Sharing the Inheritance with My Stepkids: A Compassionate Decision or a Selfish Move?

Losing a spouse is heartbreaking enough without the added weight of family disputes over inheritance. In this deeply personal account, a 30-year-old woman grapples with the expectations of her late husband’s ex—who now demands that his children receive half of everything, including the house. Her late husband wasn’t wealthy; he left behind a modest estate, a comfortable home, and some savings.

Despite having had a good relationship with his children during their bi-weekly visits, she never truly assumed the role of a parental figure. Now, facing pressure to liquidate assets and split them equally, she wonders if it’s fair to protect what she’s inherited for her own future and the well-being of her young child.

Caught between legal obligations and familial expectations, she is torn over whether she should contribute to college funds for her stepchildren or let the assets remain as they are. With her husband’s ex creating additional drama and insisting on an equal split, the question remains: is she the a**hole for not giving up her financial stability to meet these demands?

‘AITA if I don’t give anything to my step kids after my husband’s death?’

Navigating the division of assets after a spouse’s death is a complex matter, especially in blended families where clear directives may be lacking. Estate attorney Lisa Jordan emphasizes that, “Without a will or established trust, state laws will dictate the distribution of assets, but that doesn’t automatically compel you to comply with every unreasonable demand.” In this case, the insistence that the stepchildren receive half of every asset—ranging from the family home to liquid savings—raises serious legal and emotional concerns.

Financial advisor Dr. Rebecca Moore adds, “The key is to distinguish between what the law mandates and what is emotionally and practically feasible. Overextending on a divorce of assets can jeopardize the stability of those left behind.” With limited resources and a modest estate, forcing an equal split could leave you financially vulnerable, undermining your ability to secure your own future. Moreover, psychologist Dr. Emily Reyes highlights that the dynamics in blended families are inherently complex.

“If you were not a primary caregiver for those children, it is reasonable to consider that their inheritance may be managed differently. It might be more equitable to allocate funds towards their future needs—such as education—rather than an across-the-board division of assets.” Legal experts echo this sentiment, advising that a measured approach—possibly through the establishment of trusts or designated funds—can balance fairness with financial prudence.

Ultimately, the expert consensus is that protecting your long-term financial stability while honoring your late husband’s legacy is not only justifiable, but essential. Consulting a probate lawyer to clarify your legal obligations and exploring structured support for the stepchildren can help navigate these turbulent waters without sacrificing your future security.

Check out how the community responded:

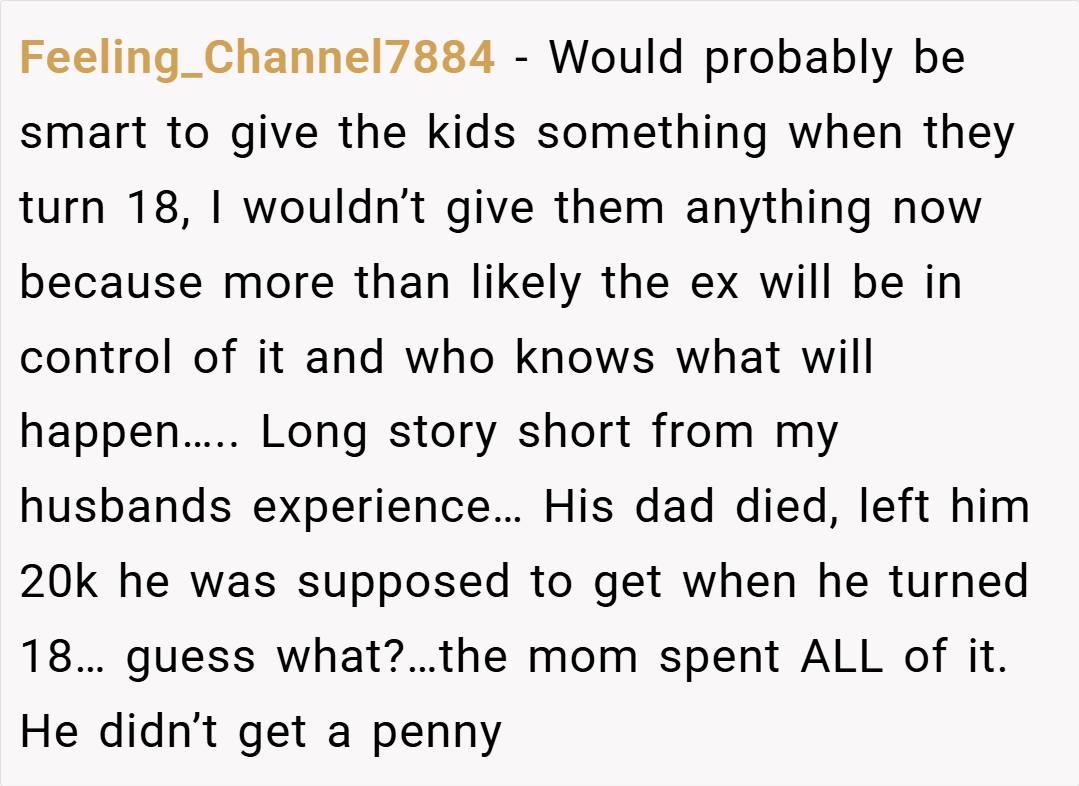

The Reddit community overwhelmingly supports a balanced approach. Many commenters agree that if your husband left no explicit instructions, you’re within your rights to manage the estate sensibly. The consensus is that it’s entirely reasonable to offer your stepchildren specific personal items and contributions for their future (like college funds) rather than splitting every asset equally.

Commenters stress that your stepchildren deserve support, but not at the expense of your own financial security. They remind us that in blended families, the relationships are complex, and a 50/50 split isn’t always the fairest or most practical solution. Protecting your future while still being there for the kids is key, and many applaud your transparency and willingness to help when needed.

This situation forces us to grapple with the delicate balance between fulfilling familial obligations and safeguarding one’s future. While it’s natural to want to support your late husband’s children, expecting you to liquidate everything—even your home—places an unsustainable burden on your young life. The question remains:

How do we honor a loved one’s legacy while ensuring that our own future isn’t compromised? Have any of you navigated similar challenges in blended families, where legal, financial, and emotional expectations collide? Share your experiences and thoughts below—let’s discuss how to strike a fair balance that respects both legacy and self-preservation.