AITA for not being willing to split my daughter’s education fund with my stepson?

In a cozy suburban home, where family photos line the mantel, a storm brews over a college fund. A woman, caught in the tangled web of blended family loyalties, faces a heated demand from her husband: split her daughter’s carefully saved college fund to bail out his son’s looming student debt. The air crackles with tension as she stands her ground, protecting her daughter’s future. Readers, brace yourselves for a tale of financial fairness, family friction, and tough love that’s got Reddit buzzing with opinions.

This saga unfolds with raw emotion, as the woman grapples with her husband’s accusations of favoritism. Can she balance love for her stepson with her duty to her daughter? The Reddit community has plenty to say, and we’re diving into this drama to unpack the clash of expectations and obligations in a modern blended family.

‘AITA for not being willing to split my daughter’s education fund with my stepson?’

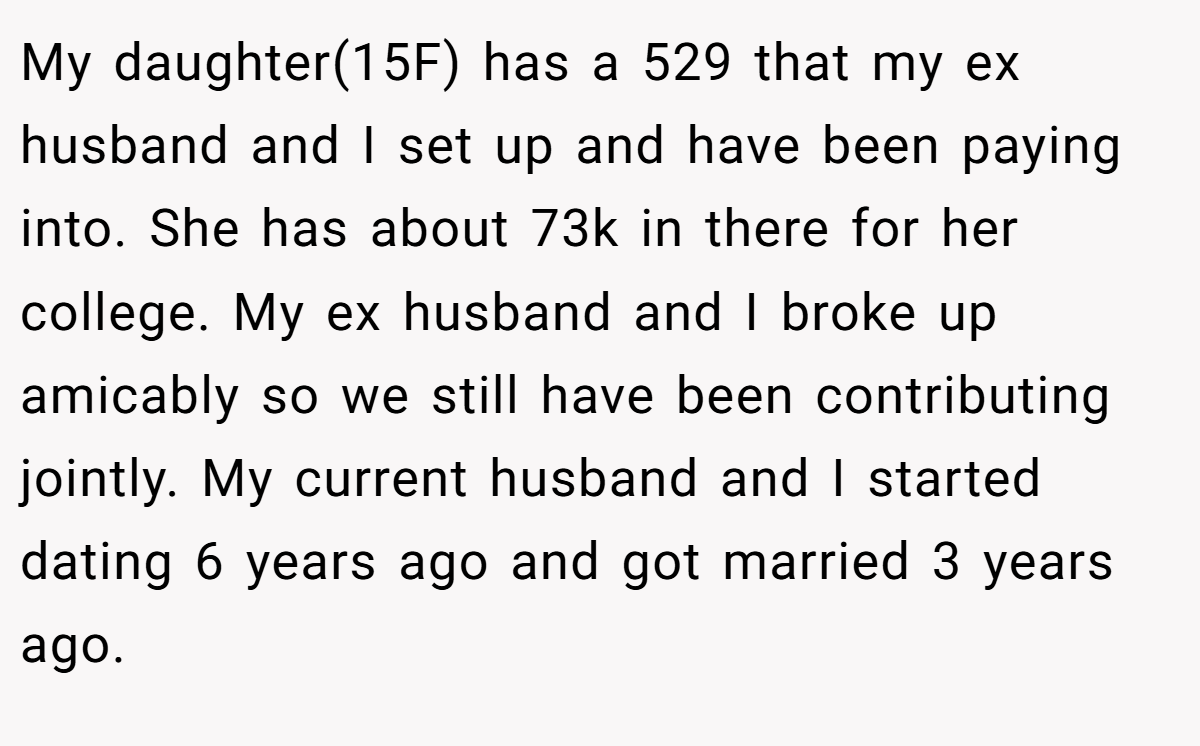

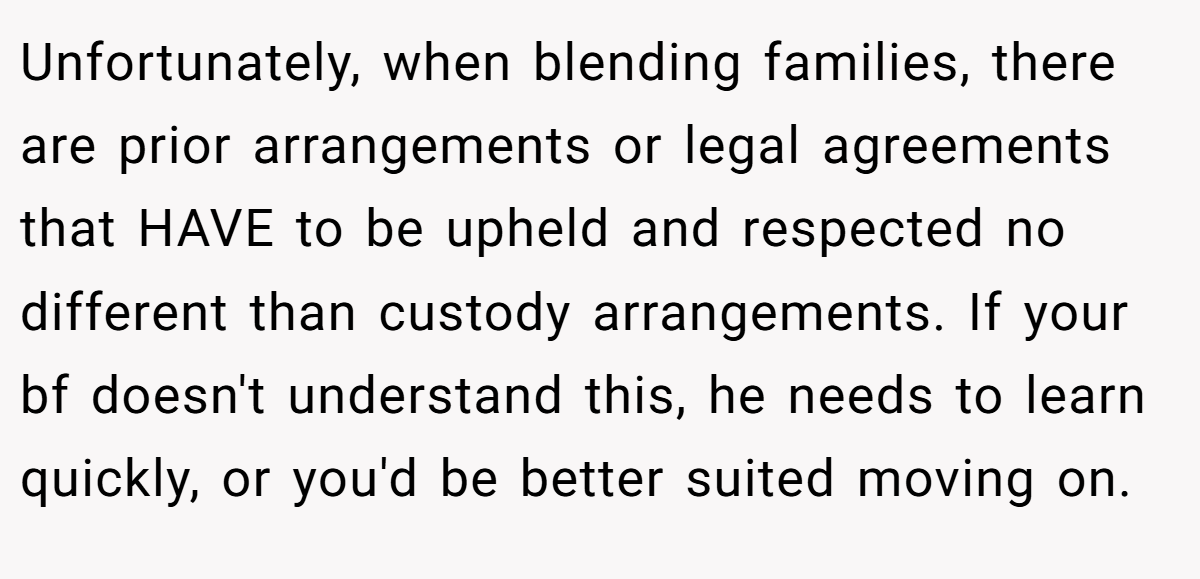

Navigating blended family finances is like walking a tightrope in a windstorm. The woman’s refusal to split her daughter’s 529 college fund with her stepson has sparked a classic clash of loyalty and responsibility. Her husband’s demand overlooks the fund’s purpose, set up years ago with her ex-husband for their daughter’s future. His insistence, laced with accusations of unloving behavior, feels like a pressure cooker ready to pop.

