems from frustration and a desire to avoid court costs, which a 2023 small claims study estimates can add $200–$500 to disputes (Nolo). However, involving parents of a 30-year-old risks overstepping, as they’re not legally liable. The friend’s evasion suggests intent to default, a breach of trust that stings.

This reflects broader issues of financial boundaries in friendships. Orman stresses clear communication to prevent resentment. Contacting the mom could be seen as manipulative, though the lender’s polite draft aims to inform, not guilt. Redditors split on this, some seeing it as fair pressure, others as inappropriate.

For solutions, the lender should send a formal demand letter to the friend, citing the agreement and a repayment deadline, before escalating to small claims court. If contacting the mom, a softer tone, as suggested, avoids sounding threatening. Consulting a lawyer ensures legal steps align with local laws, protecting the lender’s rights.

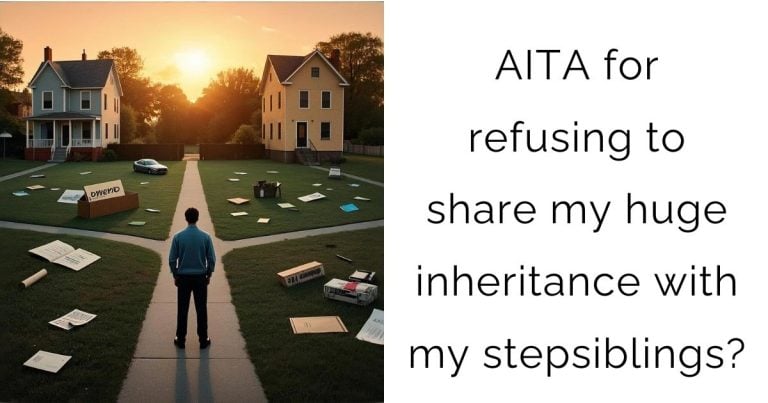

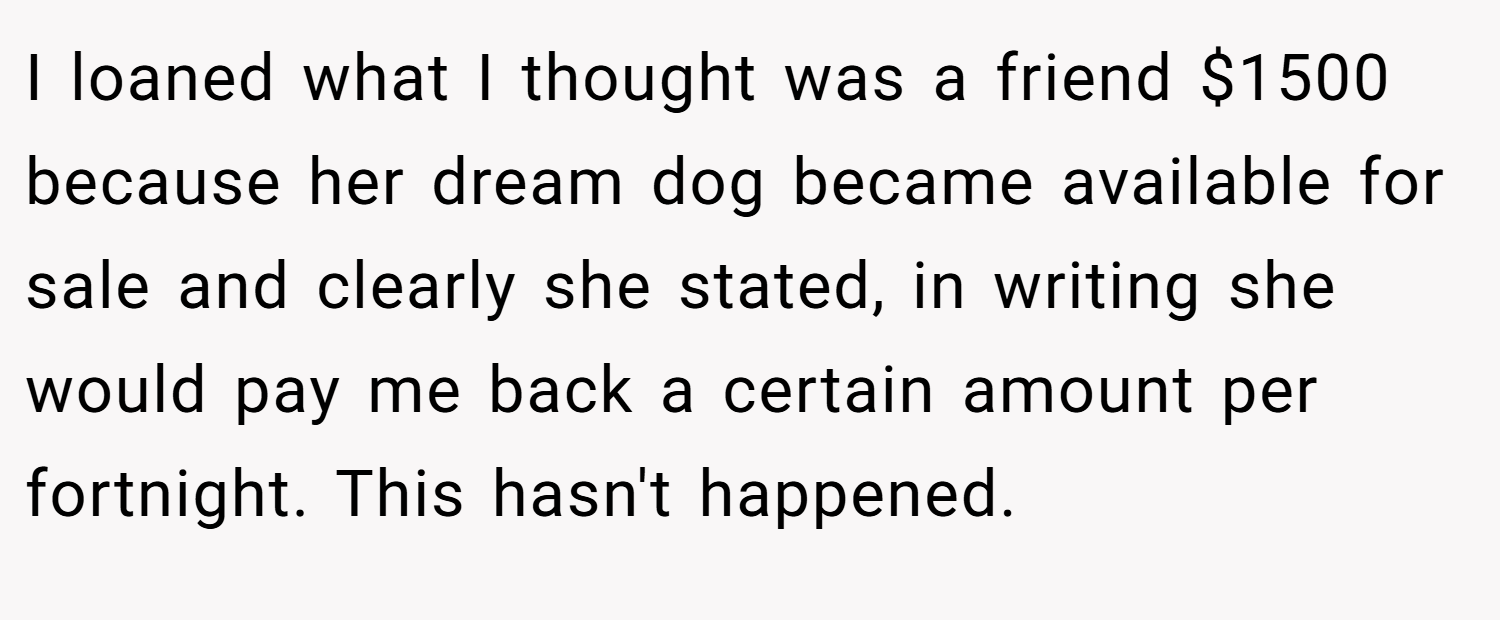

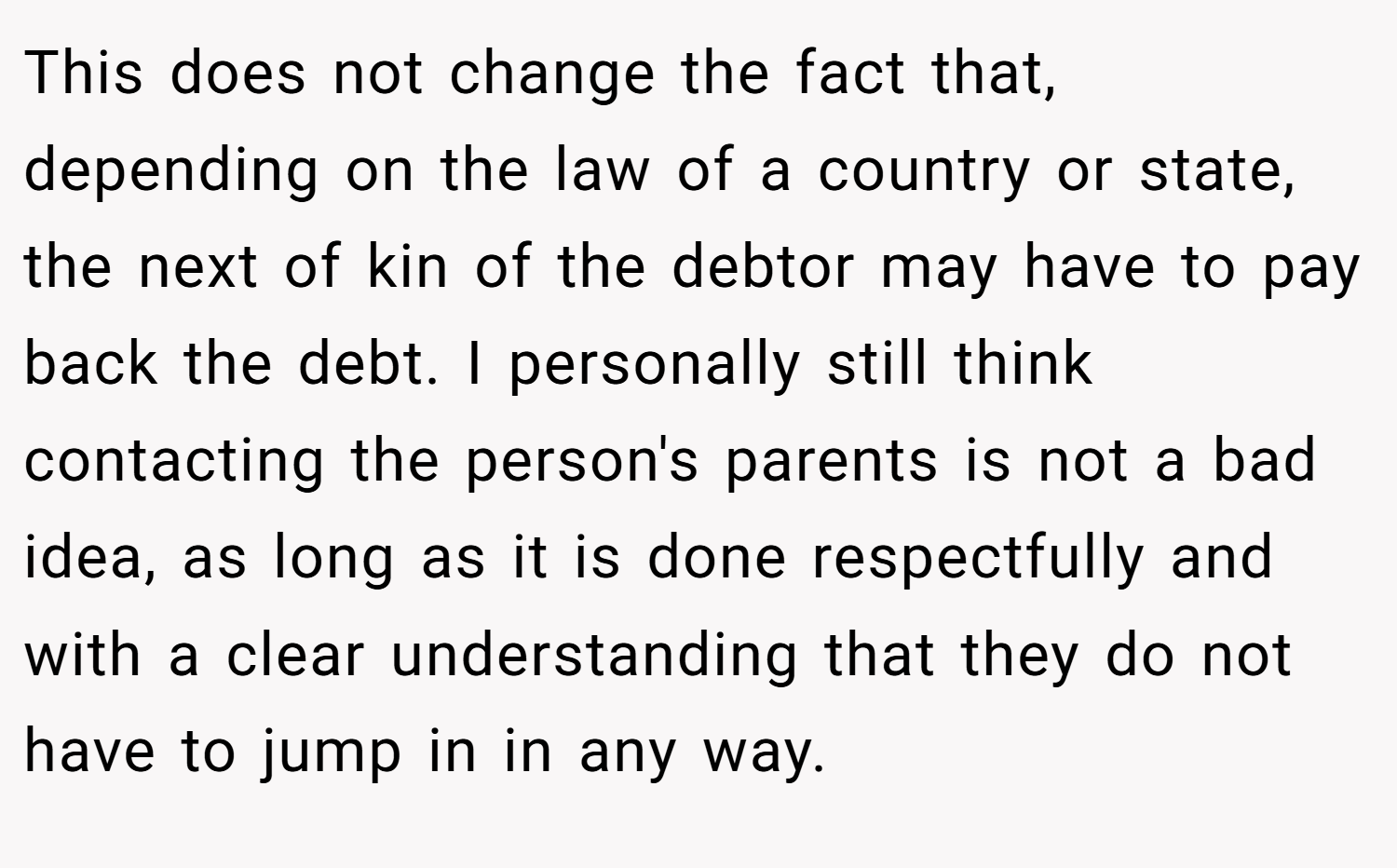

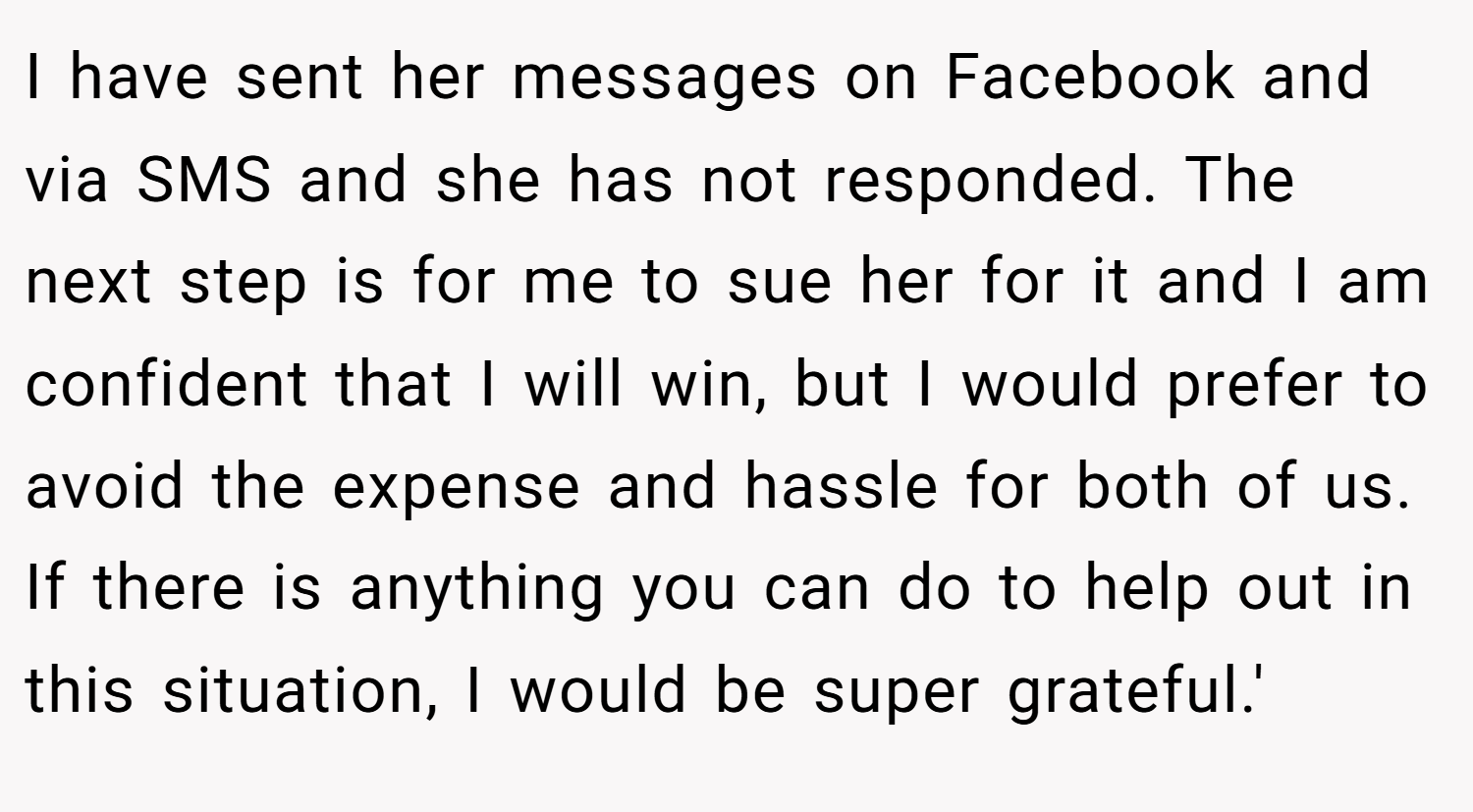

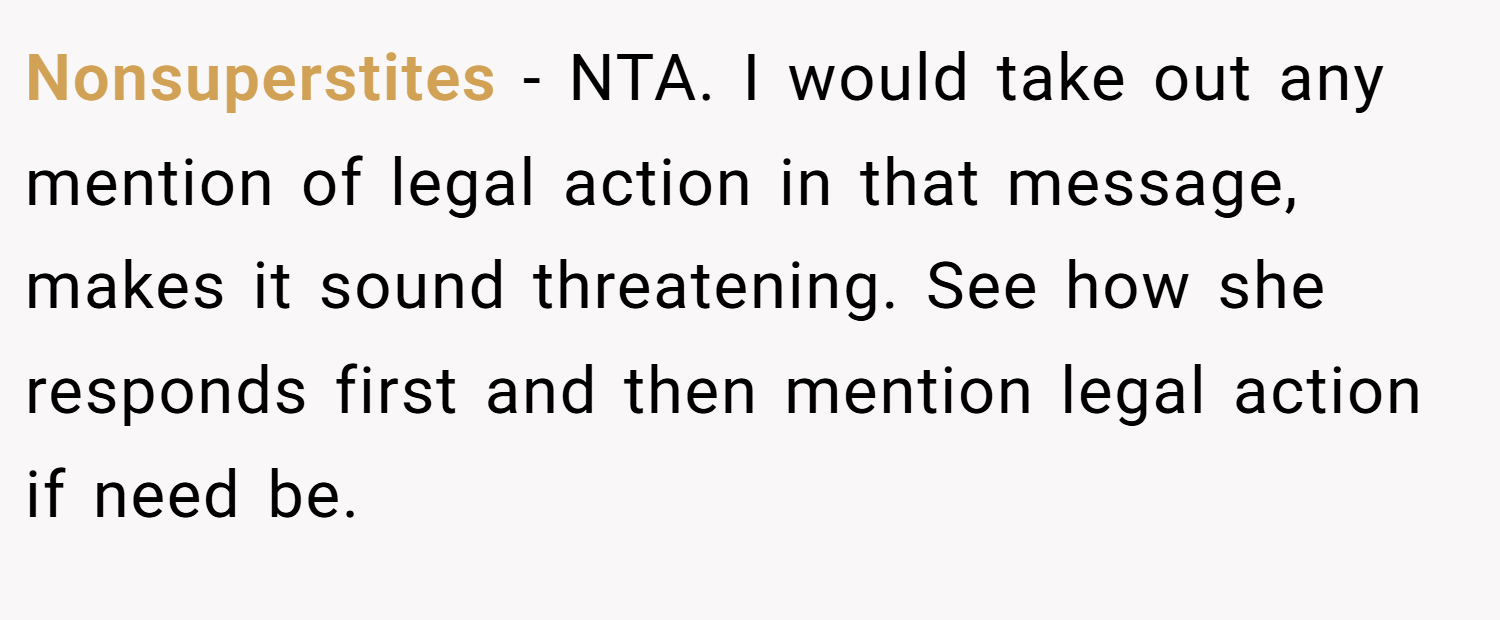

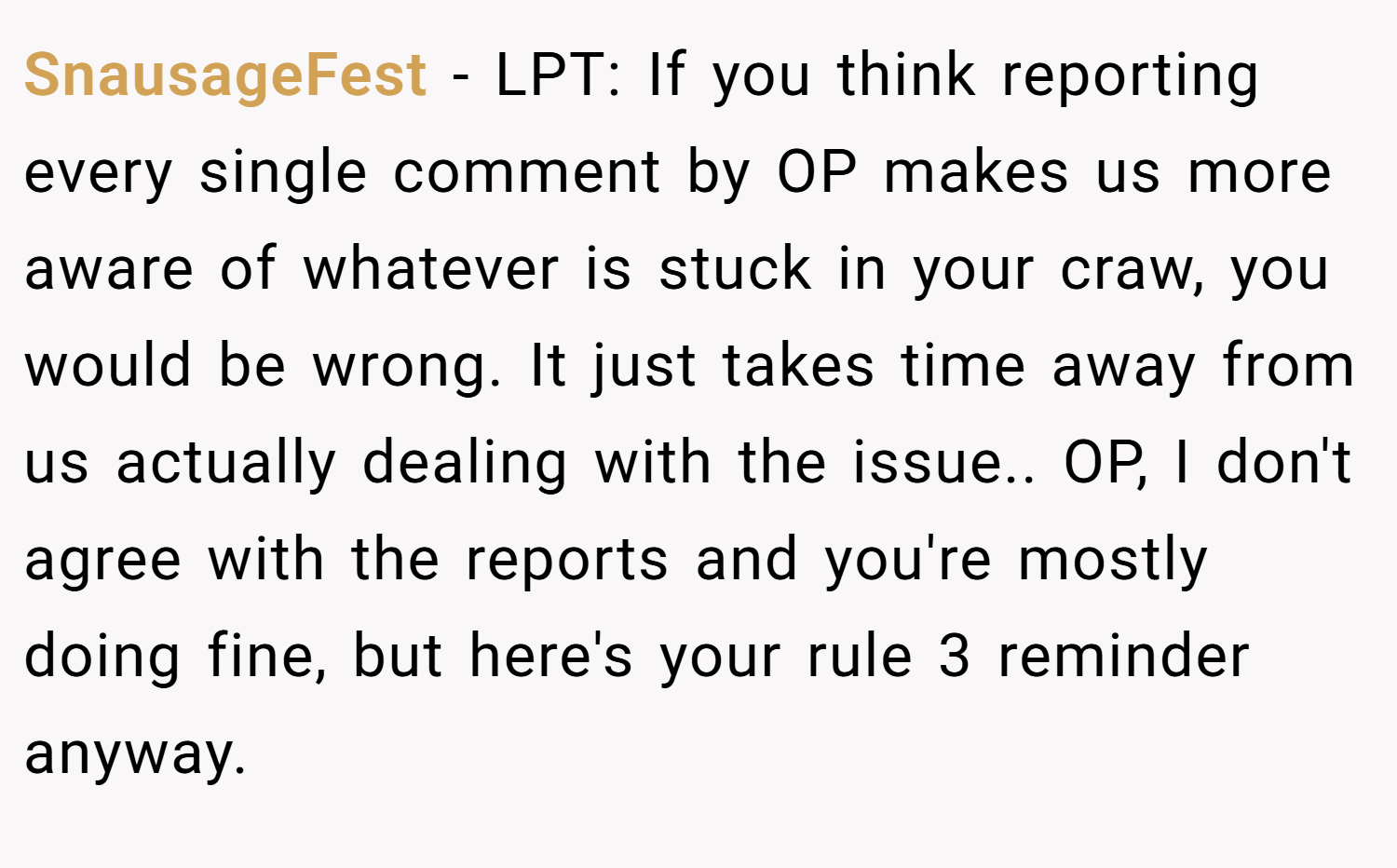

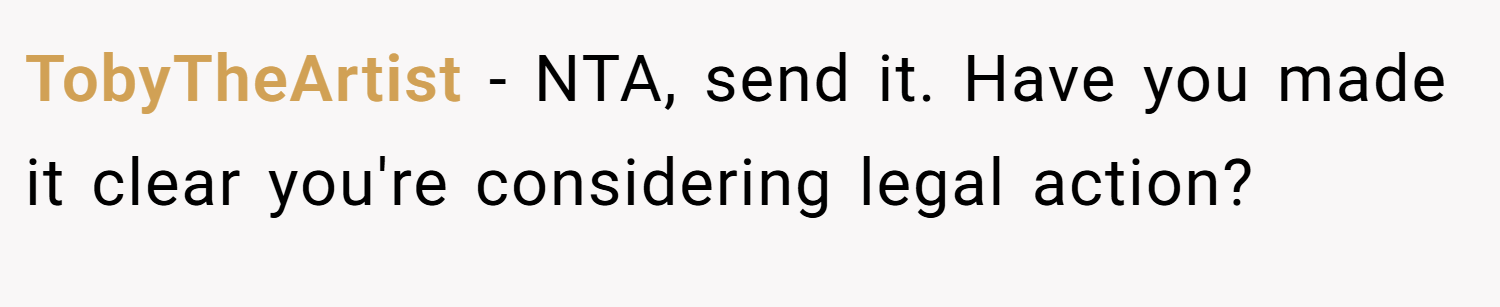

