AITA for refusing to give my grandparents my late husbands life insurance payout?

In the wake of an unimaginable loss, families are often forced to grapple with not only grief but also difficult financial decisions. The story at hand captures the heartache of losing a loved one while facing unexpected demands from extended family members. The emotional weight of such decisions is amplified when financial security—meant solely for the well-being of immediate family—is questioned. This situation paints a vivid picture of the complex interplay between legacy, obligation, and personal responsibility.

The narrative draws us into a scenario where a young widow, still reeling from her husband’s sudden passing, is confronted by in-laws asking for a share of the life insurance payout. Though compassion for struggling elders tugs at her heart, she remains steadfast in protecting her children’s future. This delicate balancing act between familial duty and self-preservation sets the stage for an in-depth exploration of both personal loss and the broader social dynamics at play.

‘AITA for refusing to give my grandparents my late husbands life insurance payout?’

Letting your partner meet your family can feel like a monumental step in a relationship, yet navigating financial decisions post-tragedy is an entirely different challenge. In this case, the widow’s decision to prioritize her children’s future over the demands of distant relatives reflects a careful weighing of emotional needs and fiscal responsibilities. The dilemma speaks to the universal challenge of honoring a loved one’s memory while securing the future of those who depend on you.

The core issue here is not merely about money but about the meaning of legacy and the boundaries of familial duty. The widow’s stance is rooted in the belief that life insurance is designed to protect her immediate family rather than serve as a financial lifeline for those who played a peripheral role. Her in-laws’ argument—emphasizing the supposed wishes of her late husband—clashes with her reality, where her children’s needs must come first. The conflicting expectations highlight a broader societal tension regarding entitlement and responsibility within extended families.

Broadening the lens reveals that such disputes are not isolated incidents but part of a larger conversation on financial planning and beneficiary designation. Recent studies indicate that clear communication about asset distribution can prevent long-lasting rifts among family members.

For instance, according to financial expert Suze Orman, “The primary purpose of life insurance is to provide a safety net for your loved ones, ensuring their financial security when you’re no longer there to support them” (Forbes Advisor, citeturn0search0). This perspective underscores the importance of intentional planning and setting firm boundaries to honor both memory and responsibility.

Expanding on this expert view, it becomes evident that effective financial planning involves more than just choosing beneficiaries—it requires an honest evaluation of each party’s role in your life. The widow’s approach aligns with Orman’s advice: ensuring that funds are allocated in a manner that directly benefits those most impacted by the loss.

Such strategic planning not only secures the future of her children but also prevents future conflicts over money. By making deliberate choices, she transforms a painful experience into a foundation for long-term stability and well-being.

In light of these insights, the key takeaway is to plan ahead and communicate clearly about financial matters. For those facing similar challenges, it is crucial to reflect on what truly matters and to protect the interests of those who depend on you. Engaging in discussions with financial advisors and legal experts can provide further clarity and help establish boundaries that honor your loved one’s memory while safeguarding your family’s future.

These are the responses from Reddit users:

