AITA for cutting the amount I contribute to our budget after my wife refused to stick to our agreement regarding our kids?

Marriages often begin with clear, heartfelt agreements on the big issues—where to live, how to manage family relationships, and even how to raise children. In one such case, a couple agreed that their children, as full-time students, would not contribute financially to the household budget. This arrangement was meant to give their kids time to learn responsibility through chores while easing them into independence. However, when one child deviated from the plan and the wife unilaterally waived his financial obligation, the carefully set agreement was disrupted, leading to a financial tug-of-war.

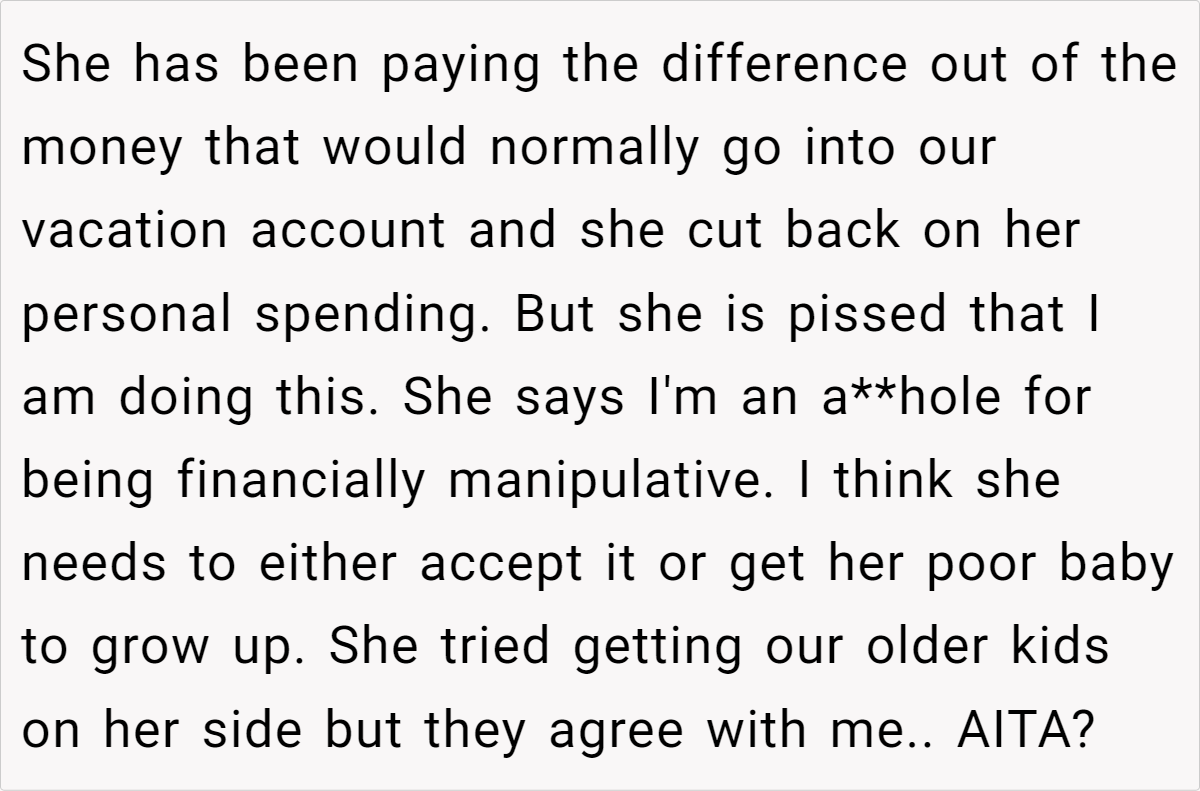

This conflict has now spilled over into the couple’s shared finances. Feeling that his partner had broken their agreement, the husband decided to reduce his monthly contribution to cover the “missed” amount. The resulting standoff not only questions financial fairness but also raises concerns about the long-term impact on their children and the overall balance in their marriage.

‘AITA for cutting the amount I contribute to our budget after my wife refused to stick to our agreement regarding our kids?’

For the full account of the situation, read the original post below:

Navigating finances in a marriage is never simple, especially when it involves agreements made long ago about parenting and household responsibilities. In this case, the husband feels justified in adjusting his contribution after his wife unilaterally reversed an agreed-upon rule. Such decisions can lead to a cycle of retaliatory actions and deepen the divide between partners. Open, honest communication about expectations is essential to avoid feelings of betrayal and resentment.

