AITA for asking my husband to contribute $ to expenses on the house we live in, even though he’s not a homeowner?

In a charming 1940s bungalow bustling with family life, a financial tug-of-war is brewing. A woman, sole owner of the home for eight years, finds herself clashing with her husband of three years over who should foot the bill for major repairs like a new roof. He pays $800 a month in rent as per their prenup, but balks at chipping in for plumbing or a cracked bathtub, claiming it’s “her house.” With two kids and a mortgage split evenly, Reddit’s buzzing: is she fair to ask for more, or is he just a tenant dodging landlord duties?

The setup—her house, their home—blurs lines of ownership and partnership, especially as both now earn solid incomes. Her frustration grows with every fight, while he leans on the prenup’s fine print. Is she pushing too hard, or is he shirking family responsibility? Let’s dive into this domestic drama where love meets legalese.

‘AITA for asking my husband to contribute $ to expenses on the house we live in, even though he’s not a homeowner?’

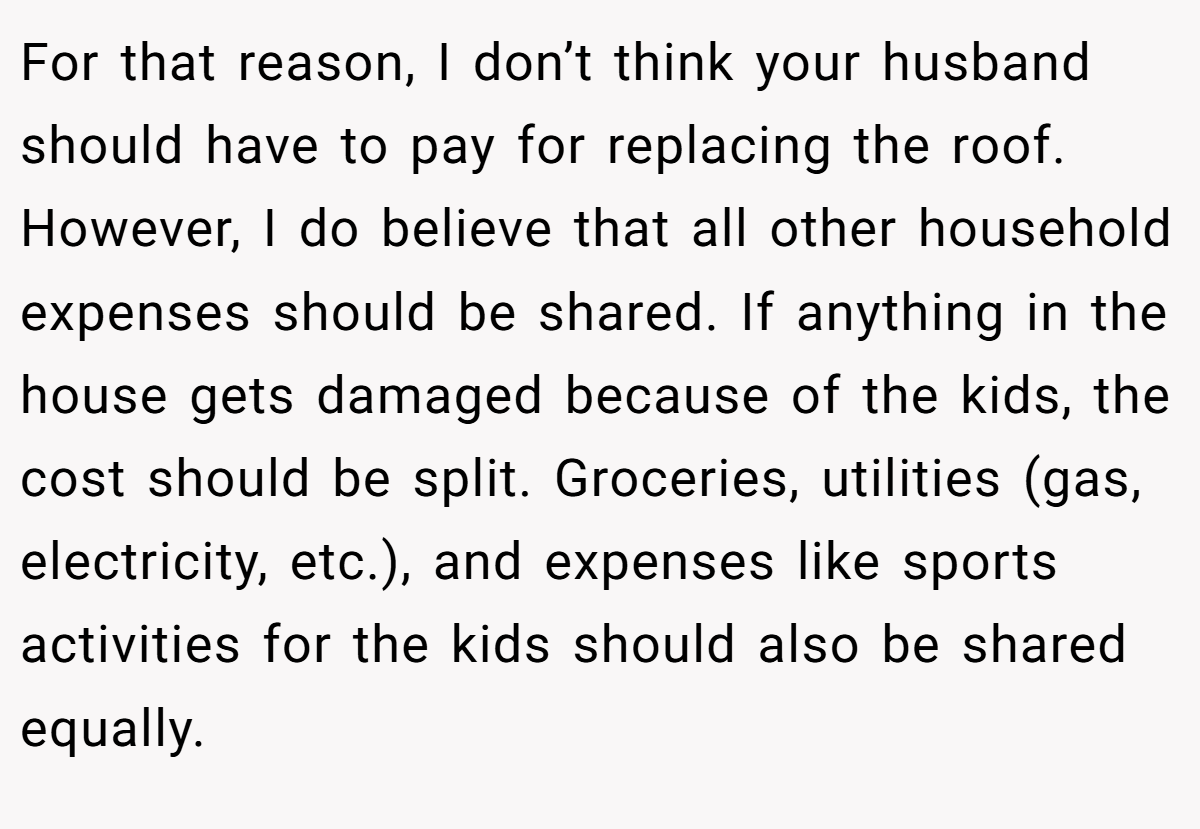

This financial feud is less about shingles and pipes and more about what “home” means in a marriage with separate assets. The woman’s request for contributions reflects her view of their shared life, while her husband’s resistance leans on a tenant-like mindset, reinforced by their prenup. Both perspectives have merit, but the constant battles signal a deeper disconnect.

Dr. John Gottman, a renowned marriage researcher, writes in The Seven Principles for Making Marriage Work, “Successful couples build a ‘we’ mentality, even when finances are separate.” The husband’s “not my house” stance undermines this, treating major repairs as her burden alone, despite their family of four relying on the home. Her covering extras like cleaners and kids’ lessons further tilts the scale, breeding resentment.

Marital finance disputes are common. A 2023 Fidelity study found 45% of couples argue over unequal contributions to shared expenses, especially when assets aren’t jointly owned. The prenup, while protective, complicates their teamwork, framing him as a renter rather than a partner.

For solutions, Gottman suggests transparent budgeting. The woman could propose raising his rent to market rates—say, $1,200—to cover repairs, keeping it fair without altering the deed. Splitting kid-related damages, like the bathtub, evenly acknowledges their shared parenting. A joint account for household costs could foster unity.

These are the responses from Reddit users:

Reddit’s comment section is a lively mix of cheers for fairness and shade for prenup pitfalls. Here’s a snapshot of their spicy takes—buckle up! These Reddit hot takes are fiery, but do they nail a fix for this marital money mess?

This house repair saga shows how quickly a prenup’s clarity can muddy a marriage’s teamwork. The woman’s push for her husband’s help clashes with his renter’s mindset, leaving their family home feeling like a financial fault line. Is she right to demand more for their shared life, or should she shoulder the repairs alone? What would you do if your spouse saw “your” house as just a rental? Drop your thoughts, stories, or advice in the comments—let’s hammer out this domestic deadlock together!