AITA for refusing to share my extra income with my wife when she didn’t share hers with me when she earned more?

In every marriage, financial arrangements can become a touchstone for deeper issues of fairness and trust. In this story, a husband and wife originally agreed to keep separate checking accounts—each enjoying their leftover income—when the wife earned slightly more. However, when circumstances shifted dramatically after the husband’s career leap into law, his earnings soared to nearly four times hers. What once seemed like a mutually accepted plan has now turned into a battleground, with each partner feeling that the scales of financial fairness have been tipped. The husband stands firm on the original agreement, while the wife now argues that the arrangement feels increasingly inequitable.

As the debate heats up, both sides are left questioning whether honoring an old promise outweighs the evolving realities of modern life. With emotions running high, this case raises important questions about how couples can navigate financial changes while keeping their commitment to fairness and mutual respect intact.

Below is the original Reddit post detailing this contentious financial arrangement and the resulting fallout:

‘AITA for refusing to share my extra income with my wife when she didn’t share hers with me when she earned more?’

Dr. John Gottman, a renowned relationship expert and author, once observed, “Couples who discuss and negotiate their financial decisions openly are better equipped to handle the stresses of a changing economic landscape.” His insights remind us that the dynamics of money management in a marriage must be flexible. Rigid adherence to an outdated arrangement, even if originally mutually agreed upon, may lead to feelings of resentment and imbalance.

Moreover, understanding that financial agreements are not static can help both partners navigate the inevitable twists and turns of life. Professional guidance, such as financial counseling or marital therapy, can offer strategies for recalibrating shared goals and ensuring that both partners feel valued.

In many cases, revisiting these decisions together can transform a source of conflict into an opportunity for deeper connection. A willingness to adapt and find a middle ground often marks the difference between long-term harmony and ongoing strife.

Ultimately, the debate over extra income sharing is not just about money—it’s about mutual respect and the evolution of shared responsibilities. As couples grow and change, so too should the arrangements that govern their finances. Addressing these issues head-on with compassion and clear communication may well be the key to sustaining a healthy, balanced partnership in the face of shifting economic realities.

Here’s how people reacted to the post:

