AITA for telling my sister-in-law she’s not getting a dime of my brother’s inheritance?

A tense family dinner fizzled out before the dessert was even served, leaving a bitter taste in everyone’s mouth. The air was thick with unspoken resentment as a sibling, tasked with guarding a hefty inheritance, stood firm against their brother’s free-spirited wife. This wasn’t just about money—it was about loyalty, love, and a promise to protect a vulnerable brother’s future. With emotions running high, the clash over a house purchase and a lavish necklace unveiled deeper family fractures.

The story unfolds in a modest suburban home, where the weight of responsibility hangs heavier than the chandelier. The older sibling, now in their late 30s, has been more than a caretaker—they’ve been a parent, a bank, and a gatekeeper since their brother was just a boy. Readers can’t help but feel the tug-of-war between duty and distrust, wondering if this guardian’s grip is too tight or just right. Will this family find common ground, or will the inheritance tear them apart?

‘AITA for telling my sister-in-law she’s not getting a dime of my brother’s inheritance?’

This family feud is less about money and more about trust—or the lack thereof. The sibling’s tight control over the inheritance stems from a deep-seated need to protect their brother, especially given his cystic fibrosis and the wife’s perceived recklessness. But is this control justified, or does it cross into overreach? Both sides have valid points: the sibling wants to secure their brother’s future, while the couple craves autonomy.

This scenario reflects a broader issue of financial control in families. According to a 2023 study by the National Endowment for Financial Education, 38% of Americans report family conflicts over inheritance management, often due to differing values. Here, the sibling’s distrust of the wife fuels tension, but their strict oversight risks alienating their brother.

Dr. Brad Klontz, a financial psychologist, notes, “Money often amplifies existing relationship dynamics, turning personal grievances into financial battlegrounds” (source: CNBC article). In this case, the sibling’s dislike for the wife shapes their decisions, potentially blinding them to their brother’s wishes. Dr. Klontz’s insight suggests that open communication could ease this standoff.

For a resolution, the sibling could involve a neutral financial advisor to mediate, ensuring the brother learns money management while protecting the trust. Setting up a term life insurance policy for the wife, as suggested by a Redditor, could also address her security without compromising the trust’s integrity. Transparency and compromise are key to mending this family rift.

These are the responses from Reddit users:

