AITA for refusing to help my friend pay rent after she spent her money on concert tickets?

In shared living arrangements, financial responsibilities are meant to be clear-cut—split equally and managed responsibly by everyone involved. This story revolves around a student who, while already juggling the pressures of school and a part-time job, found themselves covering for a friend when rent money was unexpectedly short. Initially, they agreed to lend the money as a one-time help; however, the very next day, the friend flaunted her spending on a big concert, revealing a concerning lack of financial priority.

The revelation struck a deep nerve, setting the stage for a raw, emotional clash over responsibility and fairness. The ensuing conflict has left both roommates reeling, as personal financial stress meets differing values on prioritization. Now, the question arises: is it unreasonable to refuse further financial bailouts when personal accountability is at stake?

‘AITA for refusing to help my friend pay rent after she spent her money on concert tickets?’

Financial advisors agree that budgeting is essential, especially when fixed expenses like rent are non-negotiable. They recommend setting aside funds for recurring costs before spending on discretionary activities, such as concerts. When a person fails to prioritize these basic responsibilities, friends and roommates may justifiably feel frustrated about being forced to cover for someone’s mismanagement.

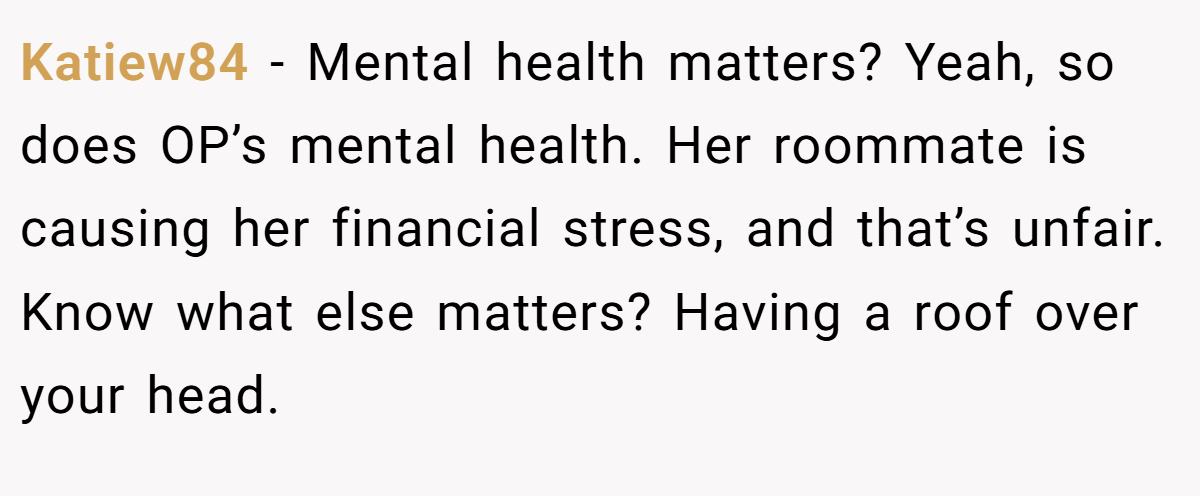

Psychologists point out that while mental health and personal well-being are important, financial irresponsibility often cannot be excused—even under the guise of needing an escape. Music and social outings can indeed serve as crucial relief from stress, but experts stress that these outlets should be balanced with core obligations. Being repeatedly bailed out by a roommate can cause significant strain, contributing to ongoing stress and resentment over time.

Furthermore, communication experts advise that issues involving shared finances should be approached through calm and constructive dialogue. Establishing clear boundaries and encouraging accountability are key steps in maintaining healthy financial and personal relationships. While empathy is important, it should never come at the expense of mutual responsibilities—a balance that, when skewed, can lead to ongoing conflict and emotional fatigue.

Lastly, counseling professionals observe that financial disagreements often echo deeper issues of trust and respect. In cases like this, it is beneficial for both parties to engage in open discussions about expectations and limits. This can help prevent future misunderstandings and create a framework where both respect financial commitments while still caring for each other’s well-being.

