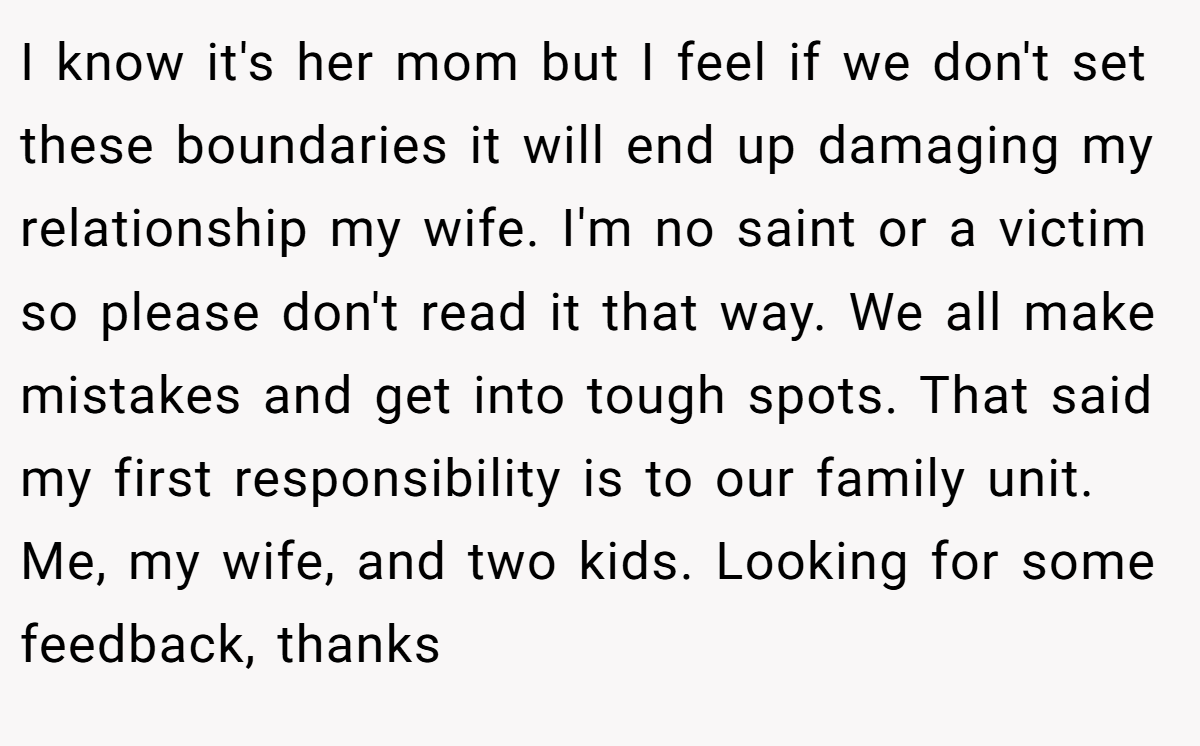

AITA because I told my wife I don’t want to loan money to family?

A simmering financial dispute has bubbled to the surface in one household, as a husband draws a firm line against further family loans. Initially, a gift of $1000 to the wife’s mom was offered out of compassion.

However, when additional demands arose—including a $600 loan with repayment terms—the husband’s resolve hardened. Now, with an urgent eviction threat looming over his in-laws and the couple’s dream of saving for a new home at stake, the tension between family obligation and financial responsibility has never been higher.

‘AITA because I told my wife I don’t want to loan money to family?’

Setting and maintaining clear financial boundaries within families is a challenge that many couples face. When informal financial help becomes a repeated expectation, it often undermines the stability of the primary household. In this scenario, the husband’s initial willingness to gift money turned into an unsustainable cycle of loans. Such a pattern can enable poor money management and foster dependency, leading to emotional and financial strain. Establishing limits is not about being unsupportive—it’s about safeguarding the relationship and future goals.

The conflict here highlights a classic dilemma: when does compassion become enabling? The husband’s concerns are rooted in a desire to prioritize his family’s financial security, especially when the wife’s relatives repeatedly request more funds. Research in family finance shows that mixing personal relationships with continuous monetary aid can erode trust and cause long-term resentment. By deciding not to continue the loan cycle, he is taking a stand against a pattern that, if left unchecked, might force them into compromising their own future.