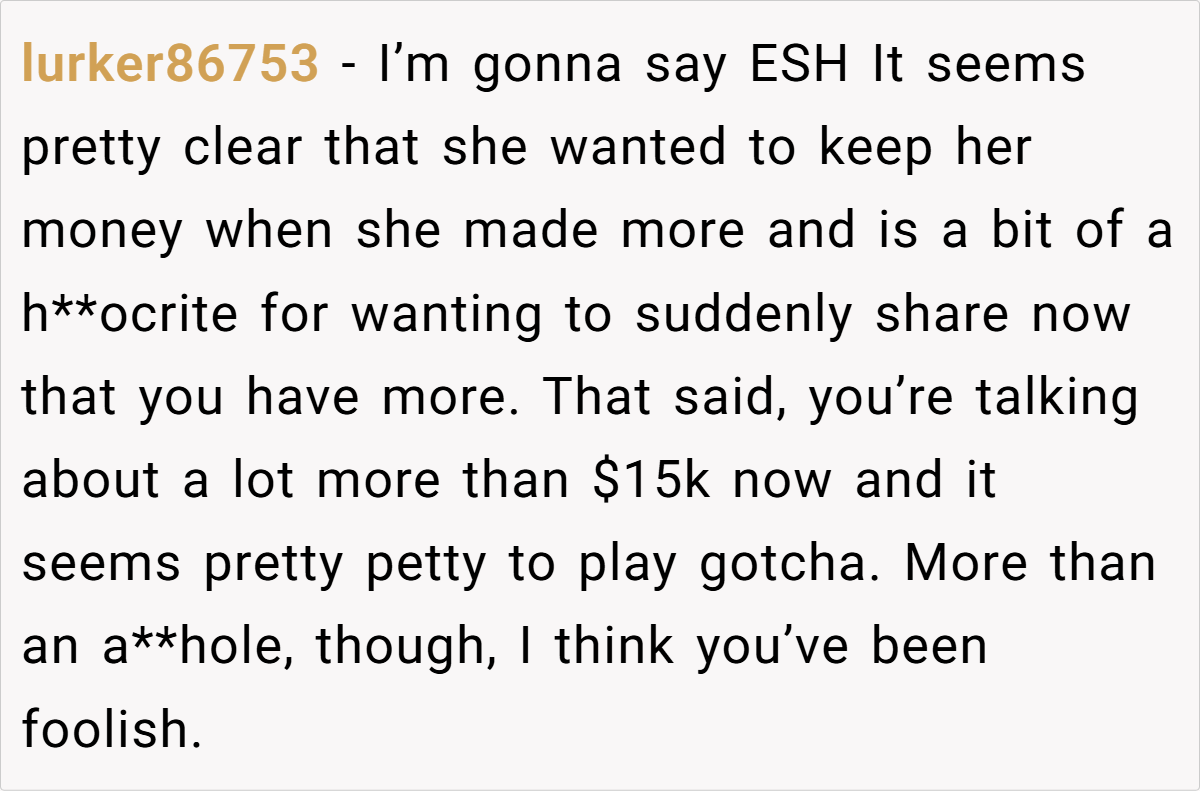

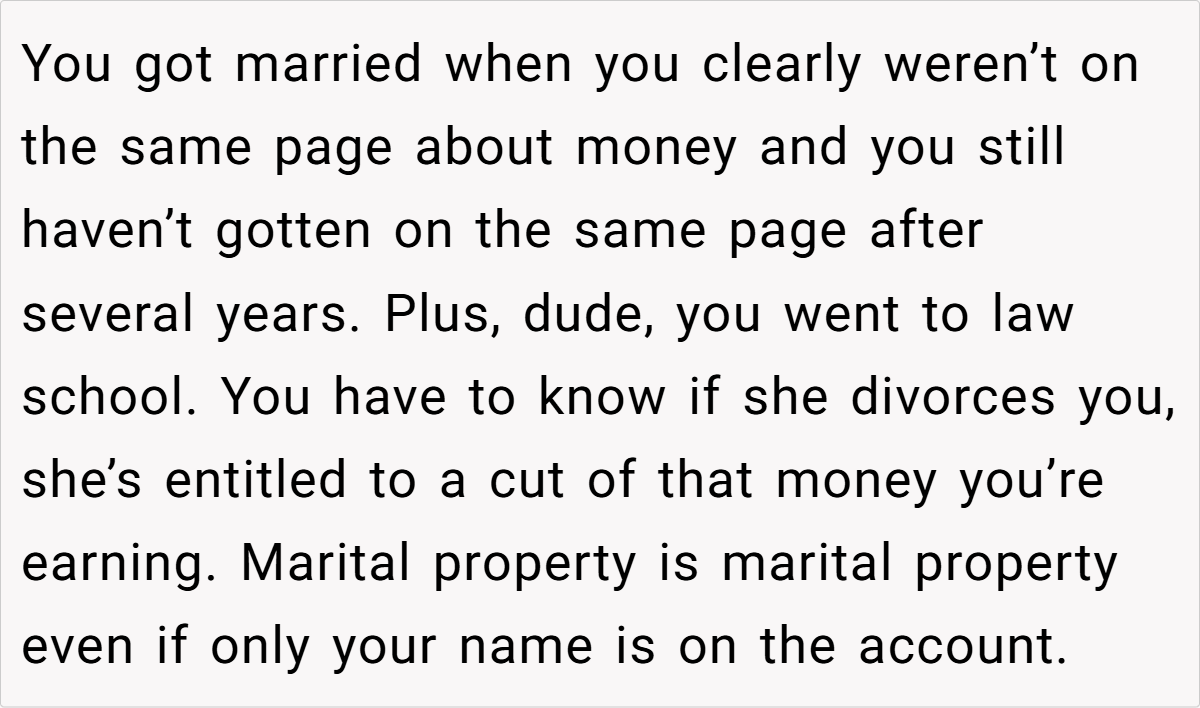

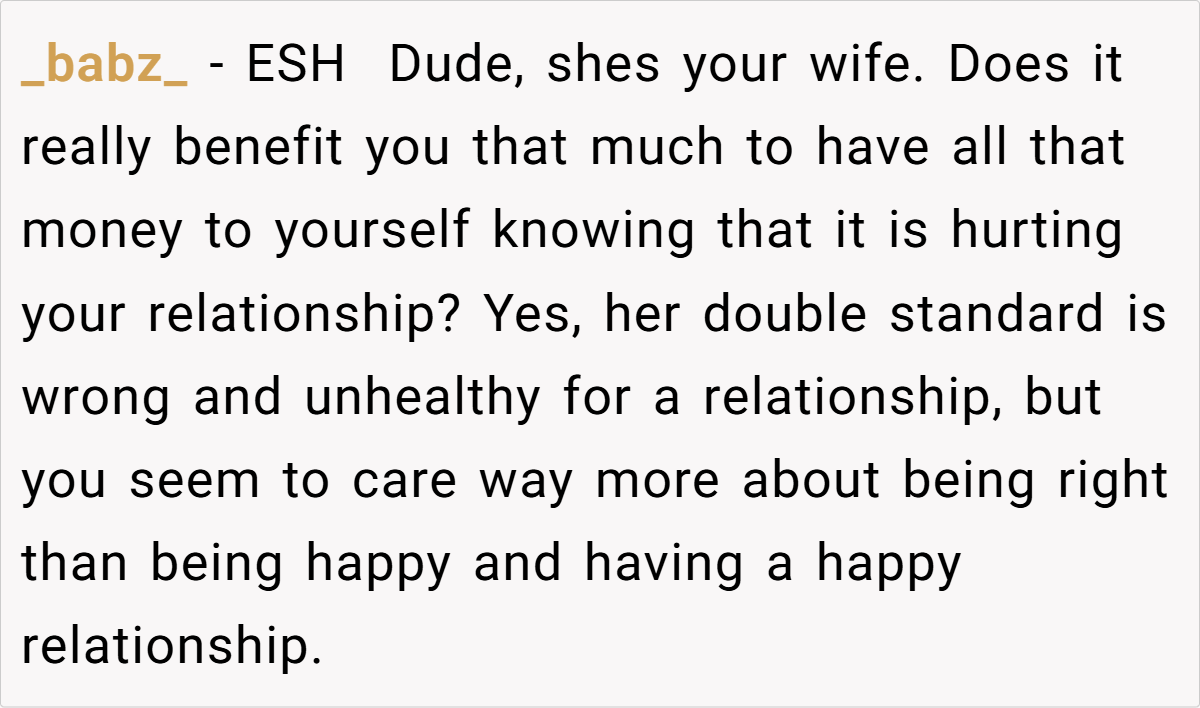

Commenters are split between those who believe that sticking to the original agreement shows consistency and those who argue that flexibility is essential when financial dynamics change. Some redditors praise the husband for holding his ground, while others criticize the arrangement as outdated and unfair.

In conclusion, this case highlights the challenges that come with financial evolution within a marriage. While the husband defends the original agreement as a matter of principle, the wife’s plea for a reexamination of their financial arrangement underscores the need for adaptability.

Is it better to honor past commitments, or should couples embrace change to ensure mutual fairness and satisfaction? What would you do in this situation? Share your thoughts and experiences below—let’s start a conversation about fairness, flexibility, and the true meaning of partnership.