AITA for buying my toiletries on my mom’s card to teach her a lesson?

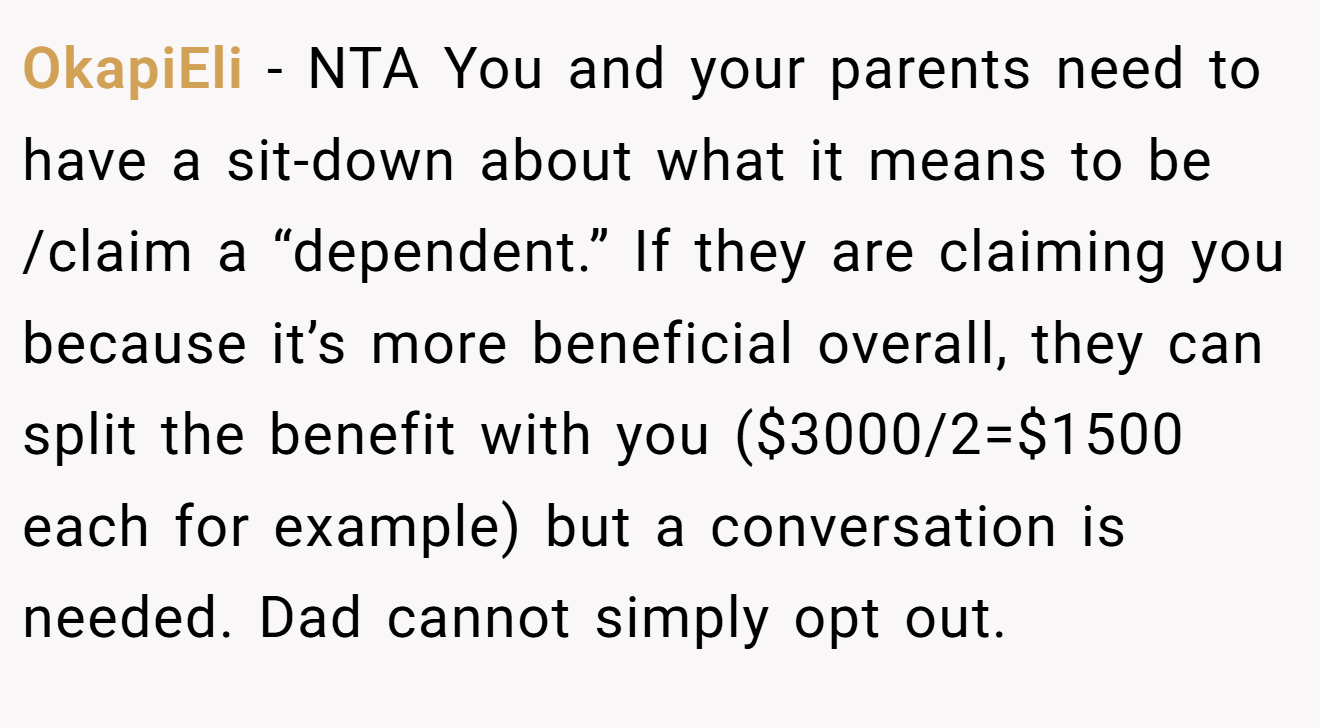

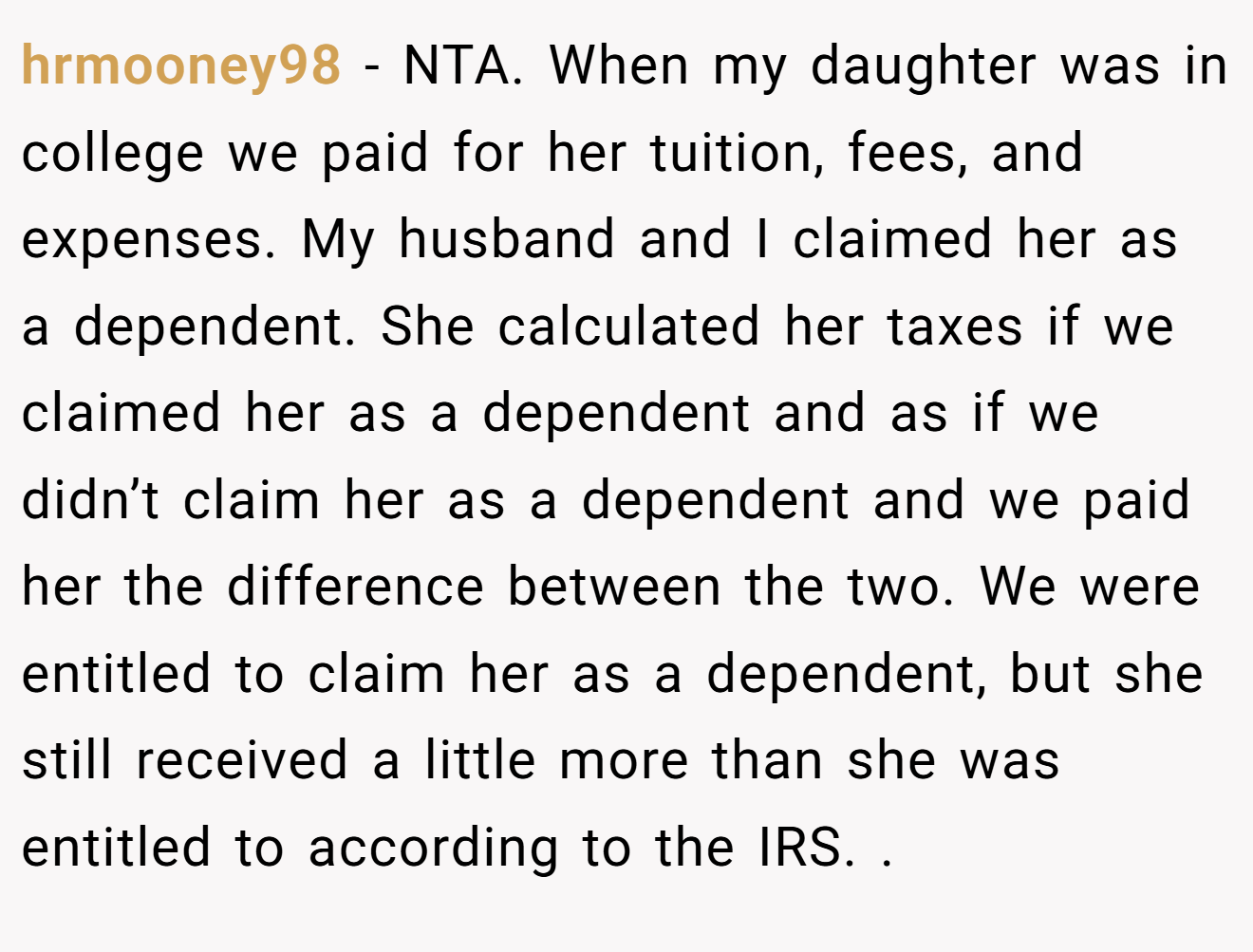

In a cramped college apartment, a student’s late-night tax filing turns into a gut-punch revelation: their mother claimed them as a dependent again, snatching thousands meant for tuition and debt relief. After a broken promise and a heated clash, the student fires back, charging $15 for toiletries on mom’s card—a small jab to teach a big lesson about trust and money.

This Reddit drama crackles with betrayal and bold moves, pitting a struggling student against a well-off parent’s questionable claim. It’s a tale of family promises shattered and financial independence fought for, begging the question: who’s really in the wrong? Let’s unpack this tax-fueled feud and find out.

‘AITA for buying my toiletries on my mom’s card to teach her a lesson?’

A mother’s tax claim turned this student’s financial plans to dust, sparking a $15 charge that’s more about principle than deodorant. The mother’s decision to claim her child as a dependent, despite earning over $250K and knowing the student’s debt struggles, breached a promise and cost thousands in refunds. The student’s card charge, though petty, was a cry for fairness.

Tax expert Susan Carlisle, in a 2024 Forbes article, explains, “Claiming a dependent requires providing over half their support—otherwise, it’s potential fraud” (source). The student, self-supporting and living independently, wasn’t a valid dependent, making the mother’s claim legally shaky. A 2023 IRS report notes 15% of dependent claims are disputed, often in cases like this (source).

The mother’s dismissal—“that’s not my problem”—ignores her child’s financial strain, while the father’s denial of need suggests family discord. The student’s charge, though impulsive, mirrored the mother’s disregard for their financial reality. Carlisle advises, “Dispute improper claims with IRS Form 8332.” The student’s threat to report prompted a resolution, but trust remains frayed.

