AITA for choosing my budget over my boyfriend this Halloween?

Halloween’s spooky charm turned into a financial fright fest when a woman’s boyfriend went all-in on his childhood trick-or-treat dreams, ignoring their agreed-upon budget. Living in her house, the couple faced early money squabbles, settling on a strict household plan. But when he assumed she’d bankroll a decked-out Halloween with animatronic clowns and full-size candy bars, tensions boiled over. Her $500 olive branch wasn’t enough for his big-spending vision, leading to a candy catastrophe and a heated clash in front of trick-or-treaters.

The night ended with him storming off to a friend’s, texting her insults for being “cheap,” and demanding she leave her own home. This Reddit saga dives into the clash of financial priorities and relationship respect, where a festive holiday became a budget battleground. Was she wrong to hold firm on her finances, or was his Halloween havoc out of line? Let’s unravel this tale of candy chaos and credit card woes.

‘AITA for choosing my budget over my boyfriend this Halloween?’

When holiday dreams clash with financial reality, relationships can turn trickier than a haunted house maze. The woman’s refusal to fund her boyfriend’s extravagant Halloween plans beyond her $500 contribution was a stand for fiscal responsibility, not stinginess. His reckless spending, from blowing the budget on a single animatronic to dumping candy by the handful, shows a disregard for their shared financial agreement. Financial therapist Bari Tessler advises, “Couples must align on money values to avoid resentment and power imbalances” . His demand that she leave her own home and use her credit card highlights a troubling sense of entitlement, especially given his existing debt.

This taps into a broader issue: financial compatibility in relationships. A 2024 study found 45% of couples cite money disagreements as a top source of conflict, often when one partner prioritizes spending over stability . The boyfriend’s reliance on her to fund his vision, coupled with his refusal to consider budget-friendly alternatives like handmade decorations, suggests a lack of accountability. His public outburst and insults in front of kids further erode trust, placing her in an unfair role as his financial backstop. Tessler notes, “Healthy financial boundaries require mutual respect and shared responsibility, not blame.”

The woman should initiate a serious talk about their financial future, setting clear expectations for spending and debt management. If he can’t align, she may need to reconsider the relationship’s viability, especially since she owns the home. Changing the locks, as some Redditors suggest, could protect her assets if trust is broken. For readers, maintaining financial independence in relationships means open budgeting and mutual respect—splurging on dreams shouldn’t mean draining someone else’s wallet. The woman’s stand was a defense of her stability; her boyfriend’s reaction is a red flag that needs addressing.

These are the responses from Reddit users:

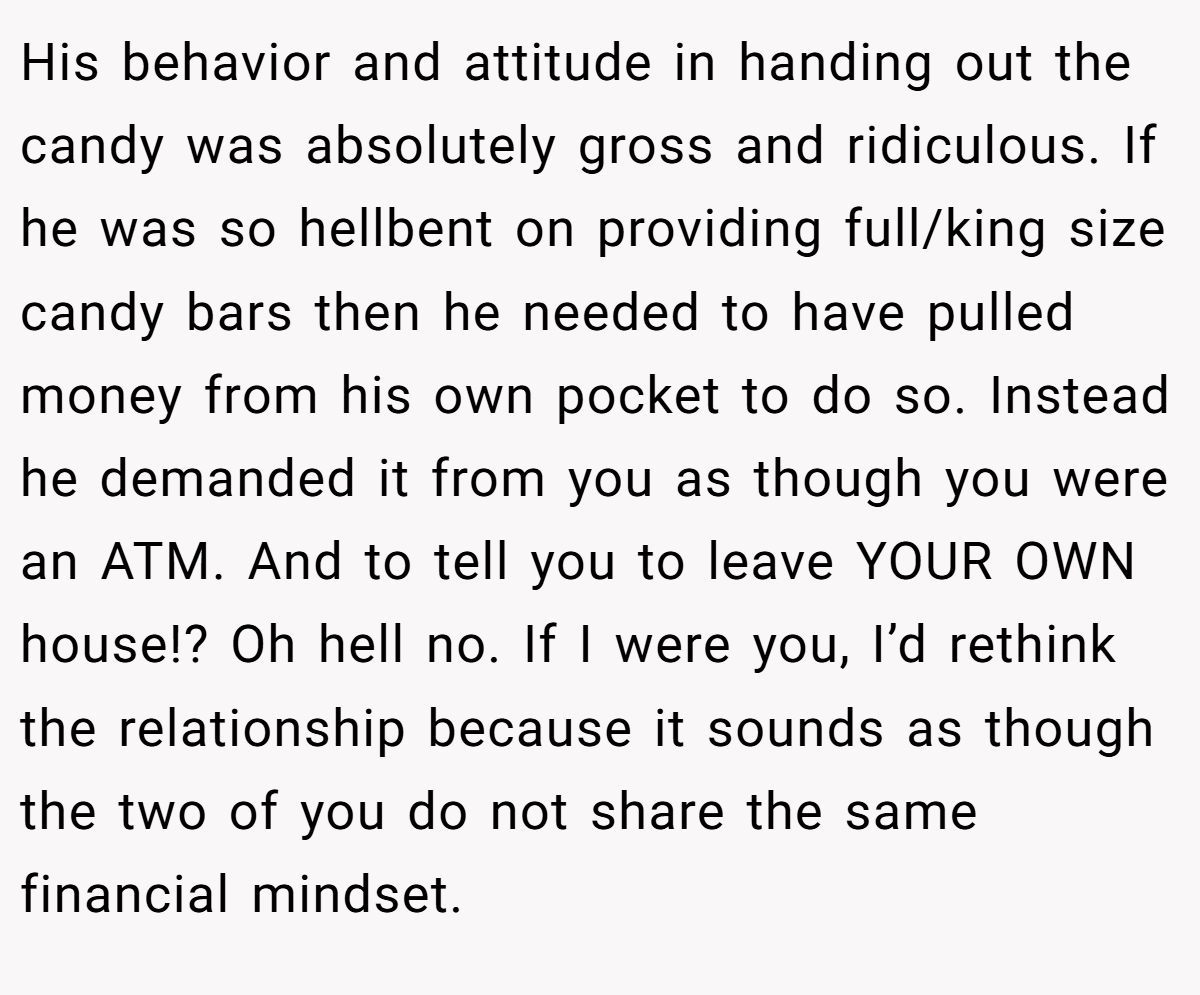

The Reddit crew didn’t hold back, rallying behind the woman with a mix of outrage and advice, while waving red flags at her boyfriend’s behavior. Here’s the raw scoop from the crowd:

These Redditors cheered her budget backbone but questioned why she’s with a financial loose cannon. Are they too quick to call for a breakup, or is this a clear case of incompatibility? Their takes spark a debate on money and love.

This Halloween tale shows how fast festive plans can sour when budgets and respect don’t align. The woman’s refusal to go into debt for her boyfriend’s candy spree wasn’t cheap—it was a stand for her financial future. It’s a reminder that relationships thrive on shared values, not one-sided splurges. Have you ever faced a partner’s spending that clashed with your budget? Share your stories—what would you do when holiday dreams threaten financial peace?

![[Reddit User] − Wtf.. NTA. He doesn't get to tell you to leave your own house because he is throwing a temper tantrum more appropriate to the kids doing the trick-or-treating than the adults handing out the candy.. And if he wants more candy, he can damn well go buy it himself.](https://en.aubtu.biz/wp-content/uploads/2025/06/293774cmggg-15.png)