Financial expert Dr. Marcia Angell notes, “Boundary-setting in family finances is crucial to avoid the unintentional empowerment of financially irresponsible behavior.” Her perspective underscores the idea that every loan or gift should be an isolated gesture, not a recurring expectation. A clear separation between familial support and personal financial priorities helps maintain long-term stability. The couple’s decision to halt further loans is a proactive measure to prevent deeper entanglement in a cycle that could burden their immediate needs.

Another important element is the mutual understanding between partners when it comes to handling family finances. Open communication is essential. In this case, the husband’s reluctance is balanced by his responsibility to secure their future—saving for a down payment on a home. The decision becomes more than just about money; it’s a stand for mutual respect and the recognition that one’s financial future should not be sacrificed on the altar of familial obligations without a clear, mutually agreed-upon strategy.

Overall, while feelings of guilt and obligation can complicate such decisions, the expert consensus is clear: families should support each other, but not at the expense of one’s own security. Maintaining this balance is critical to avoid long-term harm and to ensure that each household member retains personal accountability for their financial decisions.

Check out how the community responded:

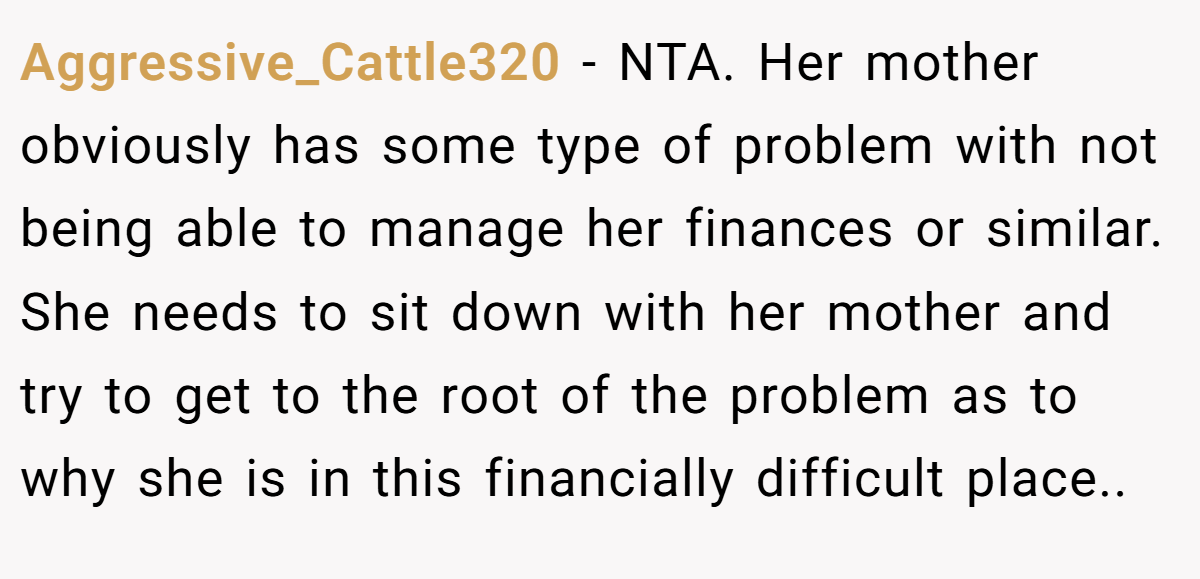

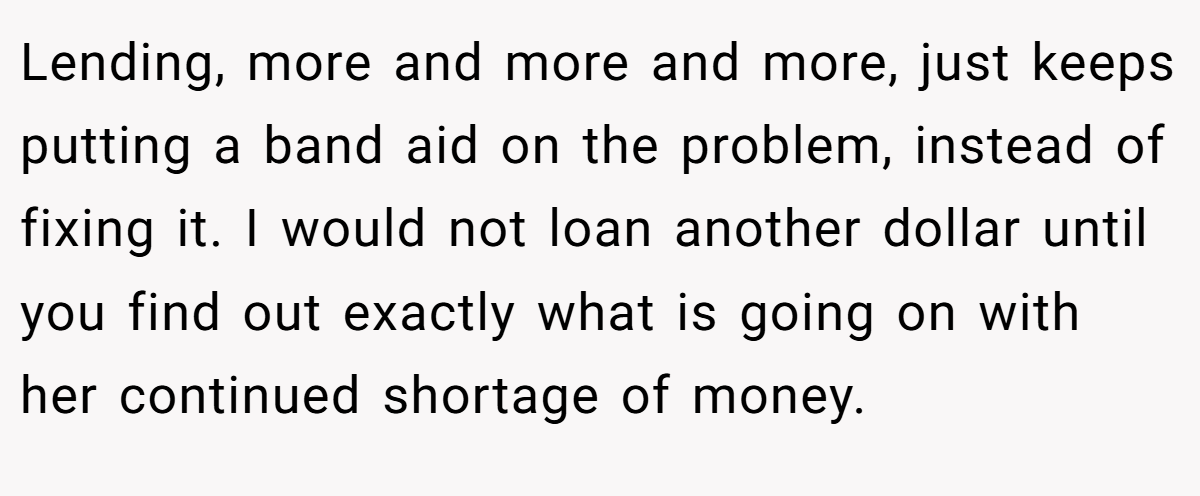

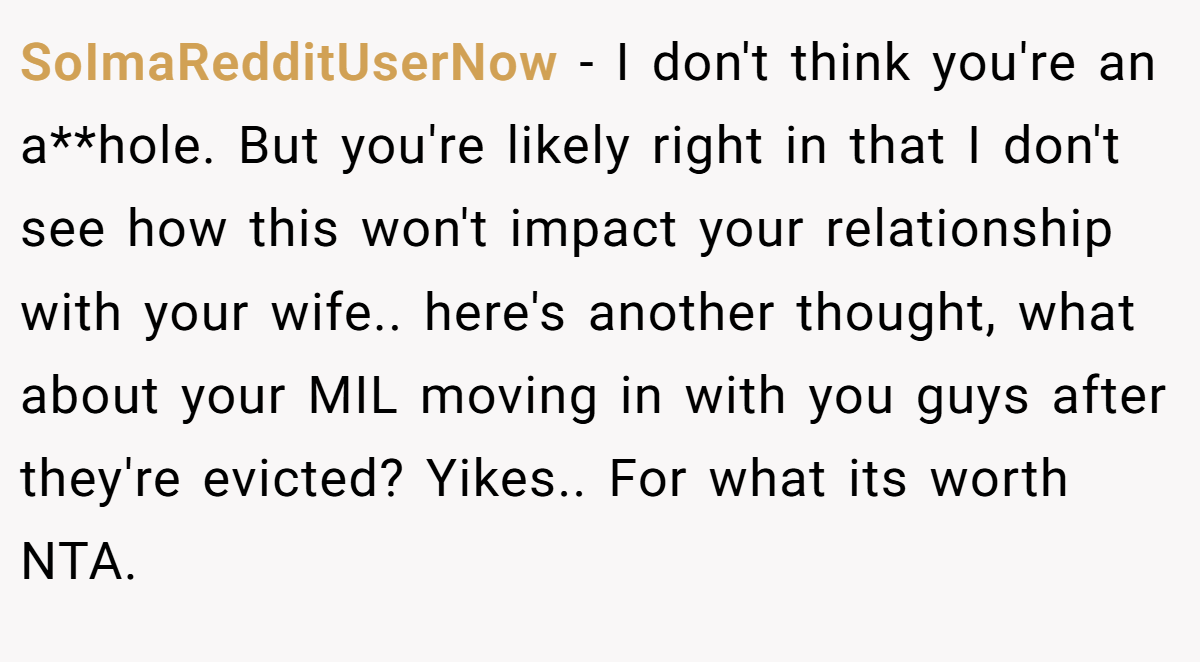

Here are some candid takes from the Reddit community—emphatic, supportive, and direct in their opinions:

These comments reveal a strong consensus on the issue. Many users agree that the husband’s stance is justified; turning into a revolving door of financial aid for family members is dangerous and unsustainable. The community warns that failing to set boundaries could lead to a continual drain on resources and, ultimately, harm the family’s own financial goals.

In the end, the core of the issue rests on the delicate balance between helping loved ones and safeguarding one’s own future. The husband’s decision to halt further financial support is less about rejecting family and more about protecting his immediate household’s well-being.

His choice raises an important question: when does support turn into enabling? It invites us to reflect on how best to manage these complex relationships without compromising personal dreams and responsibilities. What would you do in a similar situation? How do you set boundaries with those you care about without burning bridges? Share your thoughts and experiences in the discussion below!

![[Reddit User] − NTA...and you guys are not a bank. Every time you give or loan them money, you are enabling them to continue to do such behavior. It hurts to see people struggle, expressly the ones you love, but if you don't put your foot down now they will only drag you and your wife down with them. Family is the worst to do business with, and they are definitely the worst to lend money to.](https://en.aubtu.biz/wp-content/uploads/2025/04/134976c-07.png)