Moving forward, the student should file independently and confirm IRS adjustments, while the mother must respect their autonomy. A family talk, perhaps mediated, could rebuild trust. This story shows money disputes cut deep in families.

Here’s what the community had to contribute:

Reddit’s ready to audit this family feud! Here’s a roundup of the hottest takes, served with a dash of sass—because nothing says drama like a tax return tussle!

These Redditors didn’t hold back, but do their takes balance the books?

This tax-fueled family clash leaves us wondering: can broken promises ever mend when money’s at stake? The student’s $15 charge was a small stand against a big betrayal, exposing cracks in trust and fairness. Whether you’re Team Student or Team Talk-It-Out, this story challenges us to weigh loyalty against independence. What would you do if a parent pulled this tax stunt? Drop your thoughts below—let’s keep the convo as sharp as a tax refund!

![[Reddit User] - NTA. Report her to the IRS for fraud since you are caring for yourself. Make it their problem.](https://en.aubtu.biz/wp-content/uploads/2025/06/329187c-01.png)

![[Reddit User] - NTA. I would have bought a few thousands worth of stuff on her card and sold it](https://en.aubtu.biz/wp-content/uploads/2025/06/329187c-02.png)

![[Reddit User] - That is terrible. NTA and there has to be a US tax sub on reddit to get some good advice from.](https://en.aubtu.biz/wp-content/uploads/2025/06/329187c-05.png)

![[Reddit User] - NTA. They aren't providing the support required for this claim of dependency.](https://en.aubtu.biz/wp-content/uploads/2025/06/329187c-07.png)

![[Reddit User] - NTA Your mom’s got a lot of nerve. Has a pretty entitled attitude to boot.](https://en.aubtu.biz/wp-content/uploads/2025/06/329187c-09.png)