Misled or Misunderstood? When College Class Modes Spark a Family Clash

Living through the high-stakes world of college life means that every detail can have a big impact—especially when it comes to finances. When a devoted father invests in his daughter’s future by covering her summer campus housing and meal plan, he expects transparency in her plans.

Imagine his surprise when a trusted source reveals that her classes are entirely online, contrary to the in-person schedule she assured him of. His trust was based on clear communication, and discovering the truth only through a third-party website left him not only frustrated but also questioning her honesty. This unexpected twist forces him to re-examine the deal they made.

In a heated conversation, he decides that there will be consequences: he will withhold support for college housing and campus fees next year, teaching her that honesty and careful planning go hand in hand with the value of hard-earned money. As both their dreams and expectations collide, a larger discussion about trust, responsibility, and the unpredictable nature of college planning comes to life.

‘AITA for not paying for my daughter’s college housing and campus fees next year because she misled me about her summer classes?’

Educational policy and relationship experts often emphasize that financial planning for college is a delicate balance of trust and clear communication between parents and their children. Dr. Karen Flores, an expert in educational administration, explains, “When parents set aside funds for college expenses, they do so expecting that the money will be used for its intended purpose.

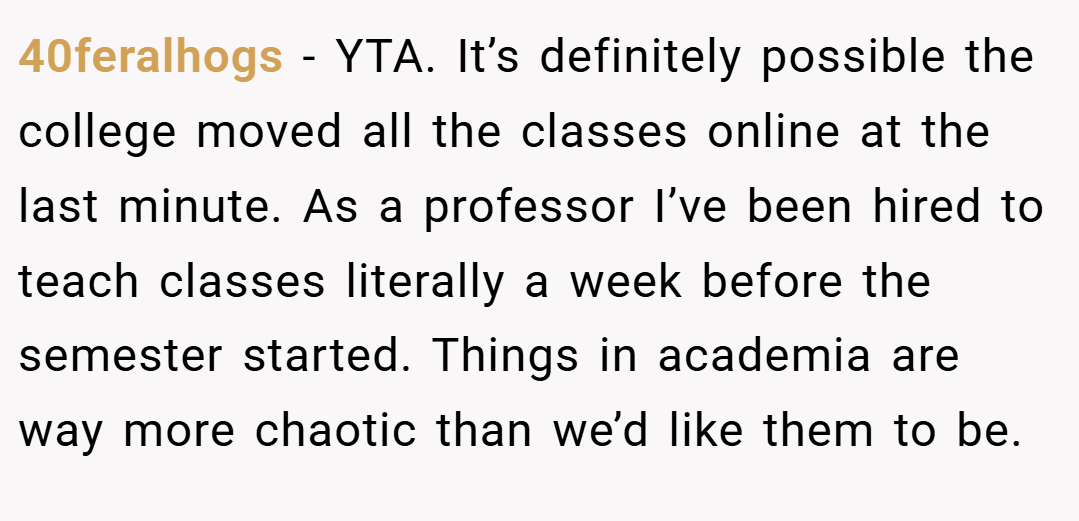

Clear communication is critical because even a small misrepresentation can lead to significant financial consequences.” In this case, the father trusted the information given by his daughter, and the discovery that the classes are online reveals a disconnect that has led to a breakdown in communication. The situation is complex. On one hand, universities often face last-minute changes in class formats due to factors like enrollment numbers, staffing, or even campus safety protocols.

In our post-COVID world, such changes are not unheard of; however, it is reasonable for a parent to expect that any changes would be communicated promptly—especially when it affects major financial decisions like on-campus housing fees. Dr. Flores adds that, “Parents and students should work together transparently when it comes to housing and tuition payments. Any significant change should trigger an immediate discussion about how to adjust plans financially.”

Furthermore, financial experts point out that using funds from a dedicated college savings account carries an implicit assumption: that every expense is deliberate and necessary to support the student’s educational experience. When a student’s actual class mode deviates from what was promised, it upends that assumption and invites a reevaluation of resource allocation.