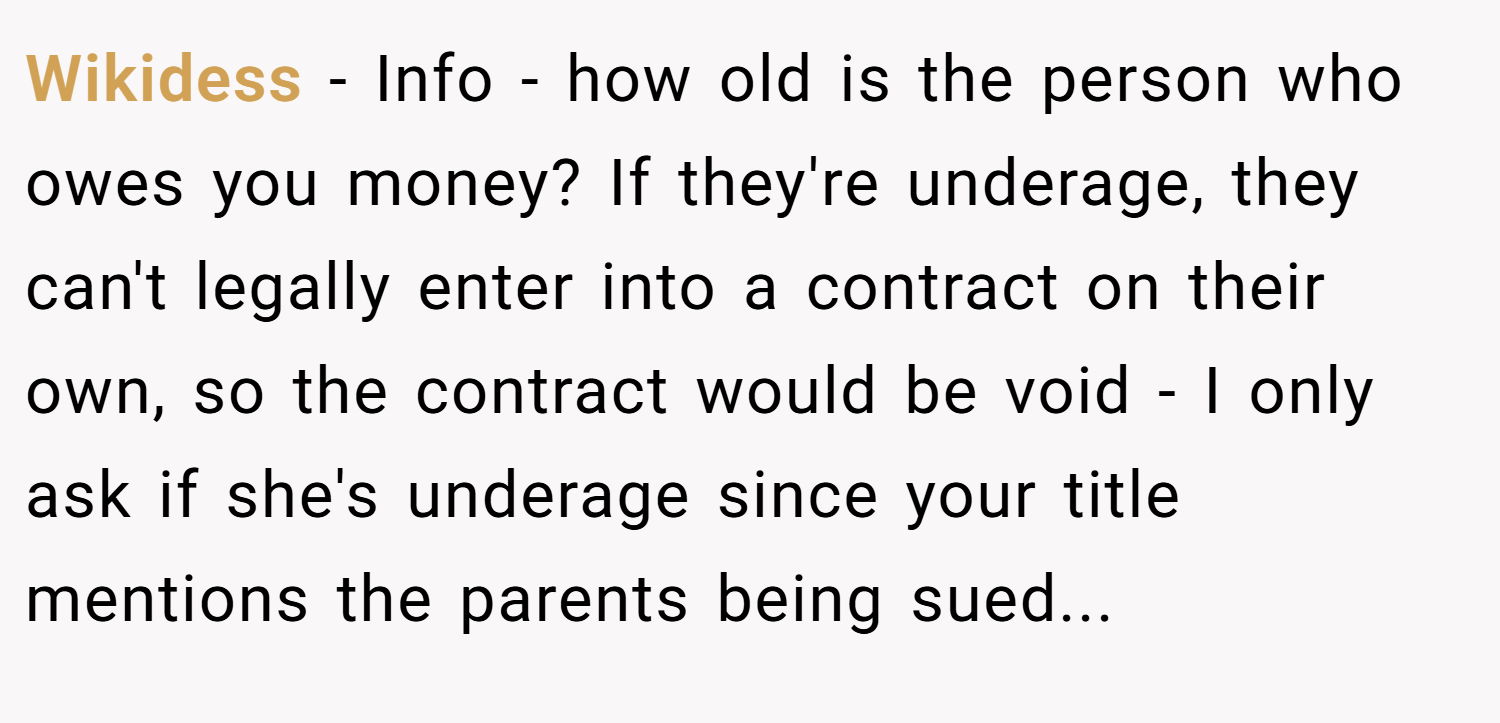

These are the responses from Reddit users:

The Reddit posse rode in with a mix of cheers and jeers, like a town hall debating a local scandal. They hashed out the ethics of dragging parents into a grown adult’s mess:

These Redditors wrestled with the lender’s plan, some backing the parent outreach, others calling it a shady move. Their takes highlight the tension between justice and tact. But do they capture the full weight of this $1500 betrayal, or just stir the pot?

This story is a spicy blend of trust, betrayal, and tough choices. The lender’s debate over involving parents underscores the pain of a friend’s dodge and the quest for fairness. It’s a reminder that money can fray even the tightest bonds. Have you ever faced a friend who wouldn’t pay up? What would you do to reclaim your cash? Share your stories below!

