Money Talks Made Easy: A Hack to Connect with Older Generations

Picture a cozy Sunday dinner, the clink of forks against plates, and a familiar question from Grandma: “Why can’t you just buy a house like we did?” Before the eye-rolls begin, imagine pulling out a simple tool—an inflation calculator—that turns this money talk into a moment of clarity. A savvy tip floating around online suggests millennials use this trick to show parents or grandparents what today’s dollars are really worth in their era’s terms. It’s like handing them a time machine for finances.

This hack doesn’t just crunch numbers; it builds bridges. By translating your paycheck into 1970s or 1980s bucks, you’re not whining—you’re showing how rent, groceries, or student loans hit harder now. It’s a gentle nudge toward empathy, sparking chats that might just leave everyone feeling closer. Let’s dive into this idea and see why it’s a conversation starter worth trying.

‘LPT: millennials, when you’re explaining how broke you are to your parents/grandparents, use an inflation calculator. Ask them what year they started working, and then tell them what you make in dollars from back then. It will help them put your situation in perspective’

Why does this trick click? It bridges the generation gap with hard numbers. First, it shows how the value of money has shifted—$10 an hour in 1970 isn’t the same as $10 today, and seeing your $40k salary as, say, $8k in their era hits home. Second, it’s a neutral way to explain your reality without sounding like you’re complaining; it’s just math.

Third, it sparks understanding—older folks might not realize how rent or groceries eat up your paycheck compared to their day. This quick calculation turns vague money talks into something concrete, setting the stage for real empathy.

It also opens doors for better conversations. You might learn about their financial struggles, picking up tips from their experience. It can ease tension, too—nobody’s arguing, just marveling at how times have changed. Plus, it’s a low-stakes way to get their advice without feeling judged, building respect both ways. Those chats can leave you feeling closer, with a shared sense of navigating life’s costs.

Have you ever had a money talk with family that shifted how you saw each other? What’s a trick you’ve used to make those chats easier or more productive?

This tip is a masterstroke for family talks—it’s less about arguing and more about understanding. As financial educator Tiffany Aliche, aka The Budgetnista, says in a CNBC interview, “Context is everything when discussing money across generations; without it, you’re just shouting numbers” (CNBC: Generational Wealth). By using an inflation calculator, you’re giving that context, showing how $50,000 today might feel like $10,000 in 1980—eye-opening for anyone who hasn’t shopped lately.

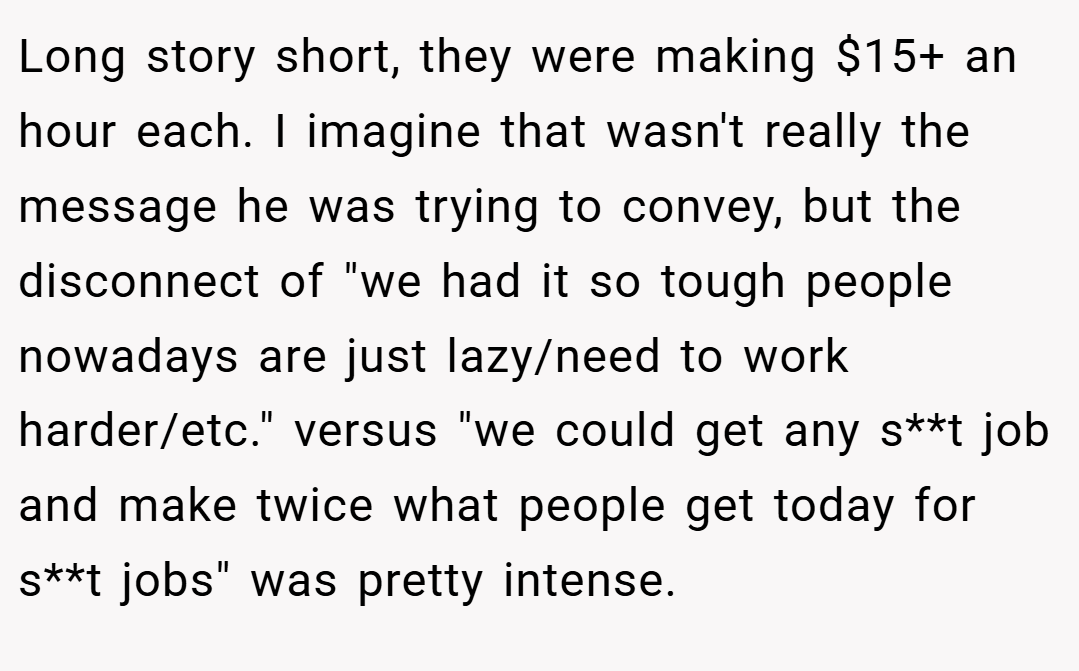

Here’s the deal: the tip’s brilliance lies in its neutrality. Millennials aren’t blaming their elders; they’re laying out facts. Parents or grandparents might think $15 an hour is plenty—until they see it’s barely $3 in their day, when a burger cost a quarter. The flip side? Older folks might argue hard work still solves everything, and calculators don’t capture grit. But numbers don’t lie, and they cut through defensiveness like a hot knife.

This ties to a bigger issue: economic shifts. A 2022 Pew Research study found that median home prices have risen 121% faster than inflation since the 1960s, while wages lag (Pew: Housing Costs). No wonder saving for a house feels like chasing a mirage. This trick helps families see that struggle isn’t laziness—it’s math.

Want to try it? Pick a free inflation calculator online, like the U.S. Bureau of Labor Statistics’ (BLS Calculator), and ask when they started working. Compare your salary calmly, maybe over coffee. It could lead to stories, advice, or just a laugh about how gas was 50 cents. What’s your take—would this spark a good chat in your family? Share below!

These are the responses from Reddit users:

The online buzz around this tip is a mix of “whoa” and witty, with folks sharing how it flipped their family talks. Here’s what redditors had to say, served with a side of humor:

Talk about receipts! These redditors prove numbers can shift perspectives faster than a heated debate. But does every family get it, or do some still say “just work harder”? Ever had a money talk go surprisingly well—or hilariously wrong?

This clever trick is like a secret handshake for generations—simple, smart, and a little disarming. It turns tense money chats into moments of connection, proving a few numbers can say more than a thousand words. Next time you’re explaining your budget to family, will you try the inflation calculator? What’s a money talk moment that changed how you saw someone? Drop your stories below—let’s swap tales of dollars and sense!

![[Reddit User] − Holy moly, I checked my current household income against what my dad was making in the 90s. I just thought I was bad at money. Turns out he was making the equivalent of 150k a year, and now I feel like I'm doing great! Like, of course I'm not keeping up!](https://en.aubtu.biz/wp-content/uploads/2025/04/127668cm-03.png)

![[Reddit User] − Nah, measure everything in](https://en.aubtu.biz/wp-content/uploads/2025/04/127668cm-08.png)

![[Reddit User] − A point of referance always helps. I like pointing out that my favourite classic muscle car cost 30% of the average salary (for my area), the year it came out but my mid level family car cost 60% of of the average salary when I bought it.](https://en.aubtu.biz/wp-content/uploads/2025/04/127668cm-11.png)