The father’s decision—though it may appear harsh—is a direct response to feeling misled and is intended to drive home the lesson of taking responsibility for one’s actions. Such actions, while painful, might serve as a catalyst for the daughter to reassess her planning and communication skills as she navigates her academic future.

In sum, while the father’s decision might seem punitive, experts like Dr. Flores caution that clear, honest communication is essential. Both parties need to engage in dialogue to understand how the miscommunication happened. Only then can they recalibrate their expectations and ensure that financial resources serve their intended purpose without compromising trust. Thus, the situation calls for a balanced approach—one that involves both consequences and a conversation about mutual responsibility.

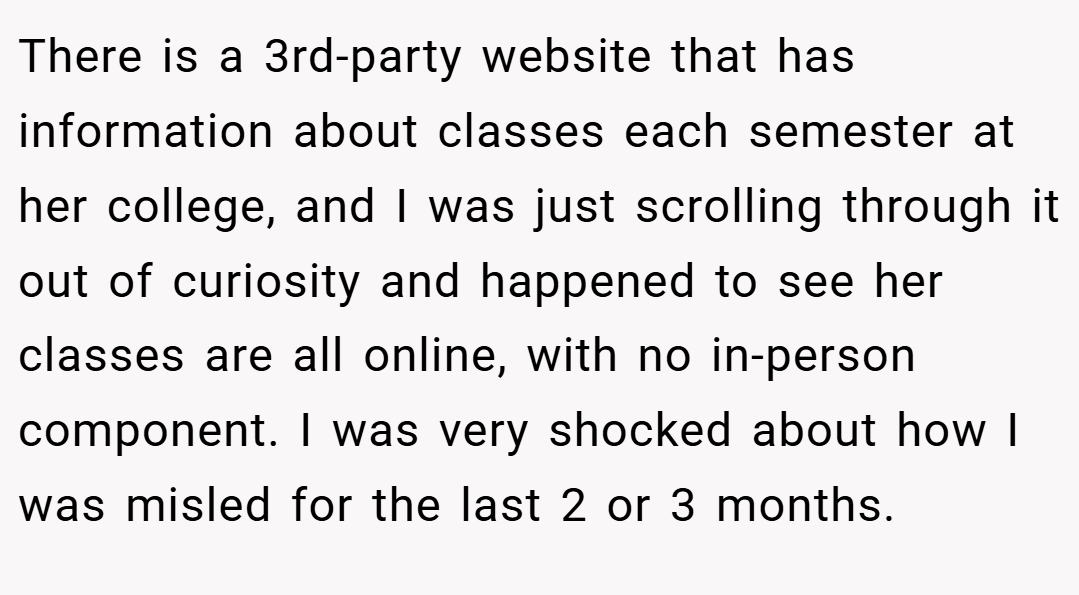

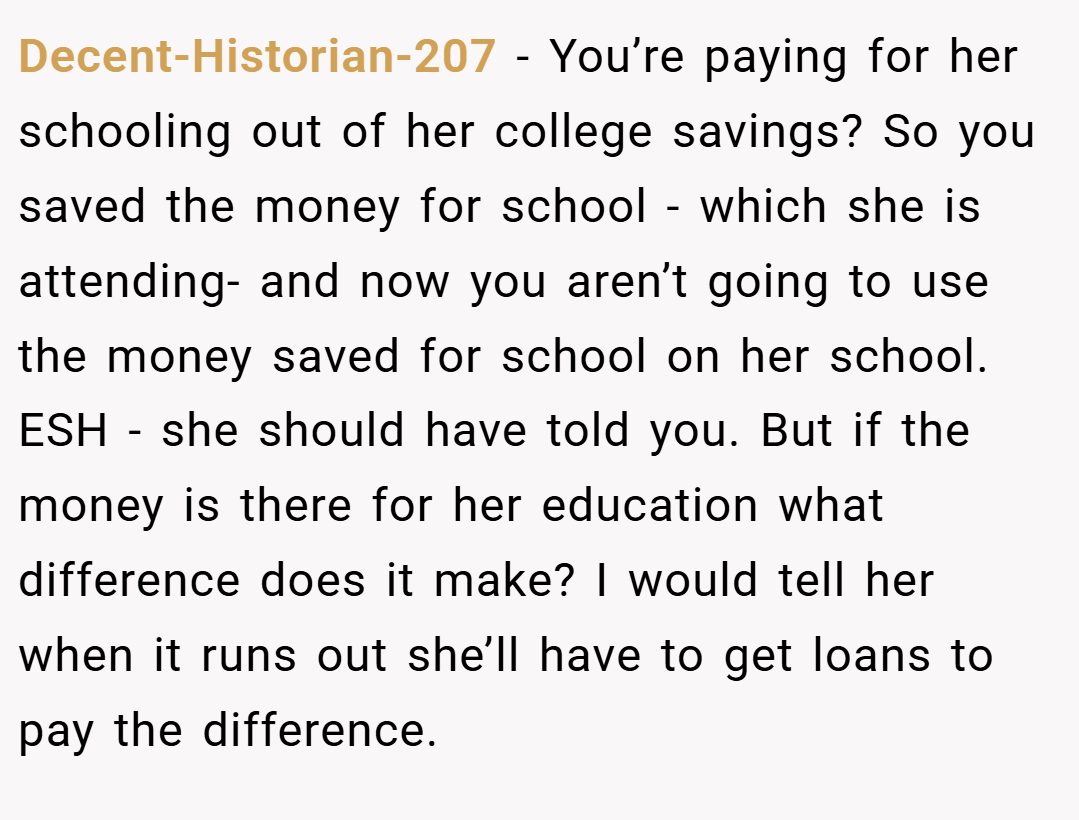