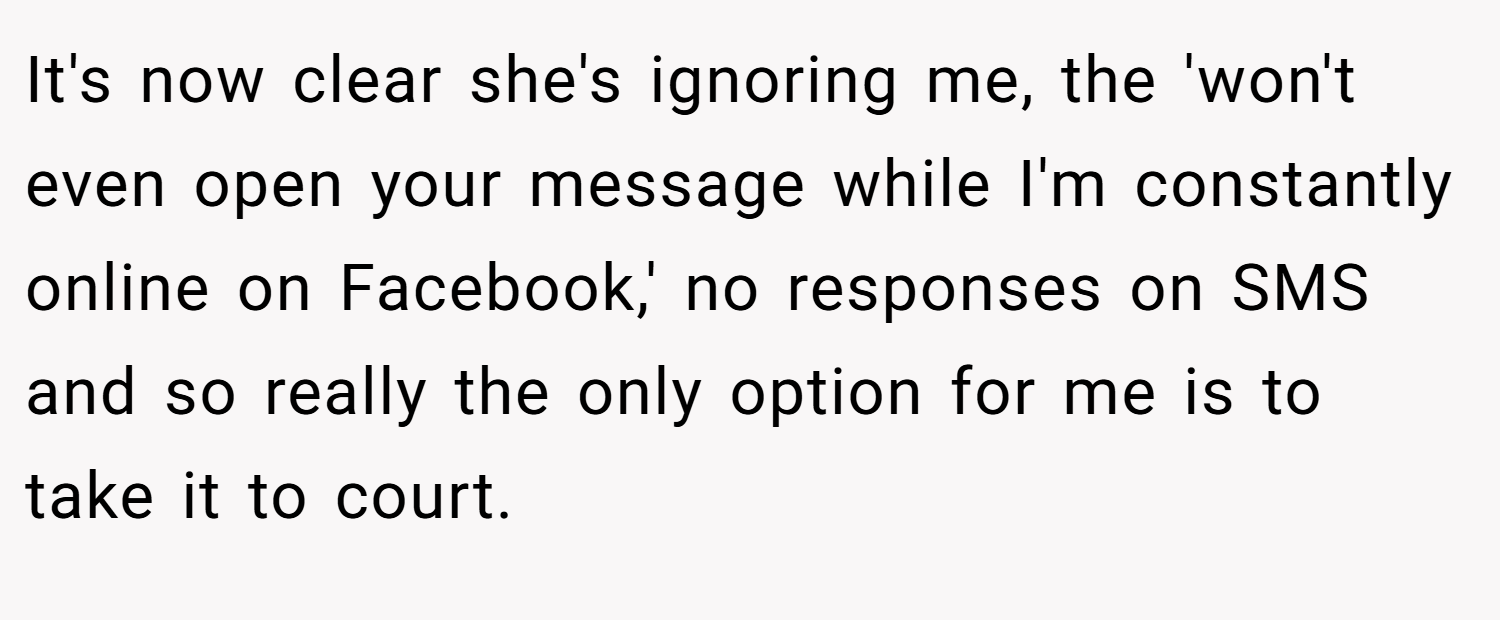

!['Hey. You may not know me and I'm still unsure as to whether it's inappropriate for me to send this message, but your daughter [L] borrowed $1500 off me to buy that dog she now has. There was a clear agreement in writing as to what has to be paid back and when and she is not paying it back.](https://en.aubtu.biz/wp-content/uploads/2025/06/327463ct-04.png)

