AITA for Telling My Son His Financial Mess Isn’t My Fault?

Picture a quiet evening shattered by a heated phone call—a college freshman, drowning in credit card debt, points the finger at his dad for not teaching him how to manage money. For the father, it’s a familiar tune: years of trying to drill life skills into a son who’d rather walk away than listen, from botched laundry loads to a broken vacuum. Now, at 19, the son’s financial fumble sparks a fiery clash, with the dad refusing to foot the bill and delivering a blunt truth: “It’s not my fault you f**ked up.”

The son’s plea for a bailout, backed by grandparents’ nagging, stirs up old wounds and new tensions. This raw tale of tough love, accountability, and family friction pulls us into the messy reality of raising a young adult who’s still learning the hard way. Was the dad’s harsh wake-up call justified, or did it cut too deep?

‘AITA for Telling My Son His Financial Mess Isn’t My Fault?’

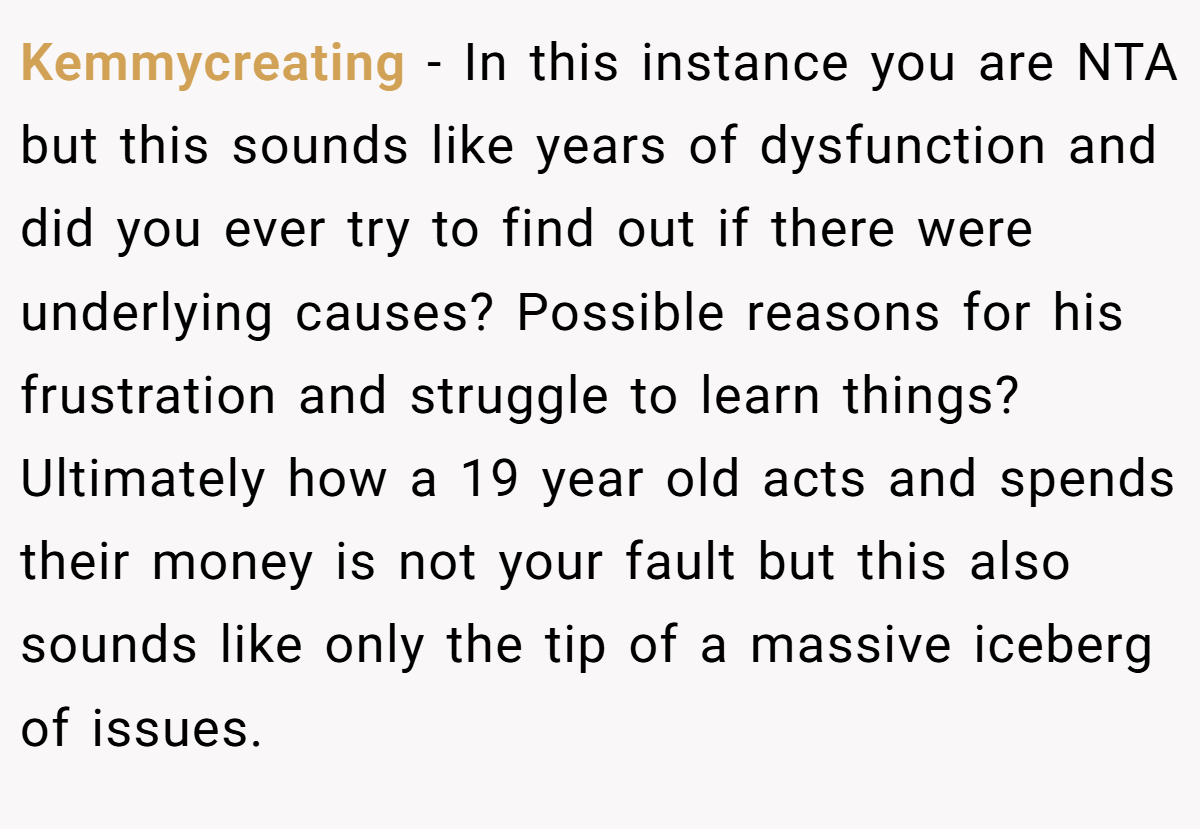

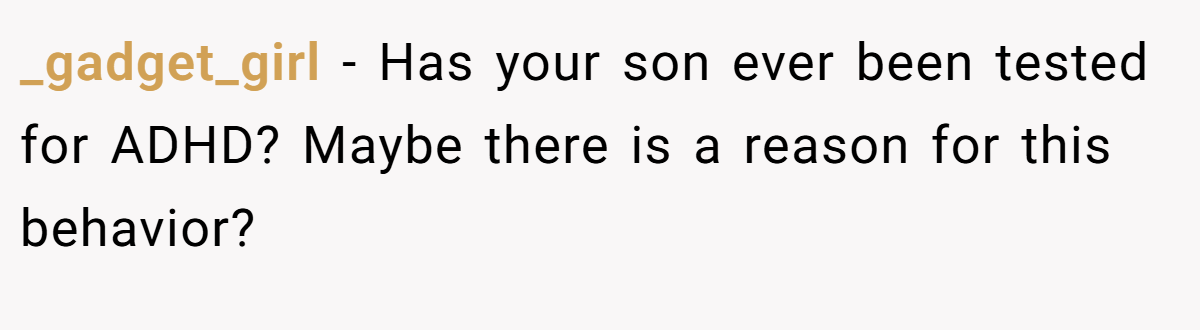

Parenting a teenager into adulthood is a tightrope walk, and this father’s frustration reflects a common struggle. The son’s refusal to learn basic tasks—laundry, cleaning, budgeting—suggests more than teenage rebellion. Dr. Russell Barkley, an ADHD expert, notes, “Persistent inattention to tasks, especially those requiring executive function like budgeting, can signal underlying issues like ADHD” .

