AITA for telling my mom I will move out vs paying $600 a month rent?

At 25, she’s ready to spread her wings—and her bank account agrees. For years, she enjoyed a nearly free ride at her parents’ house, paying just $60 a week for a private room. But with a new, stable temp job in hand, things took an unexpected turn.

One morning, her mom’s text read, “Rent starts up again, $150 a week,” and suddenly, the idea of paying what she’d normally shell out for a decent studio apartment felt unjust. This abrupt hike transformed a comfortable, familiar arrangement into a costly obligation that no longer made sense for an independent adult.

In two short sentences, her life took a decisive turn. Instead of reluctantly paying what amounted to $600 a month, she chose to move out. It wasn’t about the money alone—it was about reclaiming her autonomy and finding a living situation that truly reflected her status as an adult. After all, if you’re paying market rent, shouldn’t you have the full benefit of a space you can call your own?

‘AITA for telling my mom I will move out vs paying $600 a month rent?’

Transitioning from living with parents to independent living can be a significant financial and emotional step. Financial advisors emphasize that while parental support is invaluable, there comes a time when stepping into your own space not only builds independence but also encourages better budgeting.

Renowned personal finance expert Suze Orman has often noted, “Owning your own space isn’t just a luxury—it’s an investment in your future.” This mindset underpins our protagonist’s decision, as the increased rent no longer equated to additional services or benefits in her current living arrangement.

Another perspective comes from relationship dynamics in a family setting. Dr. John Gottman, a well-known expert in family relationships, explains, “When financial expectations shift without mutual agreement, it can lead to feelings of entitlement or resentment.”

In this case, the sudden jump to a landlord-like rent amount disrupted an arrangement that had worked for years, highlighting the importance of clear communication and renegotiation when circumstances change. The imbalance of paying a market rate for minimal space underscores the growing need for personal autonomy.