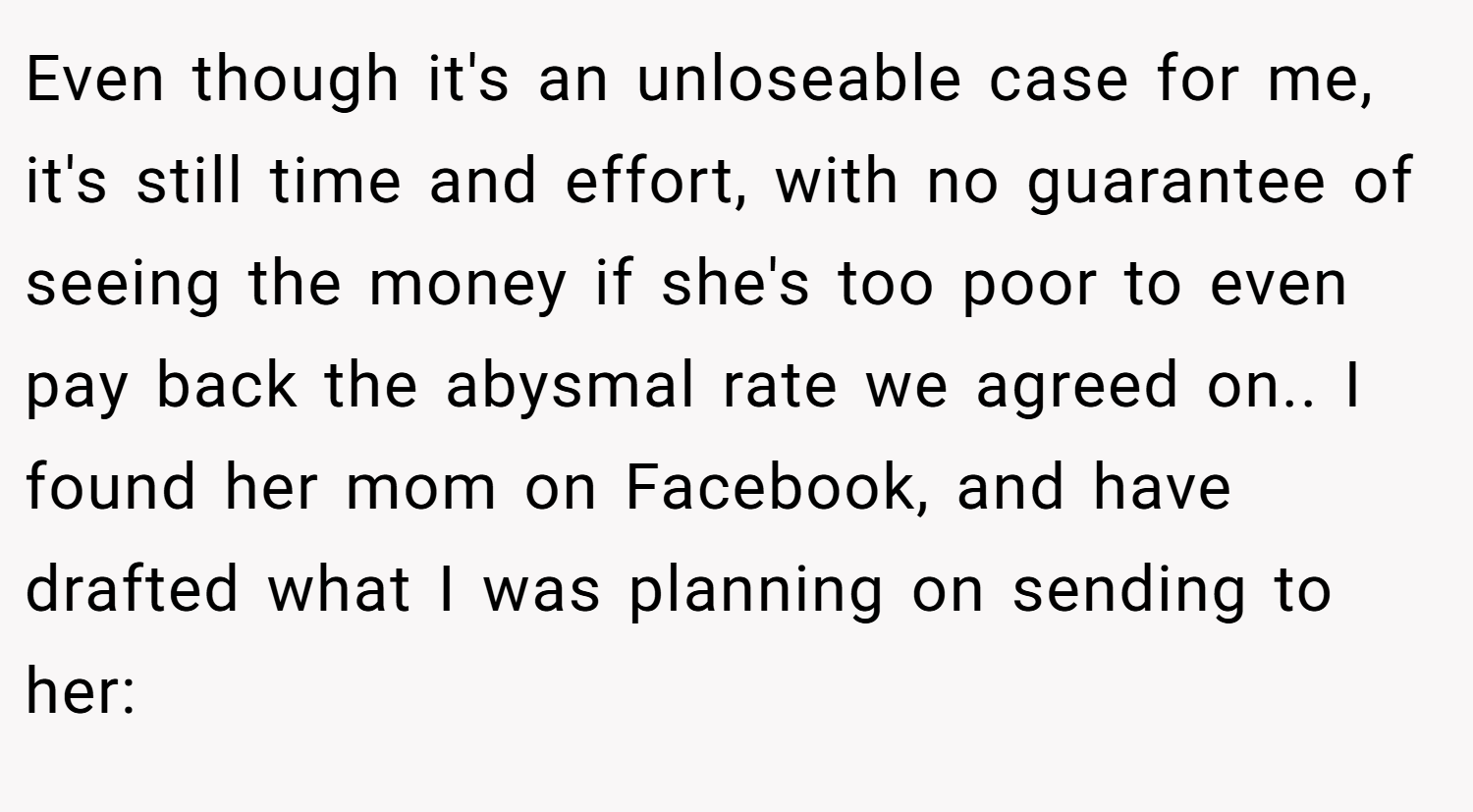

![[Reddit User] − NTA. It's uncomfortable, but I think that this is the best way to go about it. You could show a bit more compassion towards the parents with something like 'I am sorry to spring this on you' or 'I realize this is uncomfortable, but I felt this was more respectful to your family than just taking legal action immediately.'](https://en.aubtu.biz/wp-content/uploads/2025/06/327463cm-01.png)