The father’s attempts to teach, met with disengagement, likely fueled his blunt response. His refusal to pay the debt aligns with financial advice: bailing out young adults delays independence, with 60% of Gen Z relying on parental support for debt, per the Pew Research Center . However, his harsh words—“f**ked up”—escalated emotional stakes, alienating his son and inviting grandparents’ criticism.

Dr. Barkley suggests parents model accountability while exploring root causes. The son’s overspending isn’t the father’s fault, but dismissing it as laziness overlooks potential learning challenges. A softer approach, like offering budgeting tools or a financial literacy course, could’ve preserved the lesson without the sting. The grandparents’ involvement risks enabling, as cosigning debt often backfires, per the Federal Trade Commission .

For resolution, the father could initiate a calm talk, acknowledging his son’s stress while reinforcing boundaries—no bailout, but support through resources like budgeting apps. Testing for ADHD or learning issues could clarify past struggles. Open dialogue with grandparents, framing it as fostering independence, might ease family tension. Tough love works best with a side of empathy.

Here’s the input from the Reddit crowd:

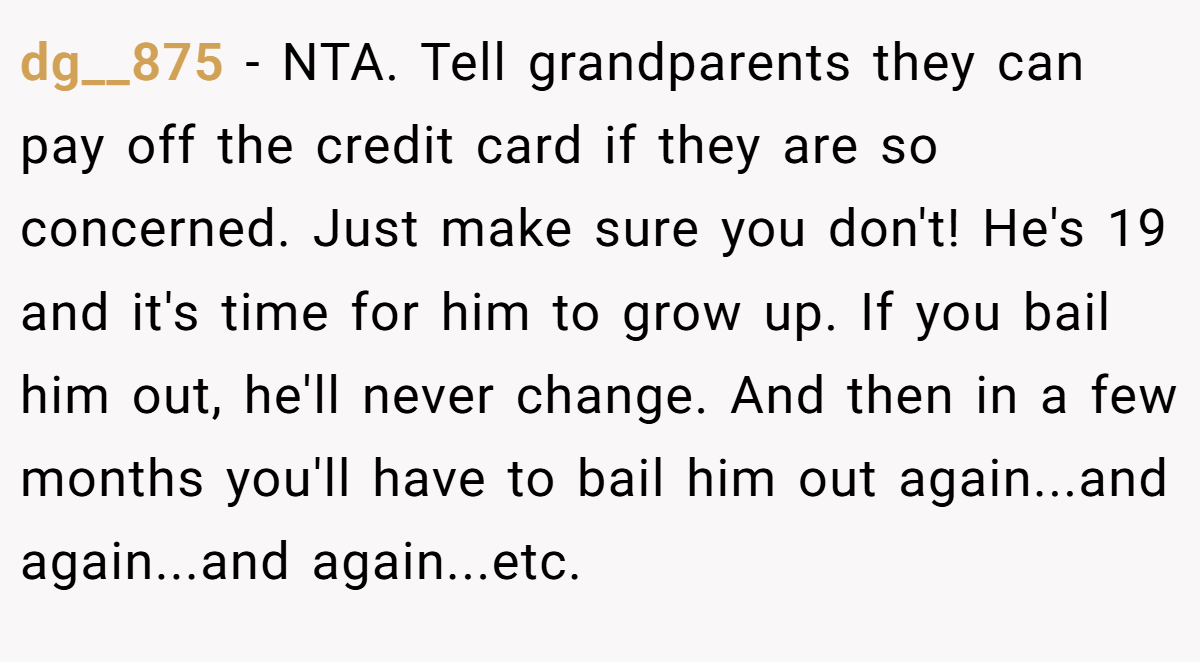

The Reddit gang dove into this family showdown like it was a reality TV cliffhanger, dishing out cheers and side-eyes with equal gusto. It’s like a group chat where everyone’s got a take on who’s slacking. Here’s the unfiltered buzz from the crowd:

Redditors mostly backed the dad’s tough stance, urging the son to grow up, but some questioned if deeper issues, like ADHD, were missed. Others called the dad’s vibe harsh, sensing years of friction. Do these takes hit the mark, or just fan the flames?

This father-son clash serves up a raw lesson in accountability and the limits of parental duty. The dad’s refusal to pay was fair, but his blunt delivery left scars. Reddit’s split on his approach, but the story begs the question: where’s the line between tough love and understanding? Have you ever had to draw a hard line with family over money? What would you do in this dad’s shoes? Share your thoughts below!