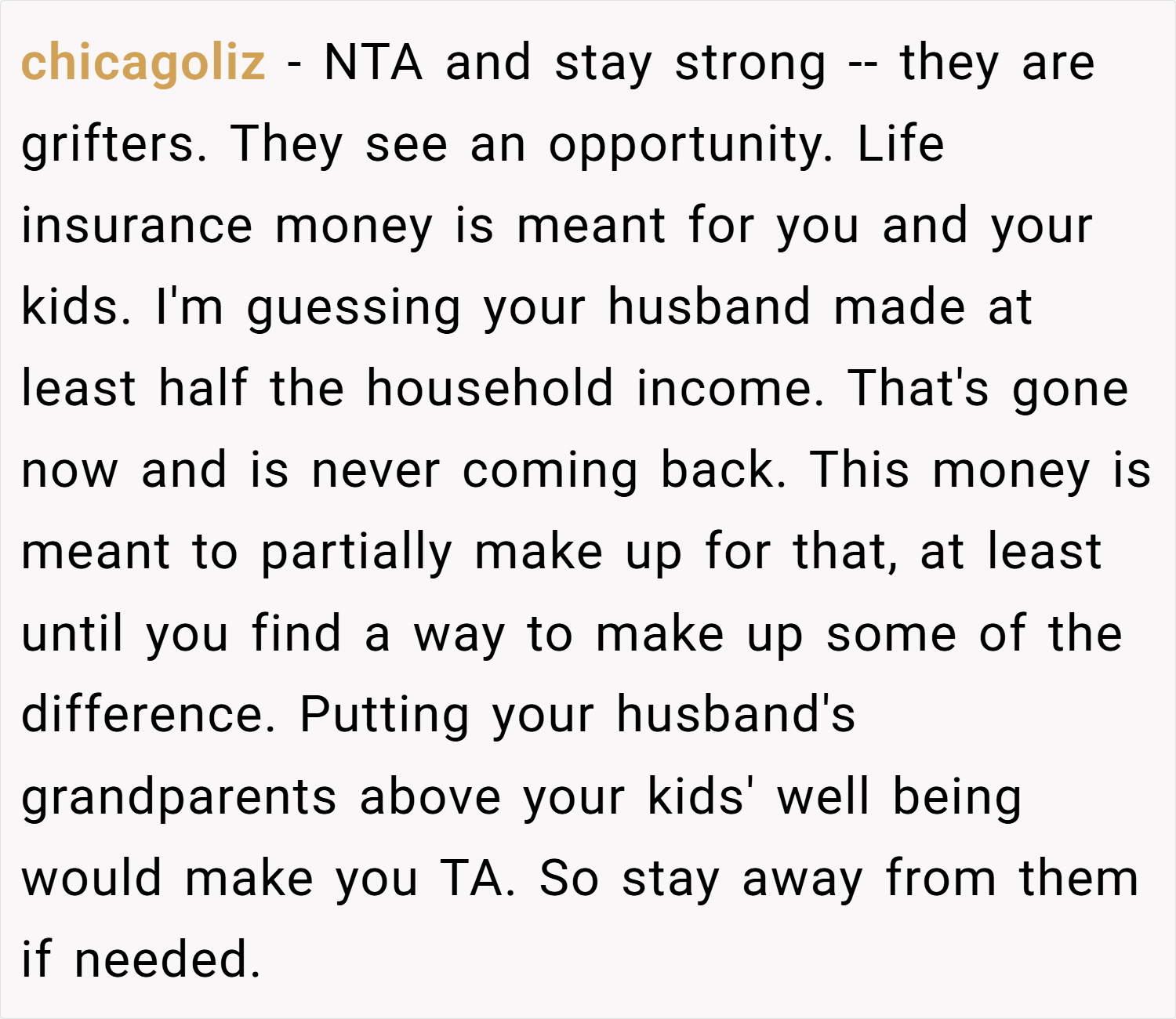

The Reddit community’s responses offer a fascinating mix of humor, empathy, and unfiltered opinions on this complex dilemma. Many users express heartfelt sympathy for the widow, emphasizing that during such a painful time, securing her children’s future should naturally take precedence over fulfilling extended family obligations

Several redditors poke fun at the in-laws’ sudden sense of entitlement, likening it to a late surge of opportunistic behavior that only appears when money is on the table. Others critique the in-laws for their past lack of support and engagement, arguing that their current demands are both untimely and unjustified.

A recurring theme is that any genuine help would have come through direct contributions rather than demands for a share of funds never meant for them. Overall, the lively community feedback reflects a broad consensus: protecting one’s immediate family and honoring the departed’s true intentions should always be paramount, even when faced with familial pressure.

In wrapping up, this story not only highlights the heartache of losing a partner but also the delicate balance of honoring memories while protecting your children’s future. It poses an important question: How do we set boundaries when expectations clash with personal priorities? What would you do if you found yourself in a similar situation? Share your thoughts and experiences—let’s discuss how best to navigate these emotionally charged financial crossroads.