AITA for not telling my boyfriend I received my unemployment?

In a cozy apartment filled with the faint hum of unpaid bills, a 28-year-old woman wrestled with a secret that weighed heavier than her empty wallet. She’d just received her unemployment check, a lifeline after her company’s collapse during the COVID storm. But her boyfriend, a charming 30-year-old with a knack for dreaming big and spending bigger, loomed like a financial tornado. His plans? Boats, vacations, and a $780 bass guitar for his buddy—none of which screamed “pay the rent.”

The tension bubbled as she guarded her secret, knowing his history of frittering away funds. His sister’s unexpected demand for a $5600 loan, casually promised without her consent, only deepened her distrust. Caught between honesty and self-preservation, she wondered if keeping quiet made her the villain—or just plain smart. Could you blame her for wanting to protect her future?

‘AITA for not telling my boyfriend I received my unemployment?’

This tale of hidden unemployment checks and lofty spending plans is a classic case of financial friction in relationships. Money disputes are a leading cause of breakups, with 41% of couples citing financial disagreements as a major issue. The woman’s boyfriend, coasting on her income for years, seems to treat her money as a shared piggy bank—without the sharing part.

Dr. Brad Klontz, a financial psychologist, notes, “Financial infidelity, like promising money to others without a partner’s consent, erodes trust as much as any betrayal” . Here, the boyfriend’s unilateral decision to pledge $5600 to his sister screams disrespect, while his frivolous spending ideas clash with her practical needs like fixing a car windshield. His back injury may limit his work, but leaning on her funds without discussion crosses a line.

This situation reflects a broader issue: financial compatibility. Couples often clash when one prioritizes stability and the other chases instant gratification. Her secrecy, while not ideal, stems from a need to protect herself from his reckless habits. Open communication is key, but so is mutual respect for financial boundaries.

For her, setting firm boundaries is crucial. Experts suggest creating a joint budget to align goals, but only if both parties commit to transparency. She could propose a shared financial plan, emphasizing essentials like rent over luxuries. If he resists, it may signal deeper issues. Trust, once cracked, needs deliberate effort to rebuild.

Here’s what the community had to contribute:

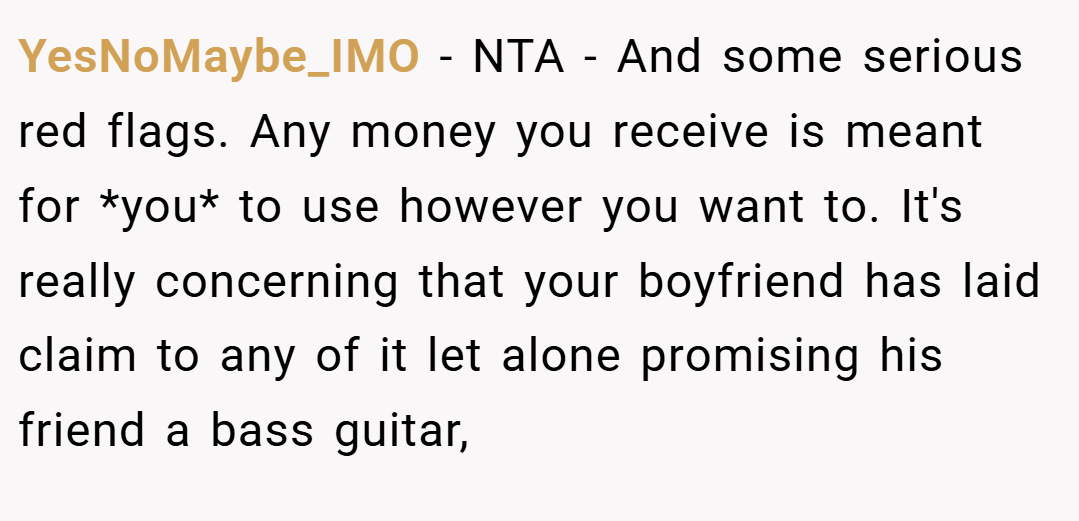

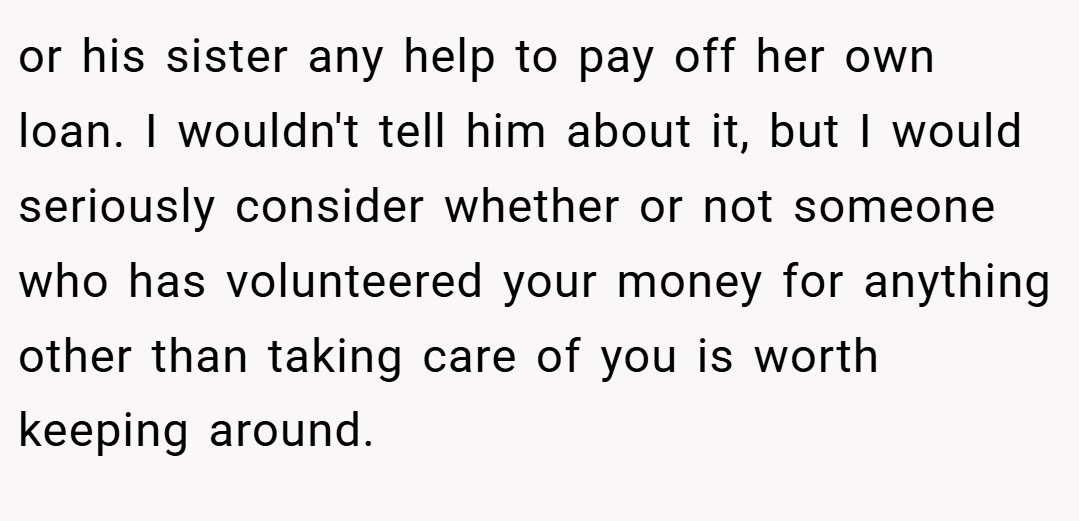

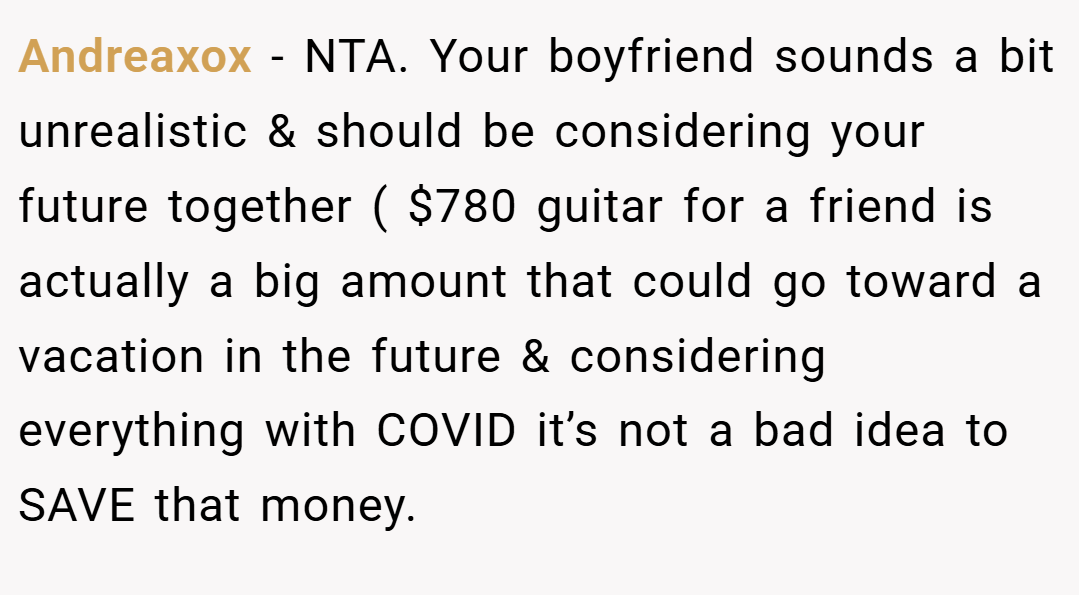

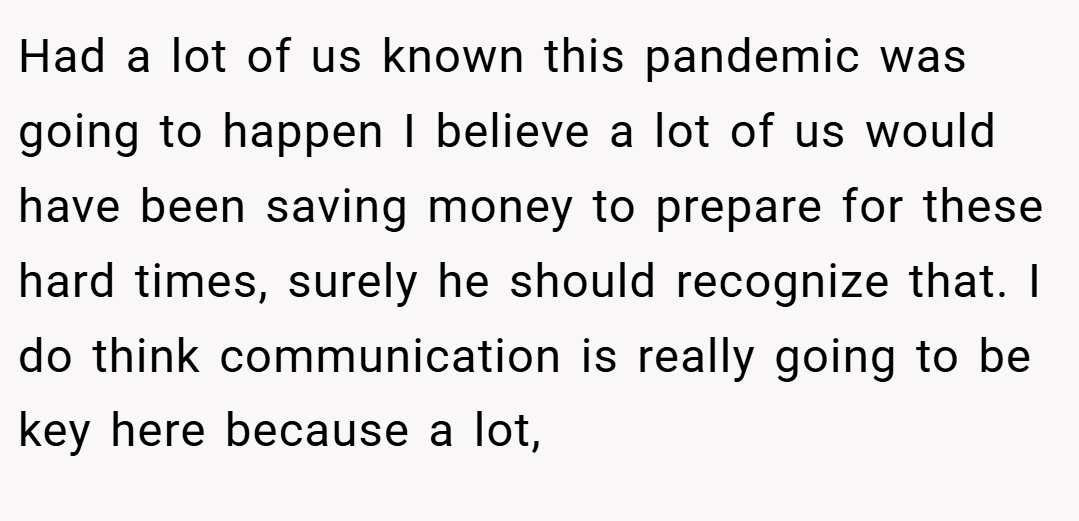

Reddit didn’t hold back, serving up a spicy mix of support and shade. The community rallied behind her, with some urging her to sprint from the relationship faster than you’d flee a bad Tinder date. Here’s the unfiltered scoop:

These Redditors cheered her caution but questioned her boyfriend’s motives. Some saw his promises to change as genuine; others smelled manipulation. Do these hot takes capture the full story, or are they just adding fuel to the drama?

This story lays bare the messy dance of love and money. Her choice to hide the unemployment funds wasn’t about deceit but survival in a relationship where trust was on shaky ground. His promises to change offer hope, but actions speak louder than words. Rebuilding trust requires both to align on financial priorities. What would you do if your partner treated your money like their personal playground? Share your thoughts and experiences below!

![[Reddit User] − NTA. Extremely concerning your boyfriend is spending YOUR money before you’ve even gotten it. In his head is one thing (saying he wants to buy a guitar, wants a vacation, whatever) but promising it away to other people who then place expectations on it is another.. Have you told him about the conversation with his sister?](https://en.aubtu.biz/wp-content/uploads/2025/06/303054cm1-03.png)