This situation highlights a broader issue: financial planning in blended families. According to a 2023 study by the National Center for Family & Marriage Research, over 40% of remarried couples face disputes over stepchildren’s financial support. Clear boundaries are crucial. Dr. Patricia Papernow, a renowned psychologist specializing in stepfamilies, notes, “Stepparents are not obligated to financially support stepchildren unless explicitly agreed upon” (source: Psychology Today). Her insight underscores the woman’s stance—her daughter’s fund is a prior commitment, not a shared resource.

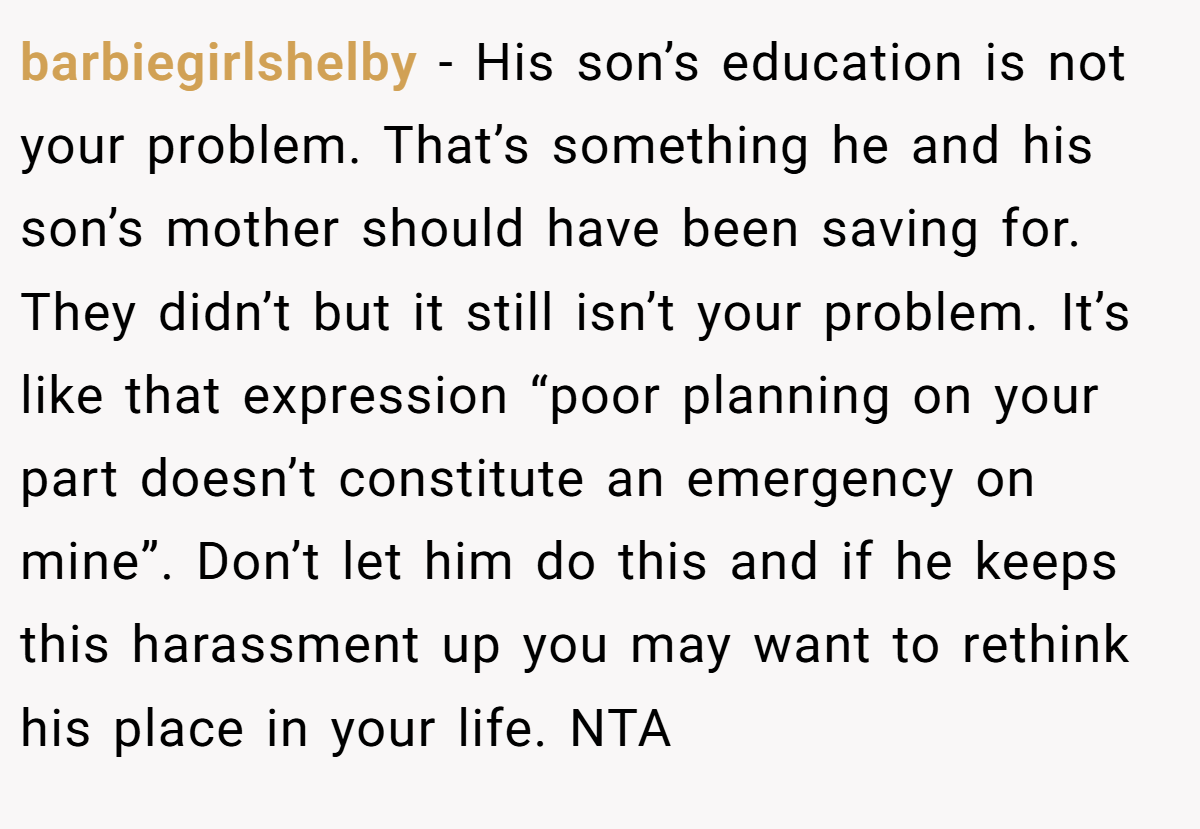

The husband’s failure to save for his son’s education, while expecting his wife to cover the gap, shifts blame unfairly. Legally, 529 plans are designated for specific beneficiaries, and diverting funds could violate agreements with her ex-husband, risking legal repercussions. The woman’s firm stance protects her daughter’s future while highlighting her husband’s lack of foresight.

For solutions, open communication is key. The couple should discuss financial expectations early, perhaps consulting a financial planner to explore options like scholarships or part-time work for the stepson. Setting boundaries now prevents future resentment. Ultimately, love doesn’t pay tuition—planning does.

Here’s what the community had to contribute:

Reddit’s hive mind didn’t hold back on this one—here’s the tea, served with a side of wit and wisdom.

These spicy takes from Reddit cut straight to the chase, but do they hold up in the real world? One thing’s clear: the internet’s got no chill when it comes to family funds!

This tale of college funds and clashing loyalties leaves us pondering where duty begins and ends in blended families. The woman’s stand for her daughter’s future sparked a firestorm, but was she right to hold the line? Financial fairness isn’t just about money—it’s about trust and expectations. What would you do if caught in this family feud? Share your thoughts below—have you faced a similar dilemma in a blended family?

![[Reddit User] − NTA.. It's on him and his ex if their son has to take loans for college, not on you.](https://en.aubtu.biz/wp-content/uploads/2025/06/330171cmt-08.png)