See what others had to share with OP:

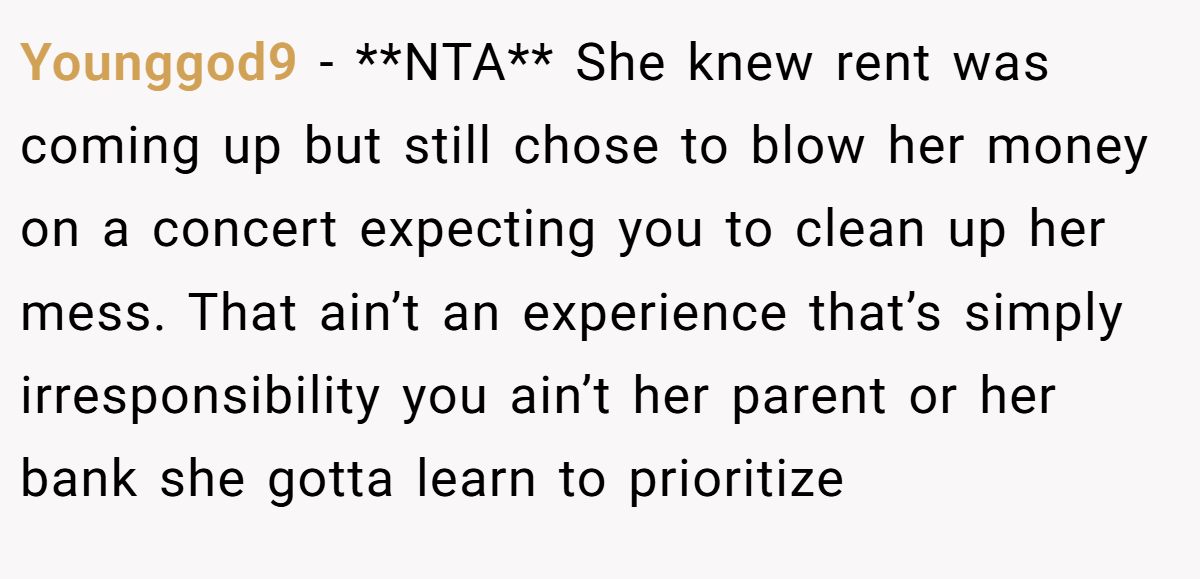

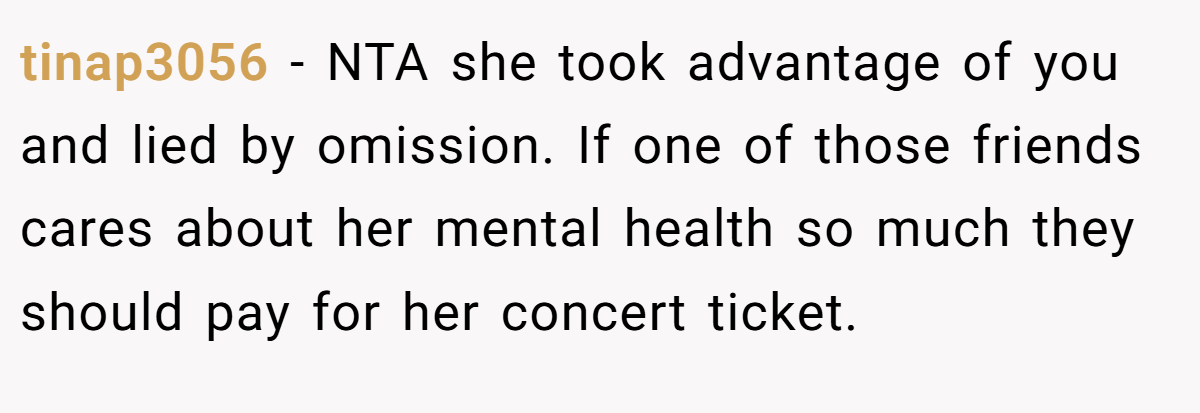

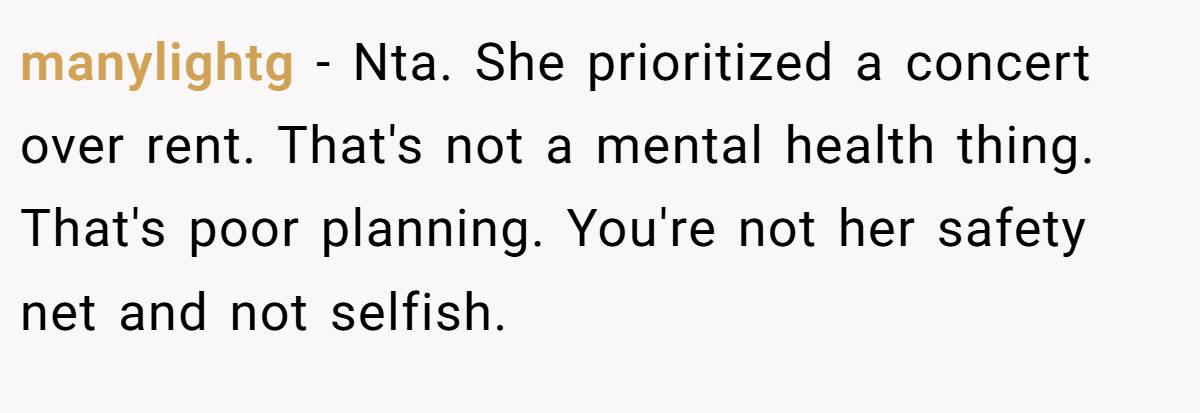

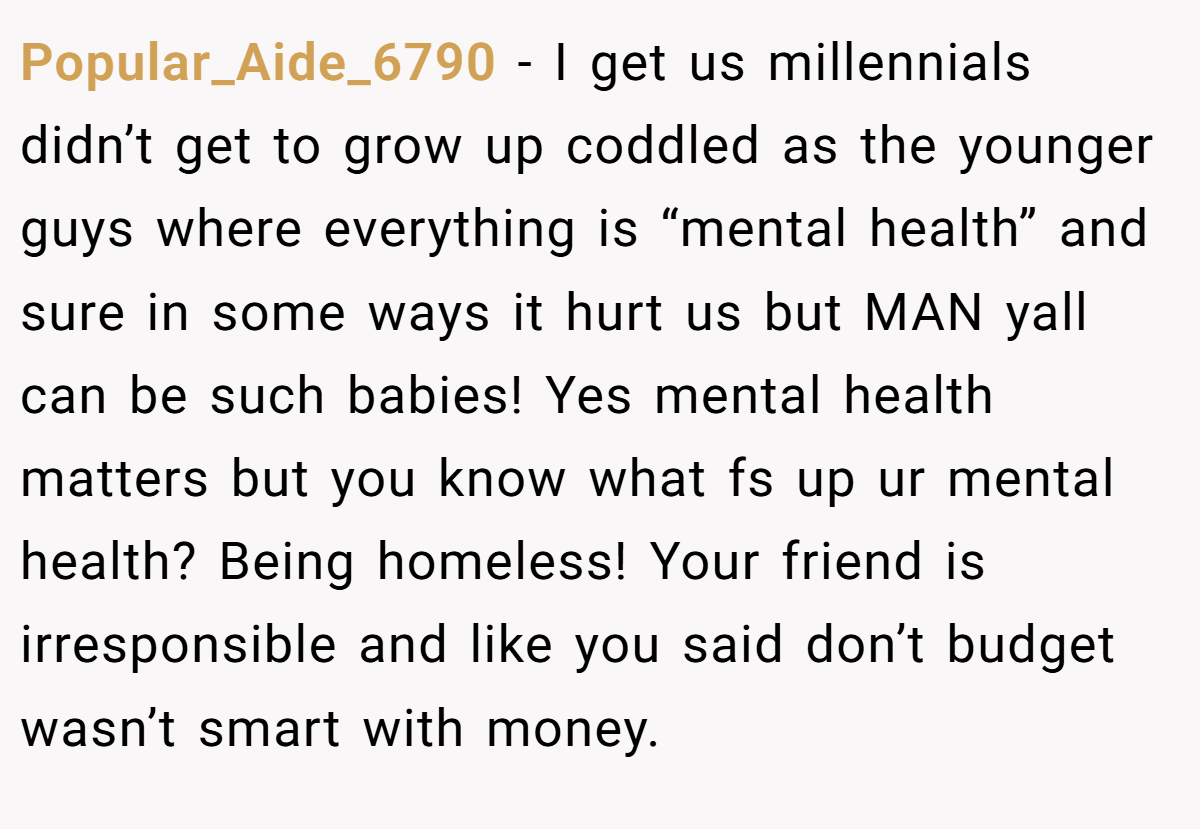

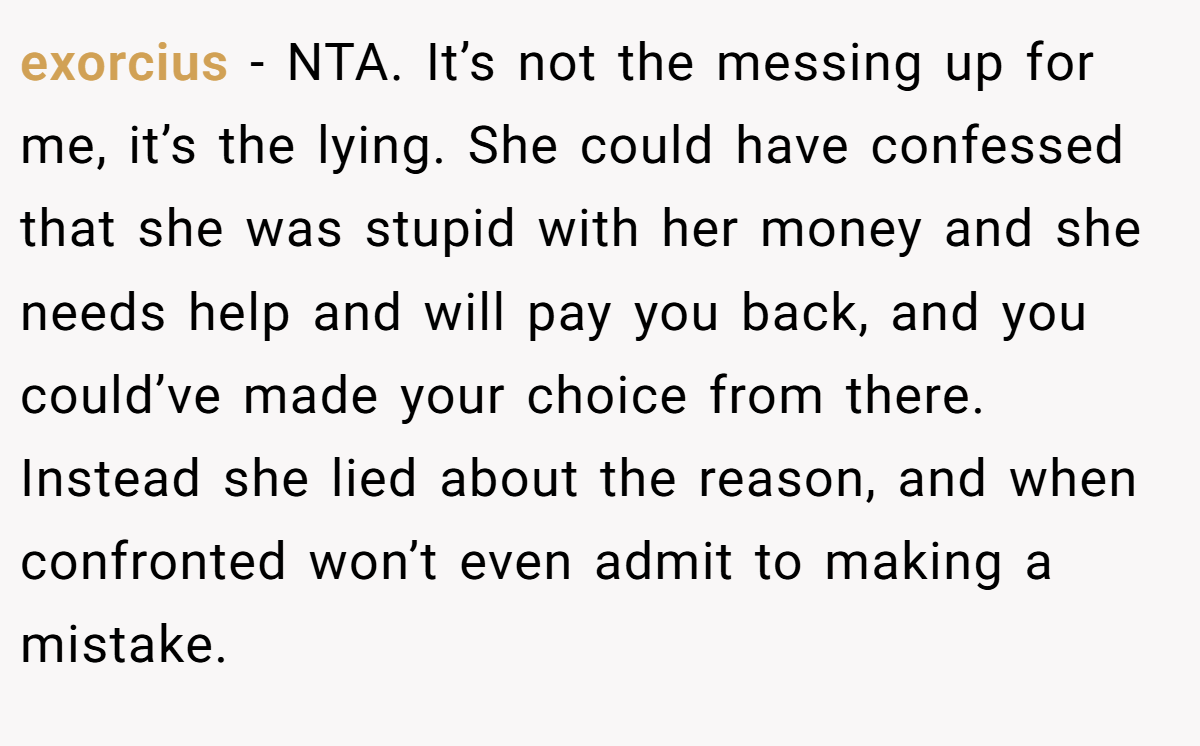

The Reddit community weighed in heavily on this matter, with the consensus being that the author is not in the wrong. Many commenters highlighted that the friend was clearly irresponsible by spending on a concert when essential bills—like rent—should have come first. Comments emphasized that the extra money isn’t a gift but rather a loan used to cover a responsibility, and that it’s entirely reasonable not to act as an ongoing safety net for financial mismanagement.

Others pointed out that personal budgeting is a common-sense practice, and that the friend’s actions reflect poor planning rather than a legitimate mental health excuse. While some believed in extending empathy, the majority argued that prioritizing rent is fundamental, and the author’s stance was justified given the circumstances. The overarching sentiment was that accountability in finances should come before indulgence in luxuries.

In conclusion, the conflict between financial responsibility and personal indulgence is at the heart of this story. The author feels justified in refusing to cover their friend’s rent after uncovering behavior that suggests a consistent lack of financial discipline. While personal escapes and mental health breaks are essential, ensuring that core responsibilities like rent are met should always come first.

So, is it fair to refuse additional financial help when someone prioritizes luxuries over necessities? Or should there be more room for understanding in financially tight times? What are your thoughts on setting boundaries in shared financial arrangements? Join the discussion below and share whether you believe prioritizing essentials over discretionary spending is an absolute must, or if empathy sometimes calls for a different approach.