AITA for refusing to let my partner decide how I have to spend my gift?

In the delicate dance of financial decisions in relationships, conflicts sometimes emerge from even the most well-intended gifts. A recent debate has ignited between a young recipient of an £1800 gift and their long-term partner. The gift was intended solely for personal use, yet it has become a flashpoint where financial autonomy clashes with shared future plans, sparking a heated discussion on the rights one has over a personal asset.

On one hand, the recipient had carefully planned to enjoy a portion of the money while continuing to save for a house. On the other, the partner—keen on their joint financial goals—felt sidelined when she learned about the spending plan for a night away and new personal purchases. This unexpected intersection of independent choices and couple dynamics sets the stage for a modern debate over money management in relationships.

‘AITA for refusing to let my partner decide how I have to spend my gift?’

Financial autonomy in relationships is a nuanced subject. When a gift is given to one individual, many experts argue that its intended use remains solely the recipient’s prerogative. This notion is supported by the idea that personal finances, especially gifts and inheritances, serve as extensions of one’s independence.

However, the intermingling of shared goals, such as saving for a house, can complicate matters. It is crucial for couples to establish clear boundaries and communication regarding money management early on.

On the flip side, a partner’s reaction to feeling excluded from significant financial decisions might stem from underlying trust or communication issues. They may worry that independent spending could undermine the joint goals of the relationship. In such situations, the importance of transparent discussions cannot be overstated. Establishing mutual understanding around finances can prevent smaller disagreements from evolving into larger conflicts that threaten the relationship’s stability.

Bridging these divergent views, financial relationship expert Dave Ramsey once remarked, “When it comes to gifts and personal funds, control over money is a reflection of personal accountability; however, healthy couples communicate openly about their expectations.”

This insight reminds us that while an individual legally owns the money gifted to them, sharing their long-term aspirations through conversation may help alleviate any fears of exclusion, ensuring that financial decisions contribute to rather than detract from mutual trust.

Finally, a balanced approach might involve setting aside a portion of the gift for immediate personal enjoyment, while simultaneously reinforcing commitment to joint financial goals. Such a compromise respects both individual independence and the couple’s future plans.

Encouraging a dialogue centered on understanding each other’s perspectives—and perhaps involving a neutral financial counselor if needed—can transform a contentious issue into a constructive discussion. Ultimately, the key lies in recognizing that money, though personal, often carries emotional weight that reflects deeper values and expectations within the relationship.

Here’s the comments of Reddit users:

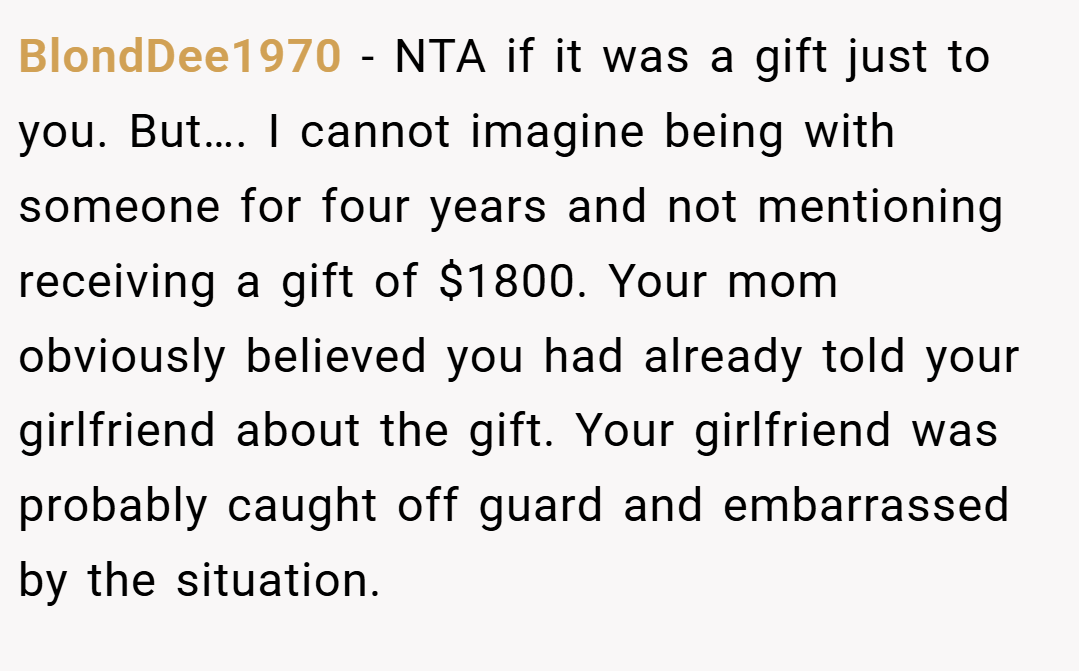

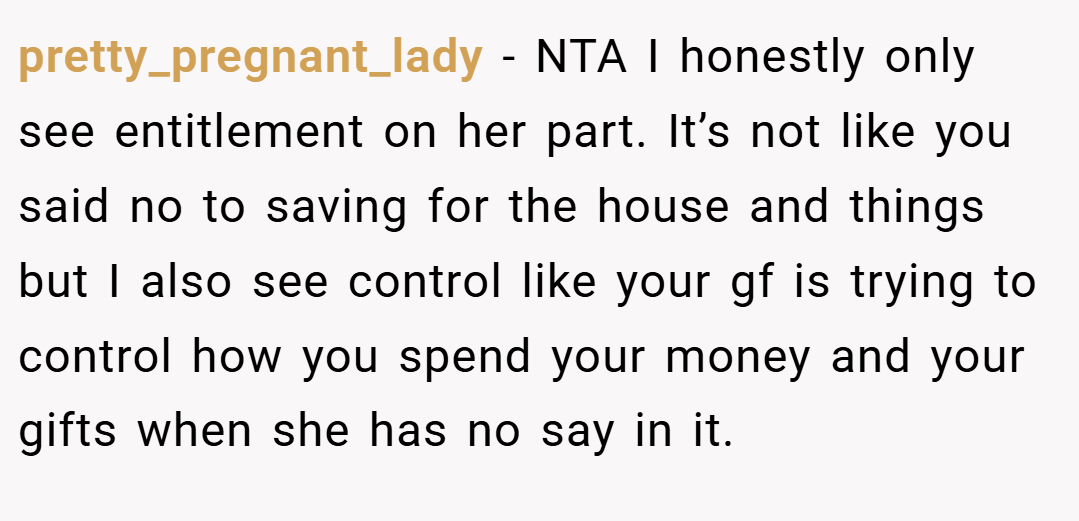

Here are some candid and varied responses from the Reddit community—ranging from staunch support for complete financial independence to calls for more open communication in relationships. Some commenters argue that since the gift was intended solely for the recipient, the spending decision is a personal matter.

Others highlight that transparency is crucial in long-term commitments, especially when both partners are preparing for significant expenses like a house deposit. These opinions reveal a spectrum of beliefs about financial autonomy and partnership dynamics.

In conclusion, the conflict over how to spend a personal gift serves as a microcosm for larger issues of financial independence and shared responsibility in relationships. While the gift was clearly intended for individual use, the reaction from the partner underscores the importance of open dialogue regarding shared financial goals.

This dilemma raises an important question: When, if at all, should personal finances be influenced by a partner’s vision of the future? What are your thoughts on balancing personal gifts and couple goals? We invite you to share your experiences and insights—how would you navigate such a scenario in your own relationship?