AITA for Expecting to Occasionally Drive a Car I Helped Pay For, but My Girlfriend Says It’s “Hers” Now?

Relationships can get complicated when financial contributions start to blur the lines between shared and personal property. In this story, a 36-year-old man is reeling from a conflict with his fiancée over a car he helped pay for. Although he willingly contributed to the down payment and monthly payments during the early stages, his fiancée now insists that the car is entirely “hers” since she’s taken over the payments.

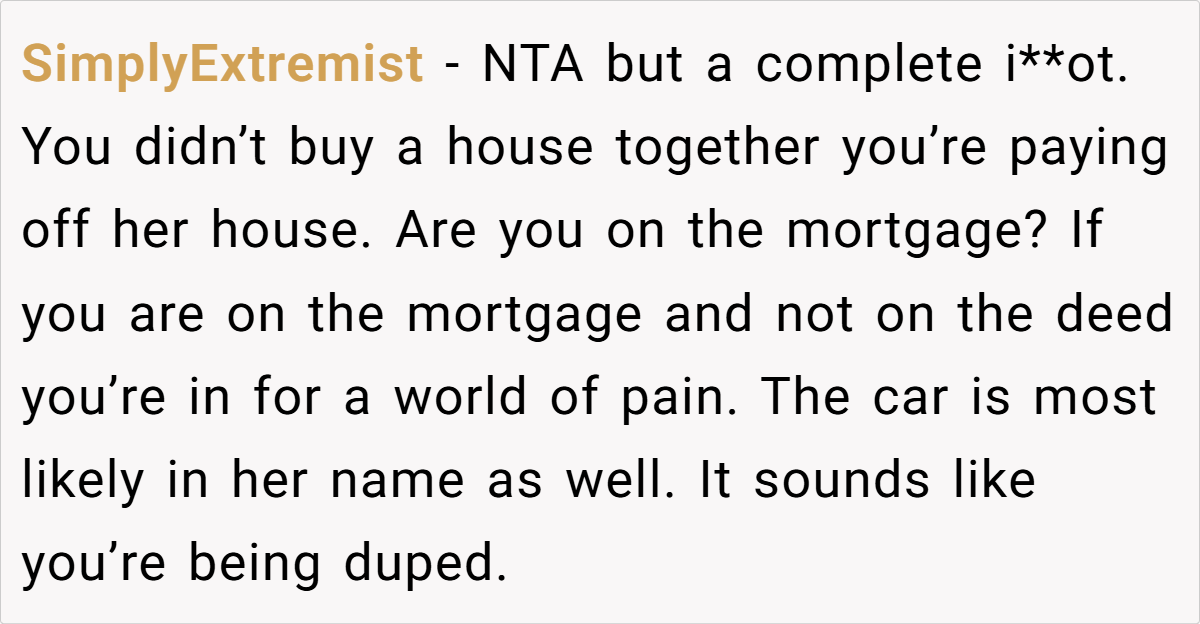

This twist has left him questioning whether his expectation of occasional access is reasonable or if he’s overstepping now that she’s financially secure. The tension doesn’t stop there. Their joint financial decisions extend to their home, which—despite a 50/50 mortgage split—is solely in her name.

This situation raises larger issues about financial fairness and control within a relationship. While he believes in acknowledging past contributions, his fiancée views the current state as a fresh start, creating a rift that might go much deeper than a car dispute.

‘AITA for Expecting to Occasionally Drive a Car I Helped Pay For, but My Girlfriend Says It’s “Hers” Now?’

Financial experts agree that transparency and clearly defined agreements are key in any shared financial endeavor. Dr. Jane Smith, a financial planner featured on MoneySense, explains, “When contributions shift over time, it’s crucial for couples to revisit their financial arrangements and ensure both parties feel respected.” Her insight reminds us that fairness isn’t just about initial contributions—it’s about maintaining balance as circumstances change.

In similar relationships, experts suggest that open dialogue can prevent resentment. “Couples should establish clear guidelines from the start regarding asset usage, especially when one party’s financial situation evolves,” notes Dr. Smith. Regular financial check-ins and written agreements, she adds, can help avoid conflicts over items like cars or even shared homes.

Moreover, relationship counselors emphasize that this situation is about more than money; it’s about mutual respect and feeling valued. “A partner’s unwillingness to acknowledge past support can create long-lasting bitterness,” Dr. Smith explains. Thus, fostering ongoing communication is as vital as the financial arrangements themselves.

Check out how the community responded:

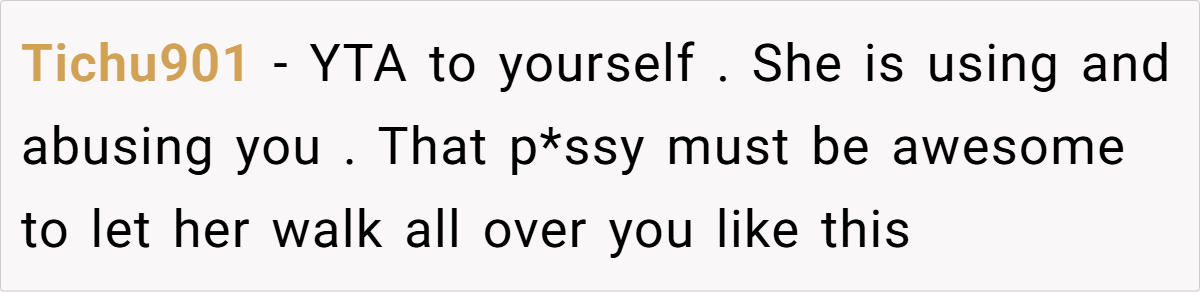

The Reddit community had plenty to say on this issue. One redditor noted that if the roles were reversed, he’d expect the same courtesy, emphasizing that past contributions matter even when financial control shifts. Another commenter argued that once the fiancée started paying the full car payment, it was fair for her to claim ownership, leaving him out of the equation.

A third voice remarked that such financial decisions are often a red flag in relationships, warning that one should always be cautious if their partner insists on rewriting history. Lastly, another user bluntly stated that both parties seem to be using financial power plays, and that open communication could resolve the imbalance. Overall, opinions vary, but many agree that clear expectations are crucial.

In conclusion, this story is more than just a dispute over a car—it’s a window into how financial contributions and evolving circumstances can strain relationships. While one partner may feel entitled to occasional use of an asset they helped finance, the other might see it as a fresh start once full payments are assumed.

This raises an important question: How do you balance past contributions with current financial realities in a relationship? What strategies do you think can help couples navigate these tricky issues? Share your thoughts and experiences—your insights might help others facing similar challenges.