AITA for refusing to settle outside of insurance after someone ran a red light and hit my car?

Picture a sunny afternoon, the light turns green, and just as you ease forward—bam! A car barrels through a red light, crunching your fender before speeding off into the horizon. That’s the heart-pounding moment our Reddit storyteller faced, left stranded on the roadside with a crumpled car and a fleeing culprit. When police finally track down the young driver, they beg to skip insurance to save their rates, but the OP stands firm. It’s a tale of accountability clashing with desperation, where trust takes a backseat.

This story isn’t just about a fender-bender—it’s about integrity and consequences. The audacity of a hit-and-run driver pleading for leniency stirs up questions: should empathy trump justice? Let’s peel back the layers of this roadside drama and see where the rubber meets the road.

‘AITA for refusing to settle outside of insurance after someone ran a red light and hit my car?’

A red light runner’s split-second mistake left the OP’s car battered and trust in tatters. Fleeing the scene only deepened the dent, making the driver’s plea to bypass insurance feel like a dodge too far. The OP’s insistence on formality reflects a need for accountability, while the driver’s panic hints at youth and inexperience colliding with consequences.

Car accidents are more than metal and money—they’re a societal pulse check. The Insurance Institute for Highway Safety reports over 1.7 million rear-end collisions annually in the U.S., often tied to distracted driving or signal violations (iihs.org). Hit-and-runs, like this one, complicate recovery, with 11% of crashes involving a fleeing driver, per 2021 AAA data (https://newsroom.aaa.com).

Dr. David Yang, executive director of the AAA Foundation for Traffic Safety, notes, “Fleeing an accident undermines trust and burdens victims with unfair costs”. Here, the OP’s refusal protects their interests, especially after the driver’s initial evasion. Their youth may explain panic, but not accountability.

For solutions, the OP did right by sticking to insurance, ensuring legal and financial clarity. Readers might advise documenting all communication with the driver and consulting an attorney if disputes arise.

Here’s the input from the Reddit crowd:

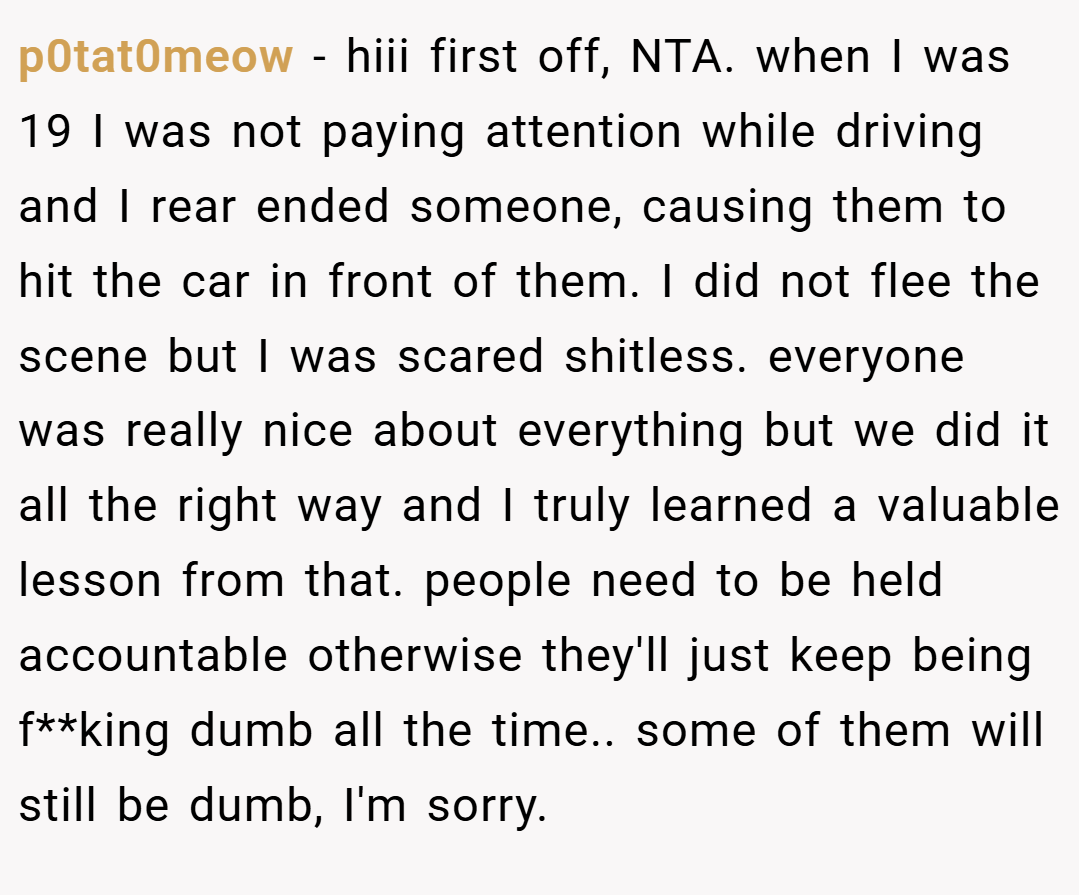

Reddit’s crew rolled in with opinions hotter than a summer blacktop. From fiery calls for justice to empathetic nods at youthful mistakes, here’s what they had to say:

These Reddit takes pack a punch, but do they steer toward fairness or vengeance? Let’s reflect on the road ahead.

This tale of a red light runner turned fugitive driver leaves us at a crossroads: justice or mercy? The OP’s resolve to go through insurance feels like a guardrail against betrayal, yet the young driver’s plea tugs at our empathy. It’s a reminder that every crash carries human stories. Would you have given the driver a chance to settle privately, or stuck to the formal route? Hit the comments with your thoughts!