AITA for telling my SO that they are not entitled to my paychecks?

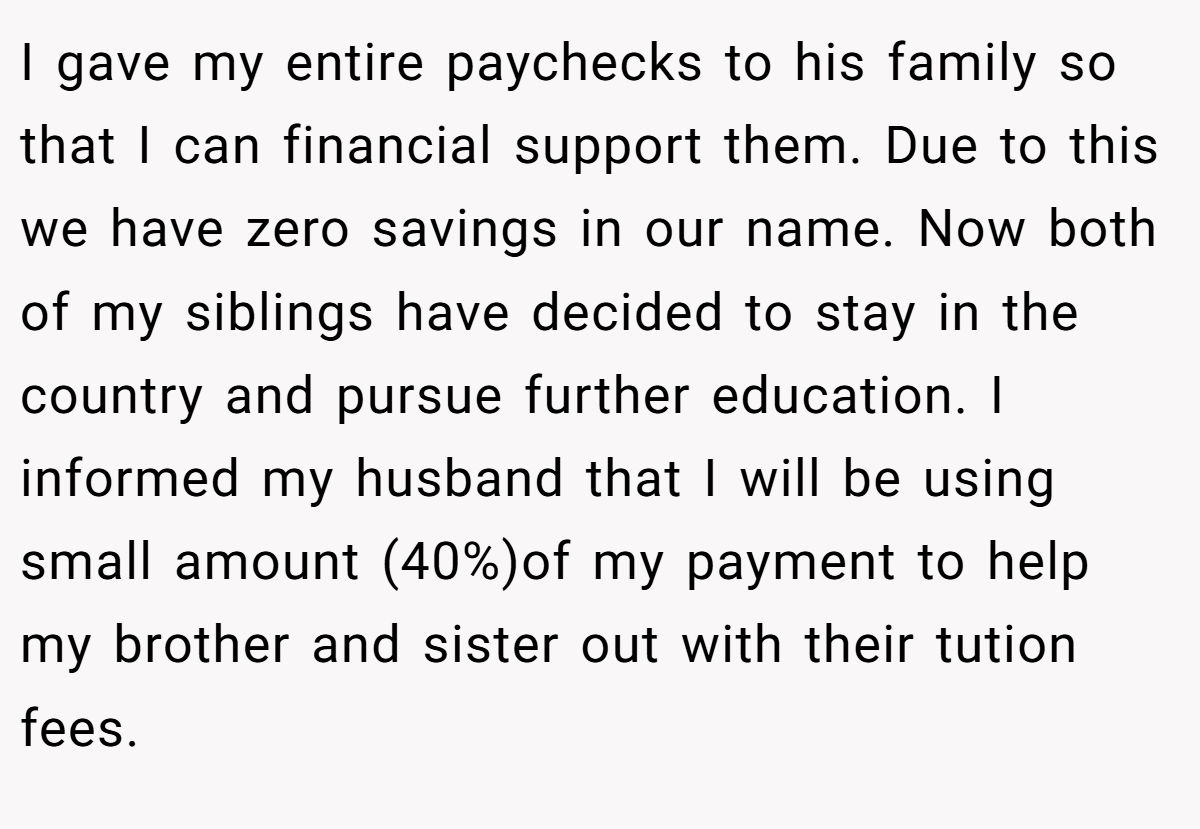

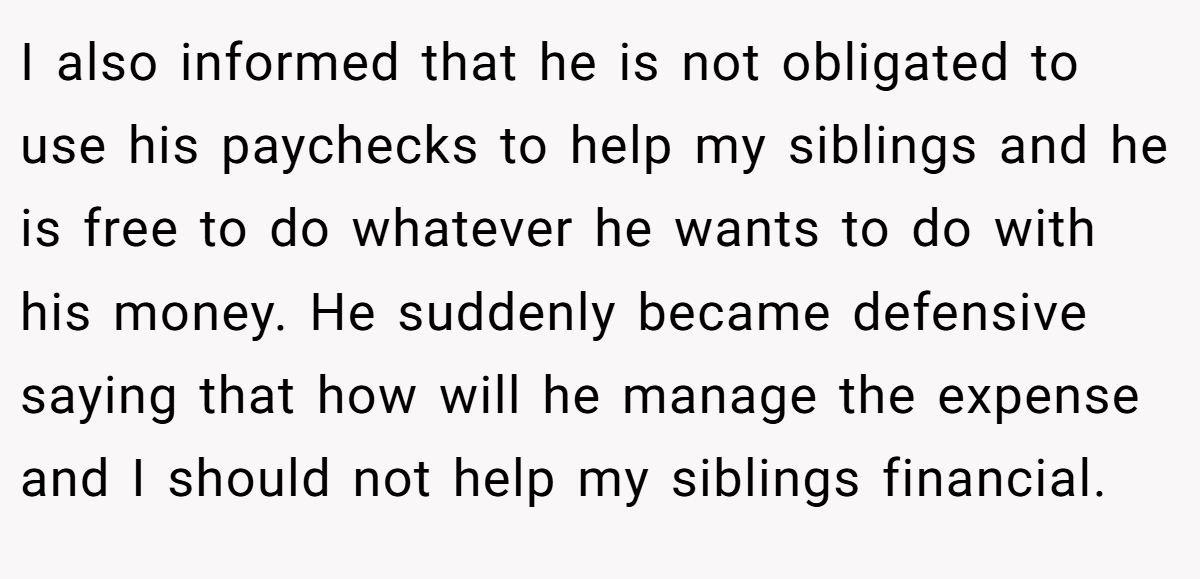

Imagine being eight months pregnant, juggling a demanding IT job, and realizing your bank account is a ghost town—not because of your own spending, but because your paycheck has been fueling someone else’s dreams. That’s the reality for one woman, caught in a tug-of-war between her husband’s family and her own. For two years, she’s handed over every cent to her in-laws, supporting her husband’s siblings abroad, leaving nothing for herself or her unborn child.

Now, with her own siblings needing help, she’s drawn a line in the sand, keeping just a slice of her earnings for them. Her husband’s reaction? Pure defensiveness, as if her money is his birthright. The Reddit hive mind erupted, and the question burns: is she wrong to claim her financial independence? This tale of loyalty and boundaries is one you won’t forget.

‘AITA for telling my SO that they are not entitled to my paychecks?’

Talk about a financial plot twist—this woman’s story is a masterclass in how money can tangle up a marriage. Handing over her entire paycheck to her in-laws for years, only to face pushback when she wants to support her own siblings, screams imbalance. The OP’s desire to help her family is fair, especially after years of funding her husband’s side. His defensive outburst, though, suggests he’s grown comfortable with controlling her income, which is a red flag waving high.

The OP’s perspective is grounded—she’s not cutting off her husband’s family but simply redirecting a portion of her hard-earned cash. Her husband’s claim that she’s making him feel indebted reveals a double standard: it’s fine for her to bankroll his siblings, but not her own? That’s a logic pretzel nobody can untwist. His reaction hints at deeper issues about power dynamics in their marriage.

This taps into a universal struggle: financial fairness in relationships. A 2024 survey by the National Foundation for Credit Counseling found that 65% of couples argue over money, often due to unclear expectations (https://www.nfcc.org/resources/newsroom/2024-financial-literacy-survey/). When one partner surrenders all financial control, resentment can fester, especially when new priorities—like a baby—enter the picture.

