AITA for laughing in my brother and SIL’s faces when they demanded to use my credit card?

Navigating family dynamics and personal finances can sometimes feel like walking a tightrope—especially when emotions, responsibility, and money collide. In this case, a young university student finds herself in an awkward and frustrating situation when her brother and sister-in-law demand access to her credit card. With the pressures of student life, rent, and saving up for driving lessons already weighing on her, this unexpected family intrusion becomes the spark that sets off a cascade of tension and disbelief.

In a moment that mixes both indignation and a touch of amusement, she chooses to laugh off the absurdity of the demand. Her reaction is a reminder that while family bonds are strong, personal financial boundaries are equally important. This incident not only highlights the delicate balance between familial obligations and individual responsibility but also opens the floor to a broader discussion on money management within families.

‘AITA for laughing in my brother and SIL’s faces when they demanded to use my credit card?’

Allowing family members to use your credit card can be a slippery slope. The student’s decision to refuse her brother and sister-in-law’s request is rooted in sound financial judgment. Credit cards are designed as tools for building a positive credit history and managing short-term expenses—not as extensions of familial financial support. Lending out your card can expose you to unnecessary risks, including accruing debt that damages your credit score and creates an imbalance in your personal finances.

The decision also reflects the pitfalls of emotional manipulation within family relationships. When her brother and sister-in-law argued that past favors, like babysitting, entitled them to her credit, it blurred the lines between genuine support and financial exploitation. This situation illustrates that mixing money with family favors can often lead to misunderstandings and resentment, making it essential to set firm boundaries. It is crucial to prioritize one’s own financial stability over unverified claims of obligation.

Suze Orman, a renowned personal finance expert, has warned, “Your credit card is not a free pass for borrowing money from family. It’s a tool meant for building your financial future, not for patching up someone else’s fiscal mistakes.” Her words underscore the importance of treating personal credit as a serious financial resource. In this scenario, the student’s humorous yet firm refusal is a practical application of that advice, protecting her future financial health while setting clear expectations with her family.

Experts advise that if family members are facing financial challenges, they should seek professional guidance or explore alternative solutions rather than relying on someone else’s credit. Locking down your card, monitoring transactions, and maintaining transparent communication about financial boundaries are all strategies that can prevent such conflicts.

By standing her ground, the student not only safeguards her credit score but also sends a strong message about personal responsibility. The key takeaway here is that financial independence should never be compromised, even for the sake of family convenience.

Here’s the input from the Reddit crowd:

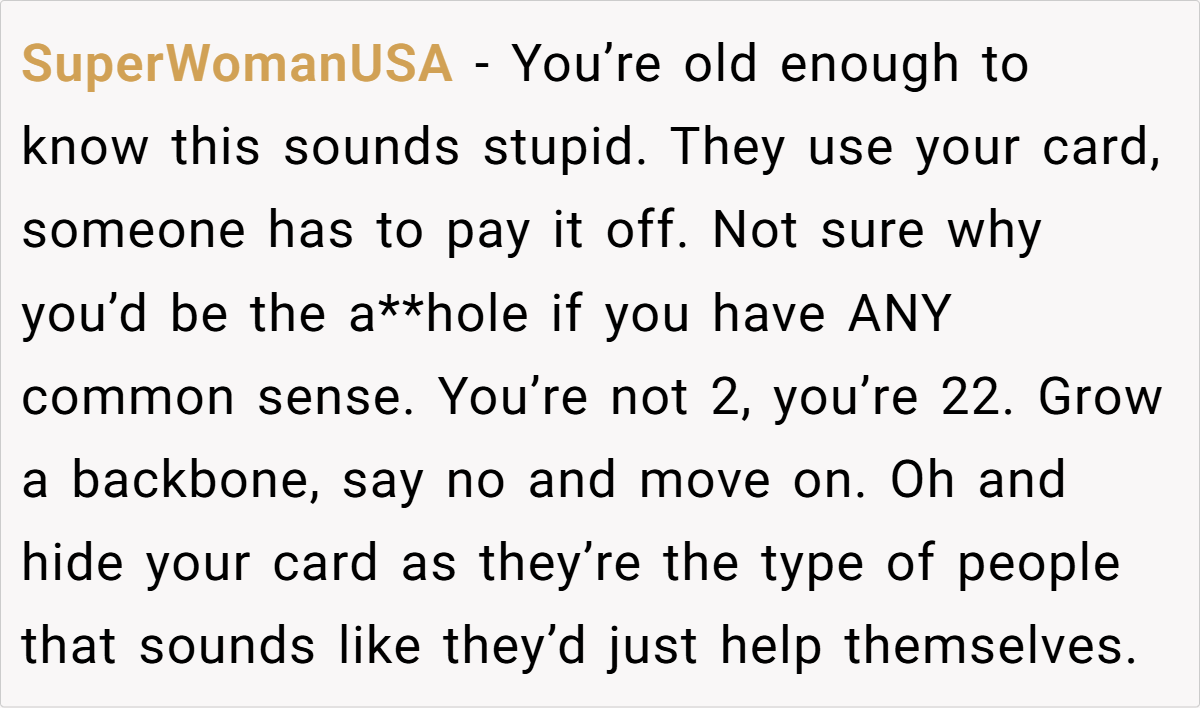

A broad consensus on Reddit supports the student’s decision. Many users agree that credit cards are personal financial tools and not a communal resource, emphasizing that lending them out can lead to a cascade of financial problems.

The community underscores the idea that those struggling with their own debts should seek help elsewhere rather than burden someone else with their financial mismanagement. The overall sentiment is clear: protecting your financial well-being is paramount, and it’s perfectly acceptable to say no when family boundaries are overstepped.

In conclusion, this incident shines a light on the often tricky intersection of family dynamics and financial responsibility. While some might argue that lending a credit card is a harmless favor, the risks and potential fallout far outweigh any temporary convenience. What would you do if you were in a similar situation? Have you ever been pressured to compromise your financial boundaries for the sake of family? Share your thoughts and experiences—your insights might help others navigate these delicate issues.

NTA but a simple fix just tell them you’ve cancelled the card because you’ve realize the trouble it’s causing. They’ll stop asking and be upset at that instead.

Put a lock on your credit file so they can open accounts/loans in your name. Contact the issuer of your current card and let them know no dpulicate cards ir authorized users can be added.

Put a lock on your credit. This notifys you of anyone trying to use your name/credentials to open or aquire accounts. This service is often free through the major credit reporting agencies