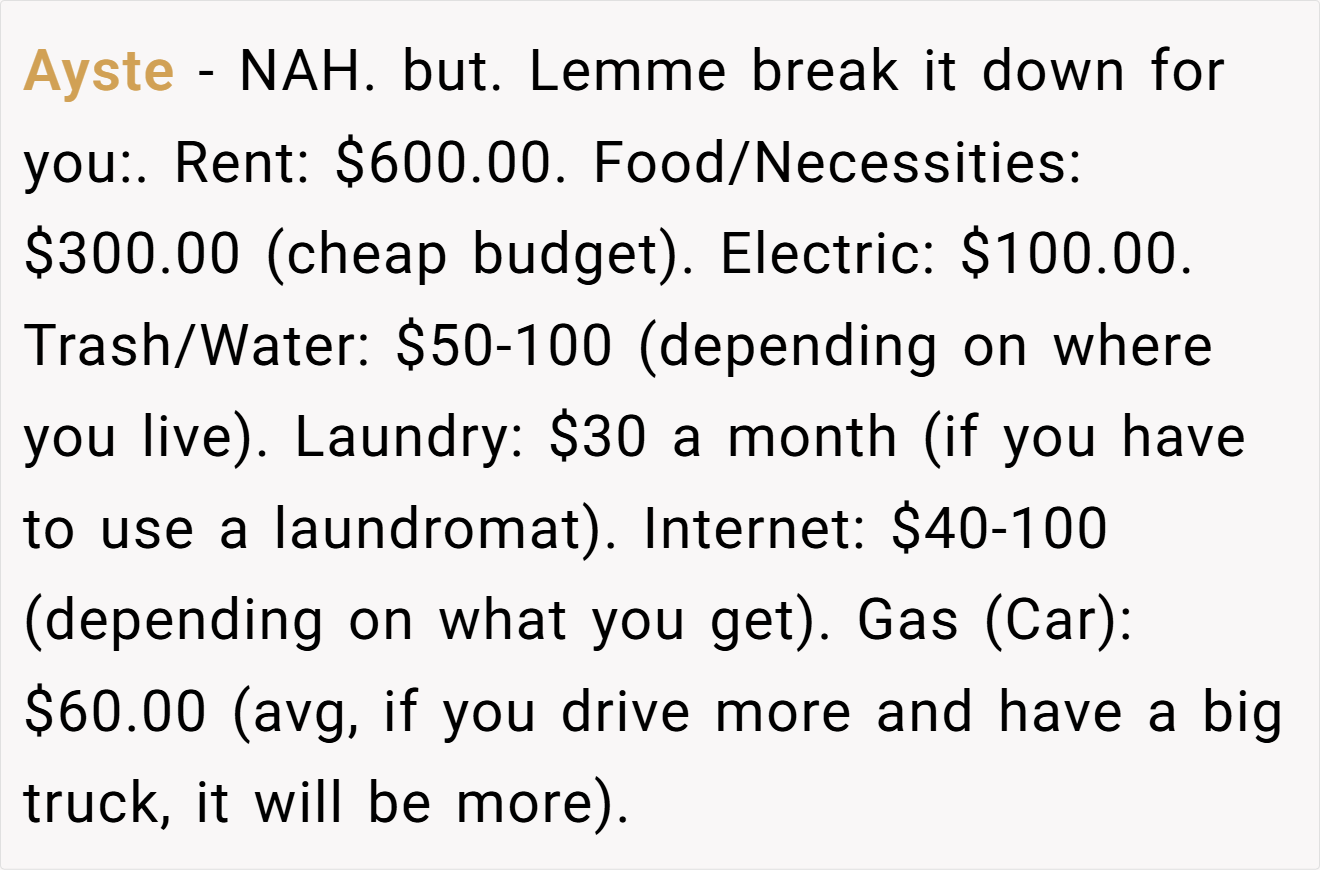

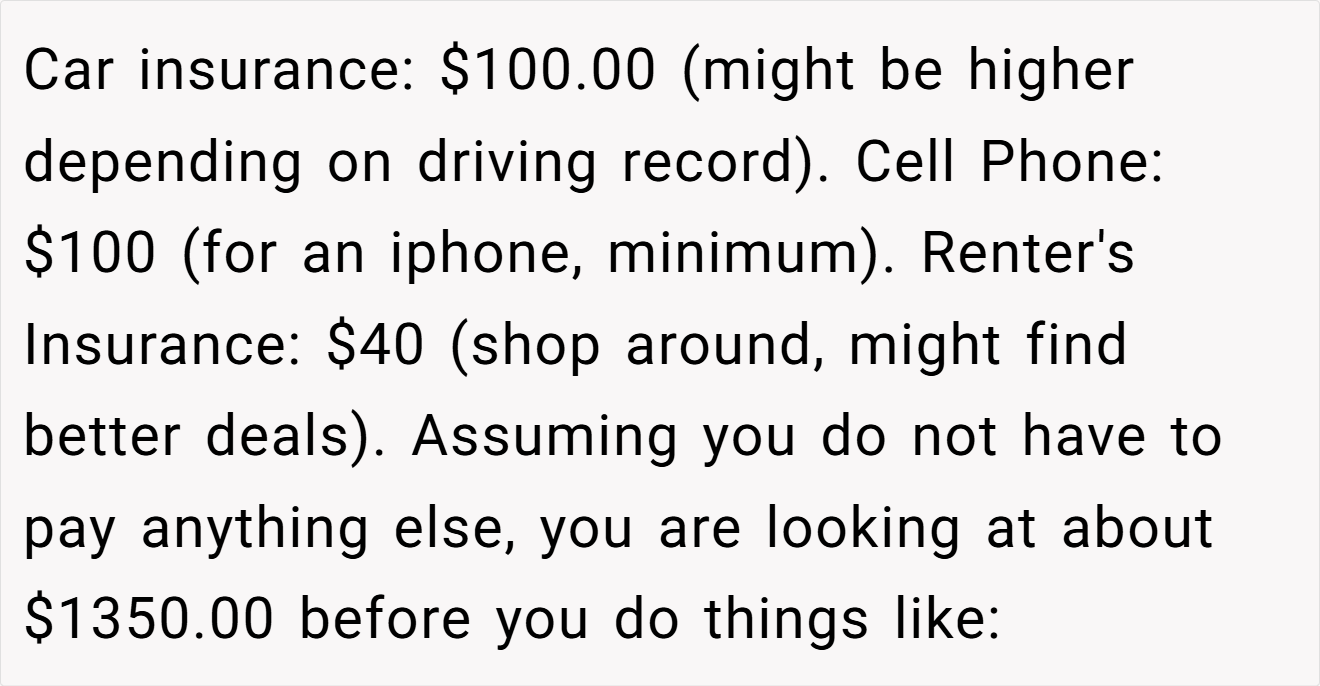

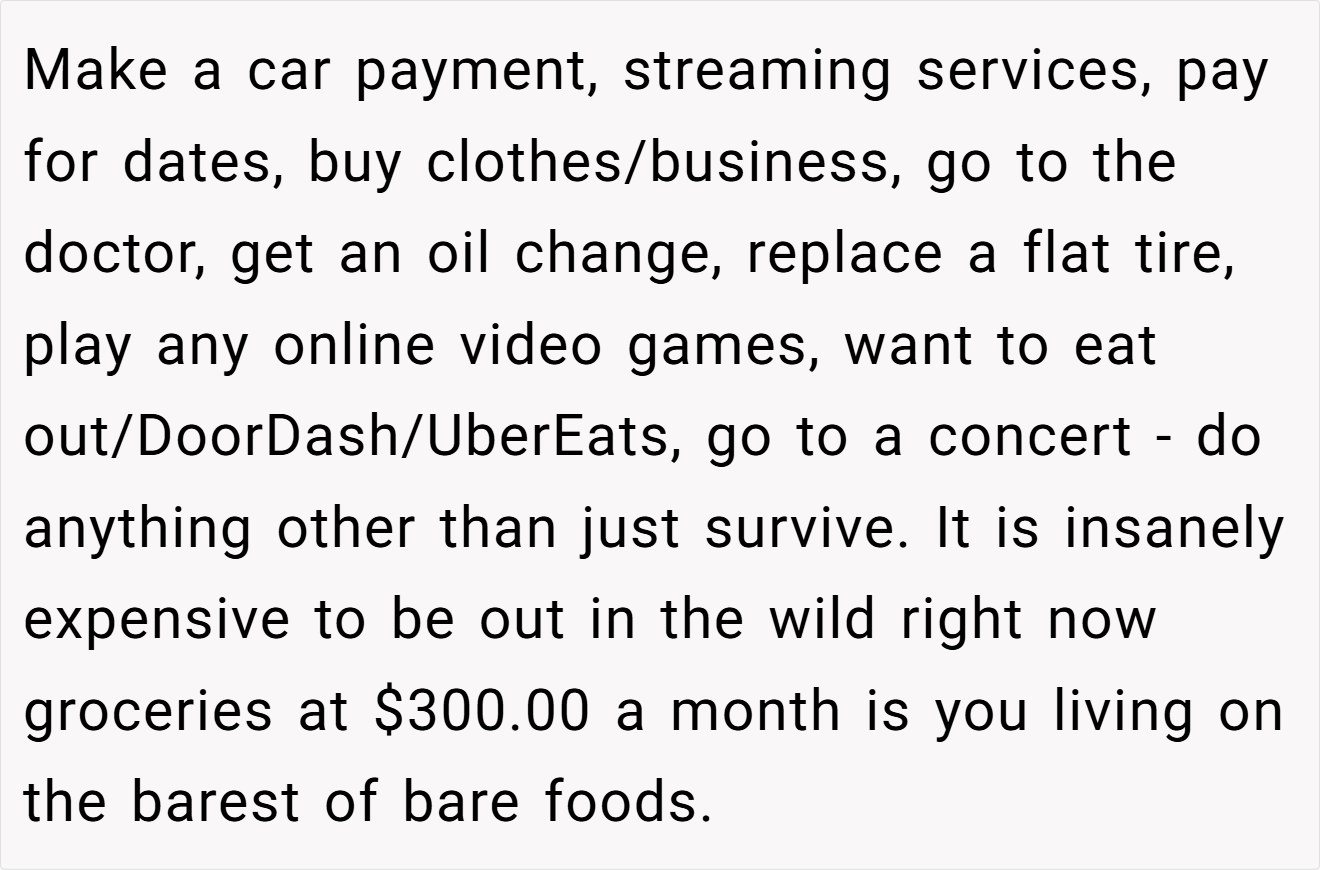

Furthermore, experts in housing economics remind us that when a young adult moves out, it’s not merely about leaving a room behind—it’s about stepping into a realm where every dollar counts. Independent living involves additional costs, from utilities to renter’s insurance, which require a well-planned budget.

However, as many experts agree, the freedom to manage your own space and finances is a crucial stepping stone toward financial maturity. With the extra money spent on rent, one also gains the intangible benefit of personal space and the independence that comes with it.

Lastly, from a psychological standpoint, the decision to move out in the face of a sudden cost increase can be seen as an assertion of self-respect. Psychologist Dr. Laura Markham explains, “Setting boundaries is an essential part of developing a healthy adult identity.”

For our protagonist, choosing independence over an inflated cost for merely a bedroom is a declaration that she values her autonomy and personal growth more than the comfort of familiarity. This crucial boundary-setting not only helps her manage her finances better but also paves the way for a more self-determined future.

These are the responses from Reddit users:

Many redditors agreed that if you’re financially independent, paying an inflated rent to live with your parents is a poor deal. One commenter remarked, “If your room isn’t even a proper space, why overpay when you can upgrade your living situation?” Another user pointed out that moving out means gaining privacy and control over your life—a win for any 25-year-old ready to fly solo. Others added that the OP’s decision was simply a practical one, given the available market rates and her own lifestyle needs.

In the end, the OP’s choice to move out rather than pay $600 a month to stay in her parents’ home is a bold assertion of her independence. It’s not about abandoning family, but about recognizing that her circumstances have evolved and so must her living arrangements. Her decision invites us to reflect on how changing financial realities can reshape family dynamics.

What would you do if your rent suddenly skyrocketed at home? Have you ever had to re-evaluate a long-standing living arrangement when your financial situation improved? Share your thoughts and experiences below—let’s discuss how to balance familial obligations with personal independence.