Relationship expert Esther Perel notes, “Money is never just about money—it’s about power, security, and trust” (https://www.estherperel.com/blog/money-and-relationships). Here, the husband’s resistance to the OP’s decision betrays a trust gap. He’s treating her income as communal property while guarding his own, which undermines their partnership. The OP’s calm assertion that he’s not entitled to her money is a healthy boundary, not an attack.

For solutions, the couple needs a financial reset. They should sit down with a neutral budget planner—apps like YNAB can help—and agree on shared expenses, personal savings, and family contributions. The OP could propose a joint fund for both families, ensuring fairness. If tensions persist, a counselor could untangle the emotional knots around money. Readers, how would you navigate this paycheck power struggle?

See what others had to share with OP:

Reddit brought the heat on this one, dishing out opinions sharper than a budget spreadsheet. Here’s a peek at what the community tossed into the ring—brace for some unfiltered takes: These Reddit gems cut straight to the chase, but do they capture the full picture, or are they just tossing fuel on the fire? One thing’s for sure: the crowd smells a rat when it comes to financial fairness.

This paycheck saga leaves us with a knotty question: where’s the line between family loyalty and personal autonomy? The OP’s stand for her siblings—and herself—is a bold move, but it’s exposed cracks in her marriage that need mending. With a baby on the way, the stakes are sky-high.

What would you do if your hard-earned cash was claimed by someone else’s priorities? Share your thoughts below—have you ever had to fight for financial control in a relationship?

![[Reddit User] − ESH. Why are you giving family members money that you can’t afford to give? I hope your child doesn’t suffer due to your financial ignorance.](https://en.aubtu.biz/wp-content/uploads/2025/04/120437cmtt-02.png)

![[Reddit User] − Girl as a fellow desi woman - wtf are you doing? It’s hard to feel bad for you because you’re a doormat. I know people that grow up in desi households are conditioned to think they need to help their families financially but that’s simply not the case. Unfortunately I know how this goes and to all y’all telling her to divorce and leave him, that’s simply not going to happen. I sincerely doubt she will follow any advice here.](https://en.aubtu.biz/wp-content/uploads/2025/04/120437cmtt-04.png)