When long-standing agreements are broken, both partners may end up feeling disrespected. As conflict resolution expert Dr. John Gottman puts it, “It’s not the conflict itself, but the way you handle it.” This insight suggests that the manner in which disagreements are managed is crucial for preserving marital harmony. Here, both parties appear to be reacting emotionally rather than discussing the underlying issues, which can erode trust over time.

Moreover, unilateral financial decisions often mask deeper disagreements about parenting and personal responsibilities. The wife’s decision to exempt their youngest from contributing, even after an agreed grace period, has not only unsettled the financial balance but also raised questions about favoritism and the proper way to encourage independence. These actions may inadvertently undermine the other children’s sense of fairness and responsibility, potentially leading to long-term consequences in their development.

Practical advice for couples in similar predicaments is to revisit and clearly redefine their agreements together. A joint discussion—possibly facilitated by a counselor—can help both partners articulate their expectations and understand each other’s perspectives. Addressing the issue calmly, rather than resorting to punitive measures, might not only resolve the immediate financial dispute but also reinforce a united approach to parenting and budgeting for the future.

Finally, couples must recognize that financial disagreements are rarely just about money. They often signal deeper issues related to communication and mutual respect. In this case, a willingness to listen and compromise could pave the way for a healthier, more transparent partnership that benefits the entire family.

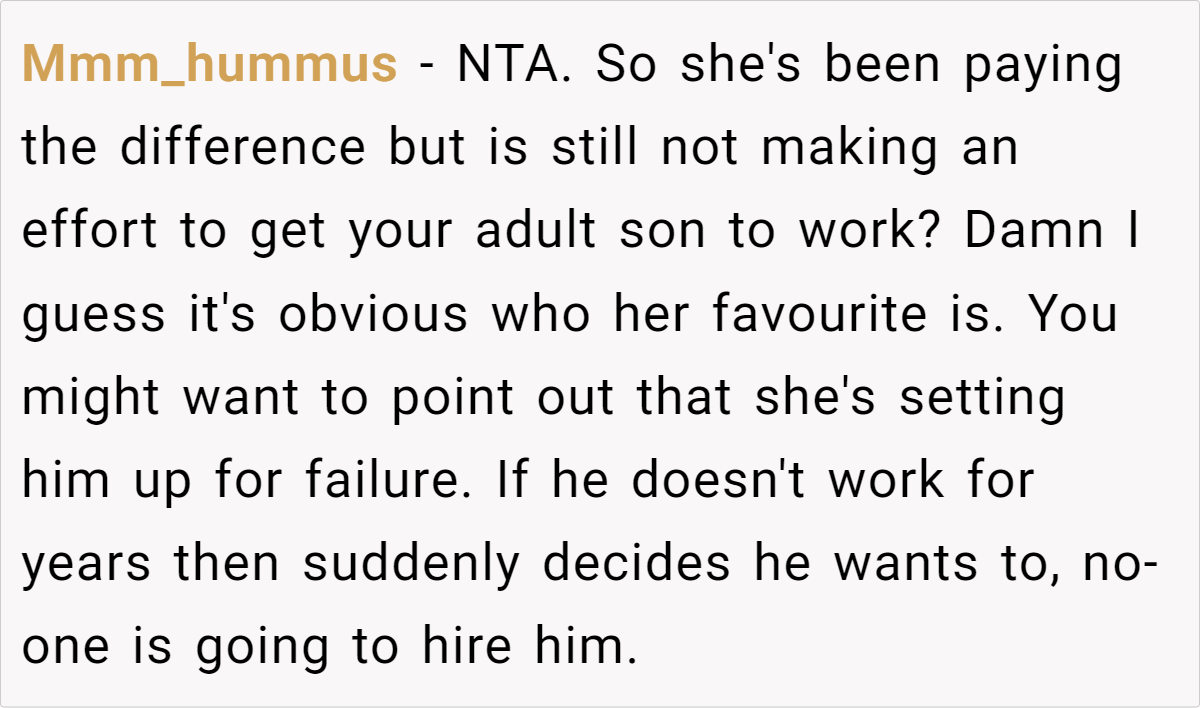

Here’s what Redditors had to say:

Here are some hot takes from the Reddit community—candid, humorous, and sharply insightful:

In the end, this marital standoff over financial contributions underscores the importance of keeping communication channels open and honoring mutual agreements. While the husband’s reaction may seem fair to some, the situation clearly reflects deeper issues that deserve a calm, thoughtful discussion.

How can couples balance the need to enforce agreements with the importance of supporting each other through changing circumstances? What strategies might you use to ensure that financial decisions strengthen rather than strain family bonds? Share your thoughts and experiences in the comments below.