Fair Share First: AITA For Refusing to Transfer My Name Before Payment?

Losing a loved one is never easy, and when it comes to handling an inheritance, emotions can run just as high as the stakes. In this case, a daughter is caught in a dilemma over her late mother’s house. Despite a pre-established legal agreement that guarantees her a share of the property’s value, she is unwilling to sign her name off the deed until she receives her portion. This decision, made amidst the emotional turmoil of recent loss, aims to protect her financial future and honor what was legally promised.

Facing mounting debts and financial challenges after purchasing another family property, she finds herself in a tough spot. Her sister, who has already moved into the house, is pressuring her to relinquish her claim prematurely. The conflict highlights the difficult balance between familial love, legal rights, and financial necessity—raising the question: is she being unreasonable, or is she simply standing up for herself?

‘AITAH for not signing off of my dead moms house before receiving my portion of the value?’

Navigating inheritance disputes can be as emotionally taxing as it is legally complex. When family agreements are put to the test, it becomes crucial to prioritize legal and financial security over rushed decisions. In this scenario, the daughter’s reluctance to sign off on the house deed without first receiving her share is a prudent move—one that is strongly advised by legal experts in estate planning.

Estate planning attorney Judith Newman states, “The key is to secure your legal rights before finalizing any transfer. Inheritance disputes often escalate when parties rush into agreements without proper documentation or financial assurance.” Her advice underscores the importance of having clear, enforceable contracts and using escrow or title companies to safeguard each party’s interests.

This perspective is reinforced by many experts who caution against the premature transfer of property rights, especially when significant sums of money are involved. With the added pressure of managing personal debt and future financial obligations, holding out until all terms are met not only protects one’s legal rights but also helps maintain a fair and balanced family relationship. In essence, standing firm on financial matters in such situations isn’t greed—it’s about ensuring that what is legally and rightfully owed is received in full.

Check out how the community responded:

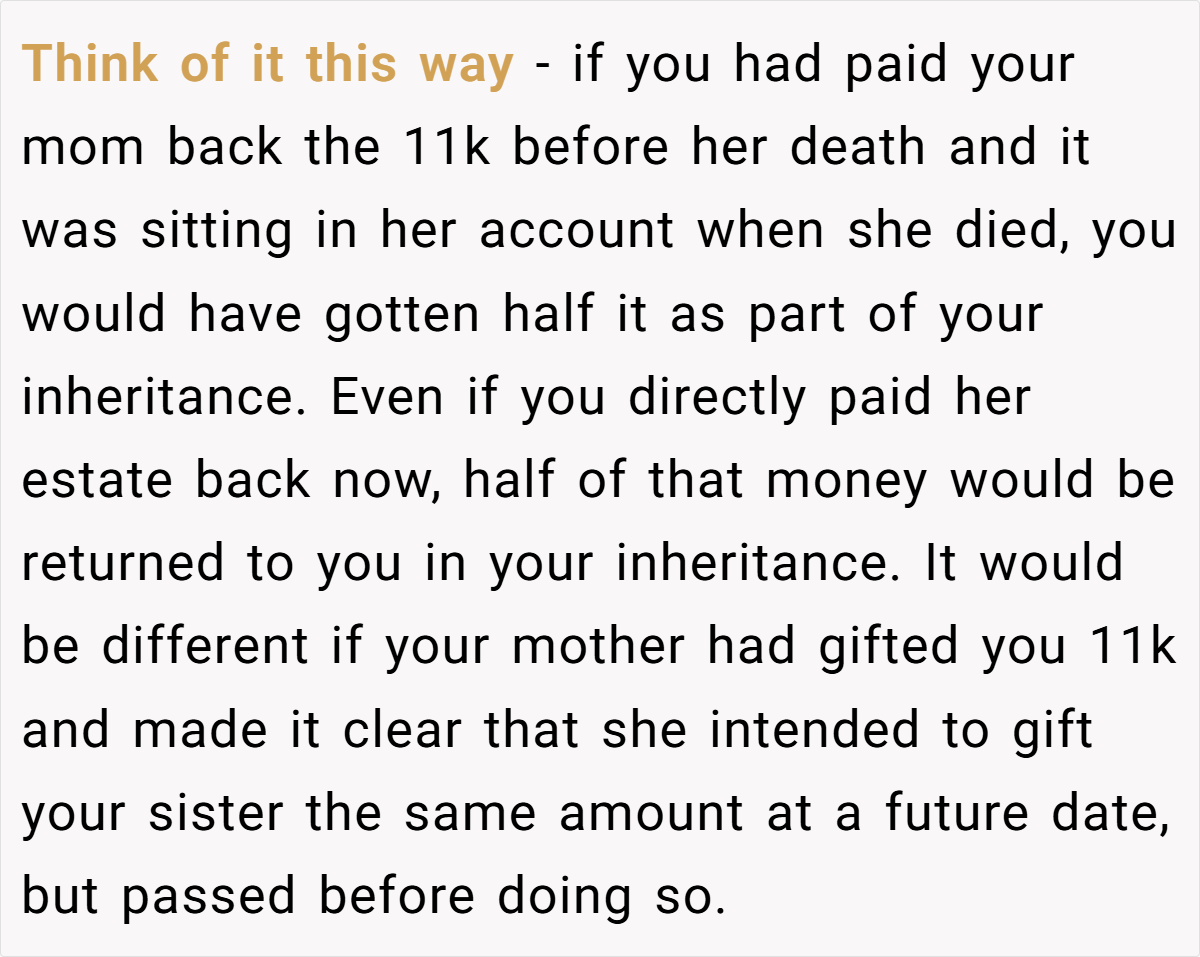

The Reddit community has overwhelmingly sided with the daughter, with many advising, “Never sign over your rights until you have the money in hand.” Commenters point out that her sister’s request to sign off before receiving payment is a red flag, potentially opening the door to future disputes or financial loss.

The consensus is clear: when it comes to significant assets like a family home, it is crucial to follow proper legal channels—whether that means refinancing, a formal buyout, or escrow arrangements—before any deed is transferred.

This case serves as a poignant reminder that even among family, financial agreements must be treated with the utmost seriousness. While emotions run high in the wake of a loss, safeguarding your legal and financial rights is essential. Is it reasonable to insist on receiving your fair share before signing off on an inheritance, or does this stance risk deepening family rifts?

What are your thoughts on balancing familial obligations with financial security in such delicate situations? Share your experiences and join the conversation on how to navigate these complex, emotional disputes.