Save Big on Taxes! Why IRS.gov Is Your Free Filing Hero Under $73K

‘LPT: If you make less than $73,000 a year, don’t do your taxes with TurboTax or H&R Block. Just go to irs.gov and do it for free and get more in your returns’

The IRS Free File program is a game-changer for those with an adjusted gross income (AGI) of $73,000 or less. First, it’s completely free, saving you from unexpected fees that TurboTax or H&R Block often charge for “simple” returns, which can eat into your refund.

Second, it’s user-friendly, offering guided tax prep through trusted partners, ensuring you claim all eligible credits like the Earned Income Tax Credit. Third, it’s safe and direct, with no risk of being upsold to a paid tier for complex forms like 1099s.

For example, one taxpayer found TurboTax would charge over half their $200 refund, but IRS.gov delivered $400 using the same info, with no cost. Starting at IRS.gov ensures you access truly free filing, maximizing your refund without surprises.

Additional benefits include:

- No hidden fees: Avoid unexpected charges for state returns or extra forms.

- Direct deposit: Get your refund faster via secure IRS processing.

- Accessible support: Free File offers guidance for first-timers or complex returns.

- Multilingual options: Available in English and Spanish for broader access.

Filing directly through IRS.gov is a smart, cost-free way to keep more of your money. Why pay for something you can get for free?

Have you tried IRS Free File or run into surprise fees with tax software? What’s your go-to for hassle-free tax filing?

This Reddit tip is like finding a coupon for free money—who doesn’t love that? Tax expert Mark Jaeger, quoted in a 2024 Kiplinger article, says, “The IRS Free File program offers robust, secure tools through trusted partners, ensuring eligible taxpayers maximize credits without hidden costs” (source: Kiplinger). This aligns perfectly with the OP’s advice: free filing saves cash and ensures you claim every credit you’re owed.

The OP’s strategy is simple but powerful. For those earning $73,000 or less, IRS.gov’s Free File program offers guided tax prep without the surprise fees that TurboTax or H&R Block might slap on for “extras” like state returns or 1099 forms. As one Redditor noted, these fees can devour a chunk of your refund—sometimes over $200! Free File, however, is transparent and user-friendly, even for complex returns.

This hack taps into a bigger issue: the complexity of U.S. taxes. A 2023 IRS report notes that 60% of taxpayers pay for filing services, yet 70 million are eligible for Free File (source: IRS). By choosing IRS.gov, you sidestep upselling and keep more of your refund. The program’s multilingual support and direct deposit options make it even sweeter.

Jaeger’s advice applies directly: “Always start at IRS.gov to find trusted Free File partners.” For the OP’s tip, go to IRS.gov, check your AGI, and pick a partner like FreeTaxUSA (praised by commenters) for guided filing. Document your process and double-check credits like the EITC. If you’re over $73,000, ask about free options like CashApp Taxes, as Redditors suggested. Share your tax-saving hacks in the comments—what’s your trick for a stress-free filing season?

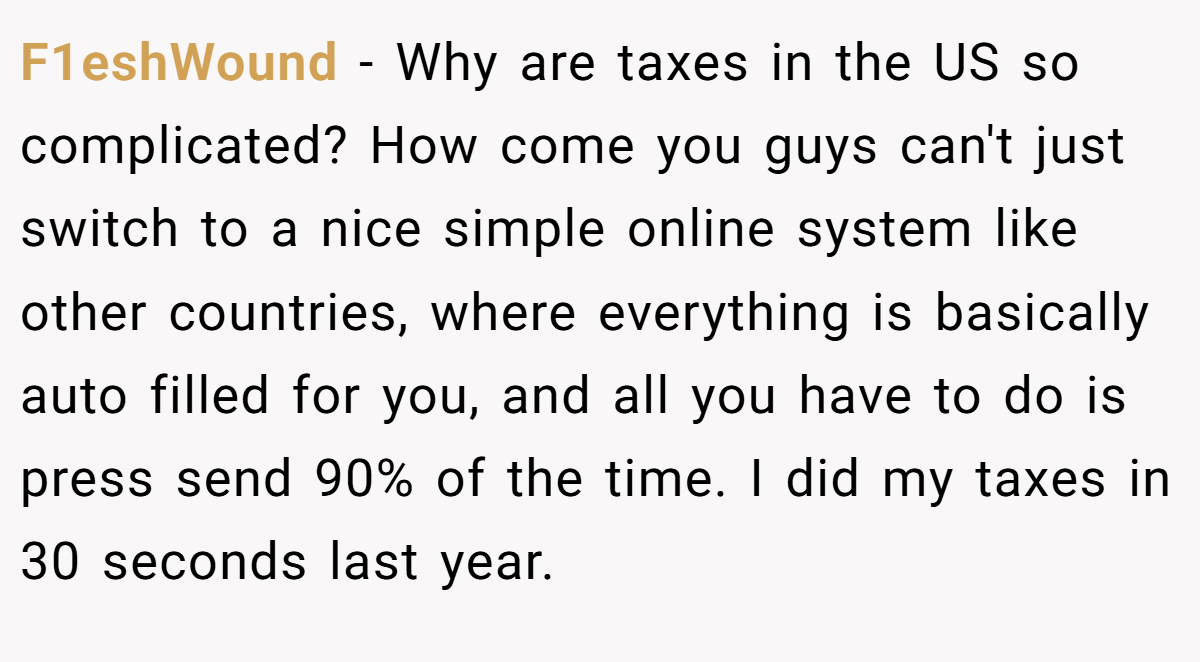

Here’s the comments of Reddit users:

The Reddit community didn’t hold back, dishing out praise, skepticism, and some hilarious horror stories about tax season. From free alternatives to rants about the U.S. tax system, here’s what they had to say, served with a side of snark:

These Reddit reactions are a treasure trove of tips and gripes—some swear by free filing, while others lament getting burned by fees. It’s a classic mix of brilliance and banter, proving tax season is a universal pain point. What’s your take on dodging those sneaky fees?

The IRS Free File tip is like finding a $20 bill in your pocket—unexpected, delightful, and totally yours to keep. By skipping pricey software and heading to IRS.gov, you could save big and boost your refund, especially if you’re earning under $73,000. The Reddit community’s mix of cheers and cautions shows it’s not perfect, but it’s a solid start. Have you ever been hit with surprise tax fees? Got a go-to for hassle-free filing? Drop your stories in the comments—what would you do to make tax season a breeze?

![[Reddit User] − CashApp Taxes is free…even for high earners.](https://en.aubtu.biz/wp-content/uploads/2025/05/226203cm-07.png)