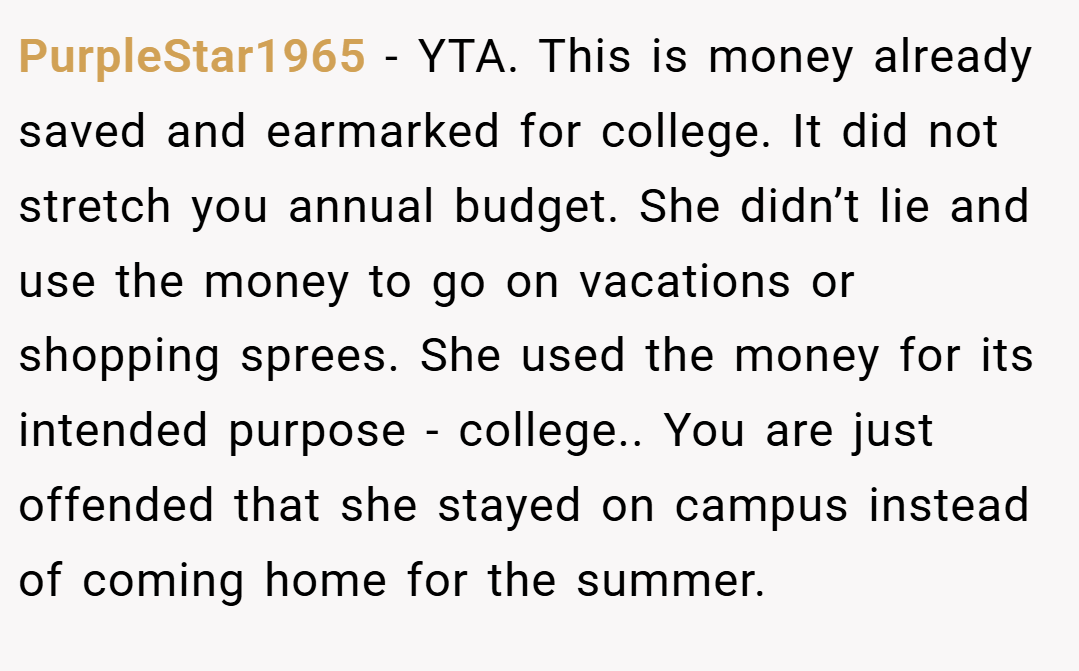

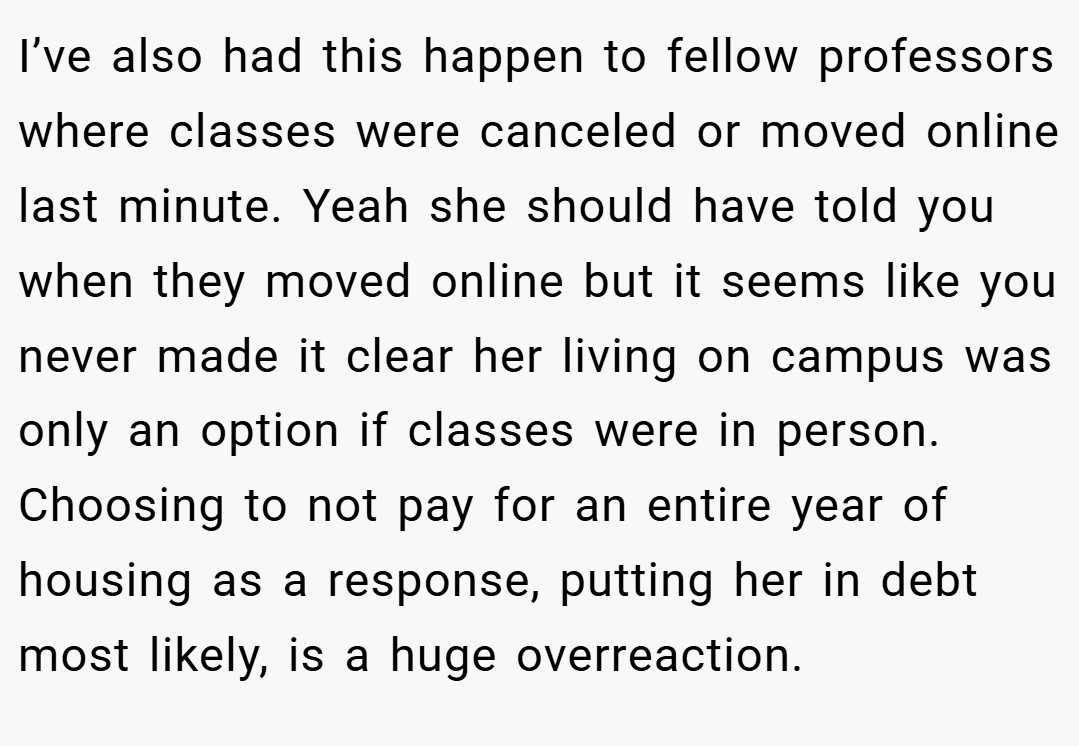

Here’s what the community had to contribute:

Here are some hot takes from the Reddit community—candid and peppered with diverse perspectives: The online reactions vary widely. Some argue that since the money is earmarked for education, any miscommunication should be resolved without imposing severe financial punishment.

Others feel that the daughter should have been upfront about the changes in her course format and that the father’s decision is a necessary wake-up call. The diversity of opinions underscores the complexity of balancing trust, honesty, and financial responsibility in college planning.

In conclusion, this contentious issue reflects a deeper conversation about trust, communication, and accountability in the realm of higher education financing. The father’s harsh decision to withhold future housing support stems from a perceived betrayal—one that disrupts the practical planning of a college education. But was it truly fair to impose such severe consequences, or could there have been a middle path to resolve the misunderstanding?

What do you think? Should miscommunications in college course formats lead to long-term financial punishments, or is there a more balanced way to teach accountability without compromising the student’s future? Share your thoughts and experiences in the comments below—your perspective might help others navigate similar challenging family dynamics.

![[Reddit User] − INFO What exactly is the issue with her doing online courses? It's still through the university right? What's the issue with her wanting to stay on campus to do these classes. I always found it easier to be in a school mindset either at school or in my college apartment rather than my parents home.](https://en.aubtu.biz/wp-content/uploads/2025/04/107428cmt112gb-06.png)