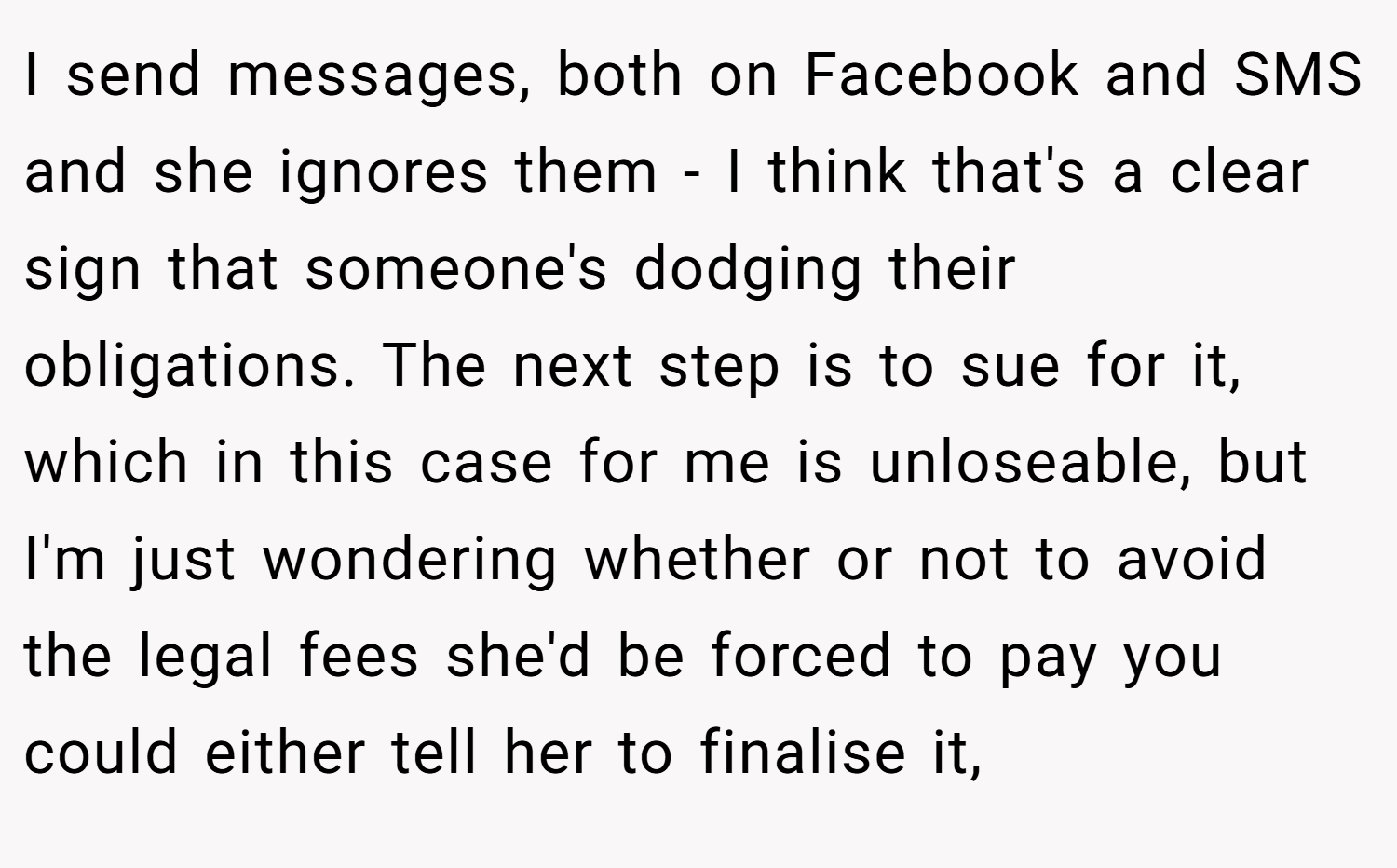

![bigrottentuna − NTA. Send a note.. I'm a professor and I can't help editing other people's writing. Here is what I recommend: 'Hi. You may not know me and I'm terribly sorry to bother you with this, but your daughter \[L\] borrowed $1500 from me to buy her dog. We have a written agreement as to what has to be paid back and when, but she is not paying it back.](https://en.aubtu.biz/wp-content/uploads/2025/06/327463cm-04.png)

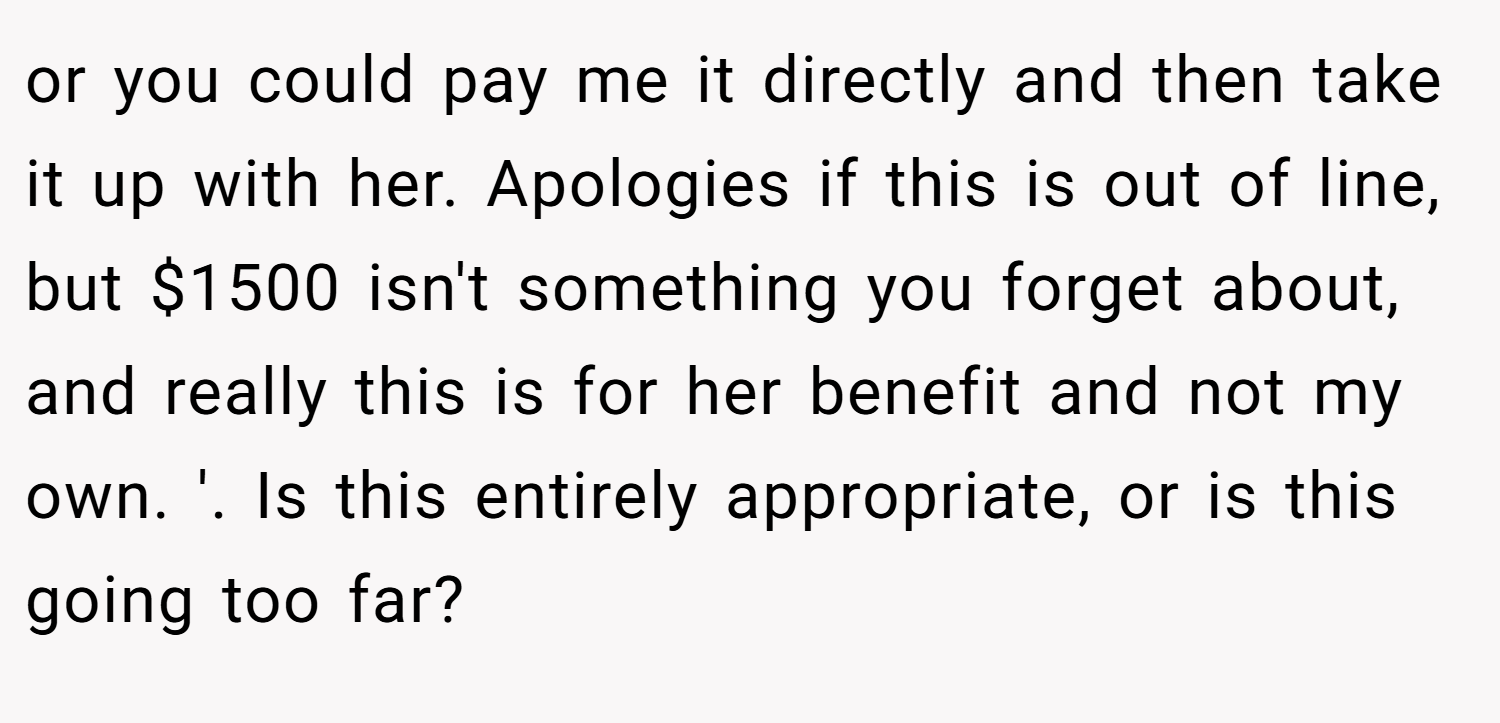

![[Reddit User] − YTA. This is between you and another adult - a 30 year old adult. Why would you Bring their parent into it? If this person isn’t paying you then sue them.](https://en.aubtu.biz/wp-content/uploads/2025/06/327463cm-11.png)