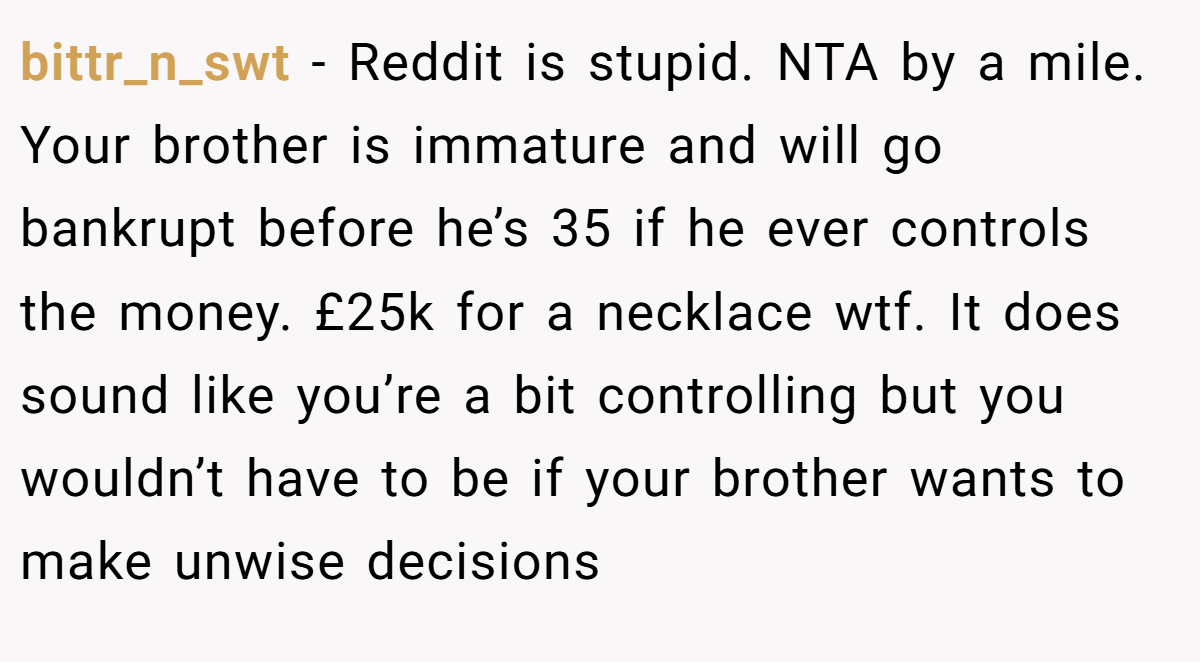

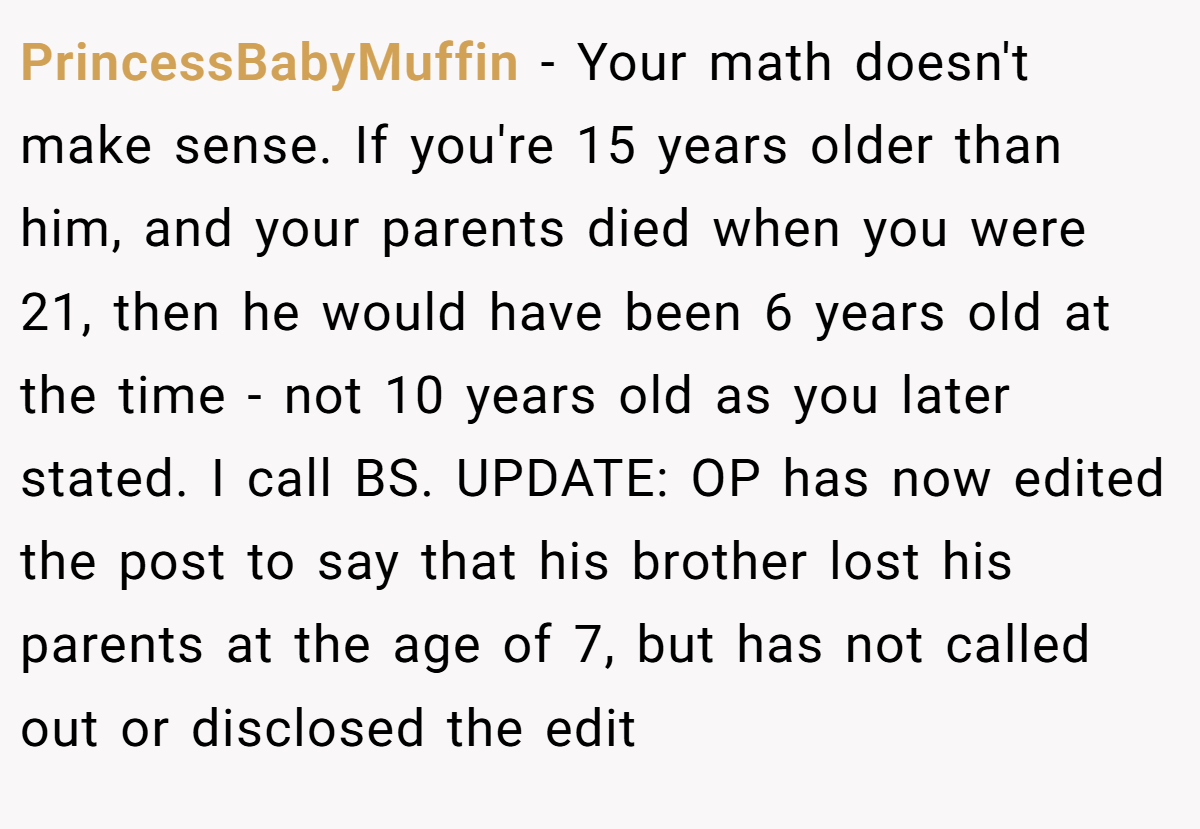

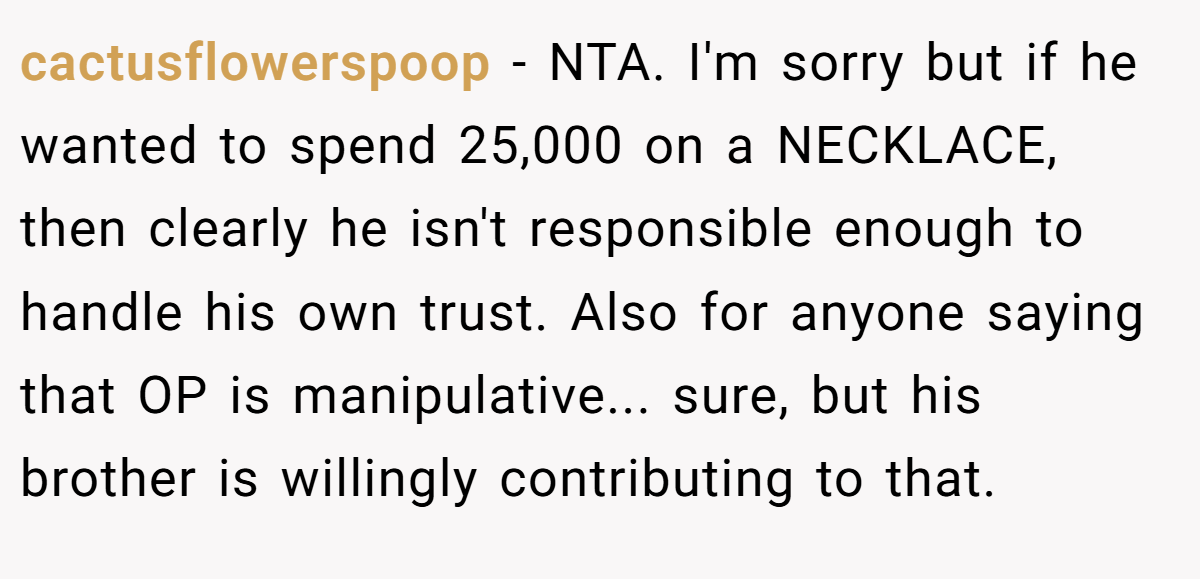

Reddit didn’t hold back, dishing out opinions as spicy as a family barbecue gone wrong. Here’s what the community had to say about this inheritance saga:

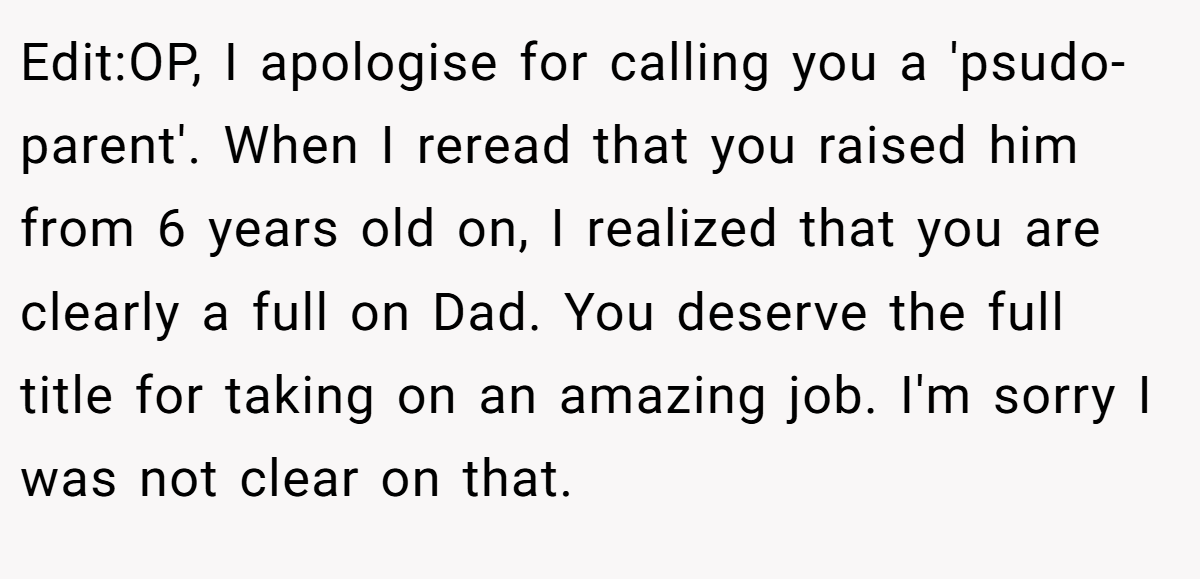

These are popular opinions on Reddit, but do they really reflect reality? Some see the sibling as a hero, others as a control freak—truth likely lies in the messy middle.

This tale of family, money, and mistrust leaves us pondering where duty ends and control begins. The sibling’s heart may be in the right place, but their iron grip might cost them their brother’s trust. What would you do if you were caught in this financial tug-of-war? Share your thoughts—would you side with the sibling, the brother, or find a middle ground?

![[Reddit User] − YTA. So, you've beocme the controlling parent now.. I suppose as executor of the estate you have that right, but the cost seems high.](https://en.aubtu.biz/wp-content/uploads/2025/05/247940cmt-01.png)