AITA for giving my son a bill for half his expenses?

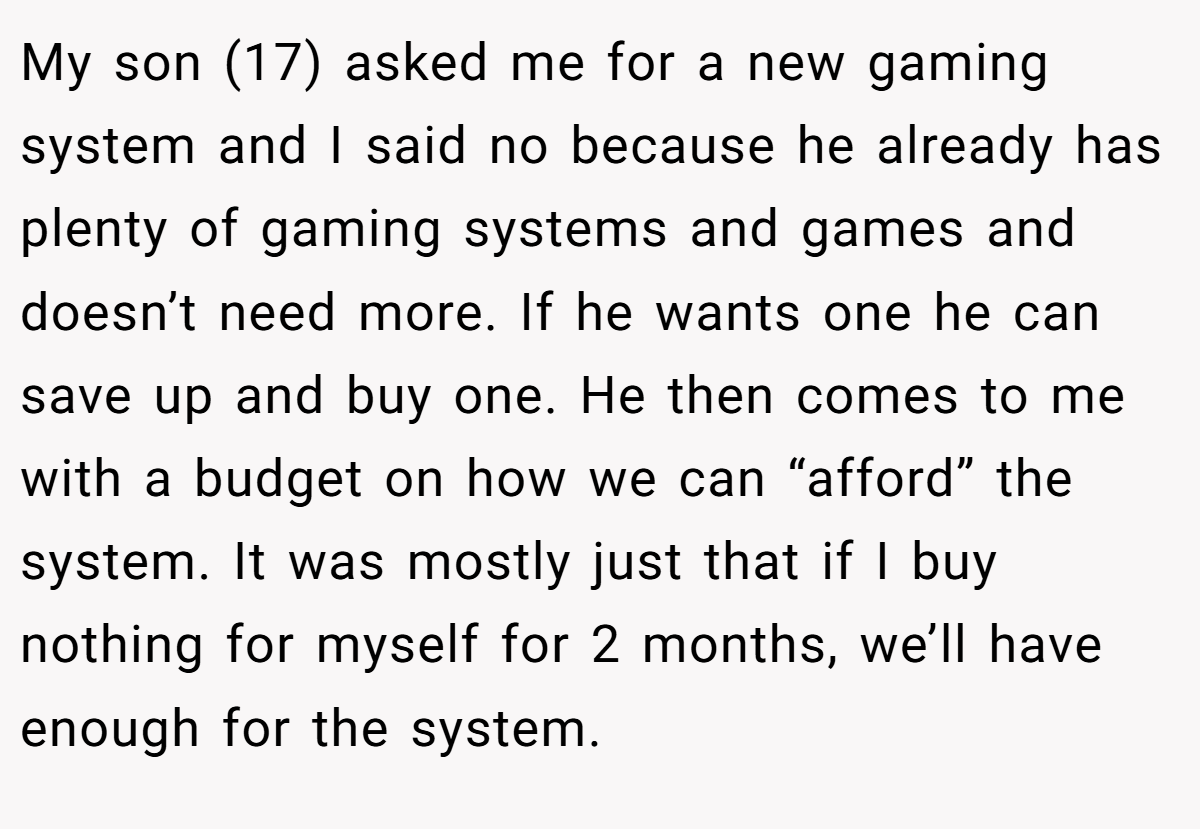

In a world where every dollar counts, one parent’s decision turned a teenager’s request for a new gaming system into a lesson on real-life finances. The tension in the household was palpable as a 17-year-old challenged the norm by calculating child support numbers to argue for luxury spending.

This unexpected exchange wasn’t just about a gaming console; it revealed a deeper conversation about entitlement, budgeting, and the true cost of growing up. With emotions high and expectations clashing, the narrative unfolds like a candid family debate where numbers meet heart, inviting readers to reflect on how money shapes responsibility and values.

‘AITA for giving my son a bill for half his expenses?’

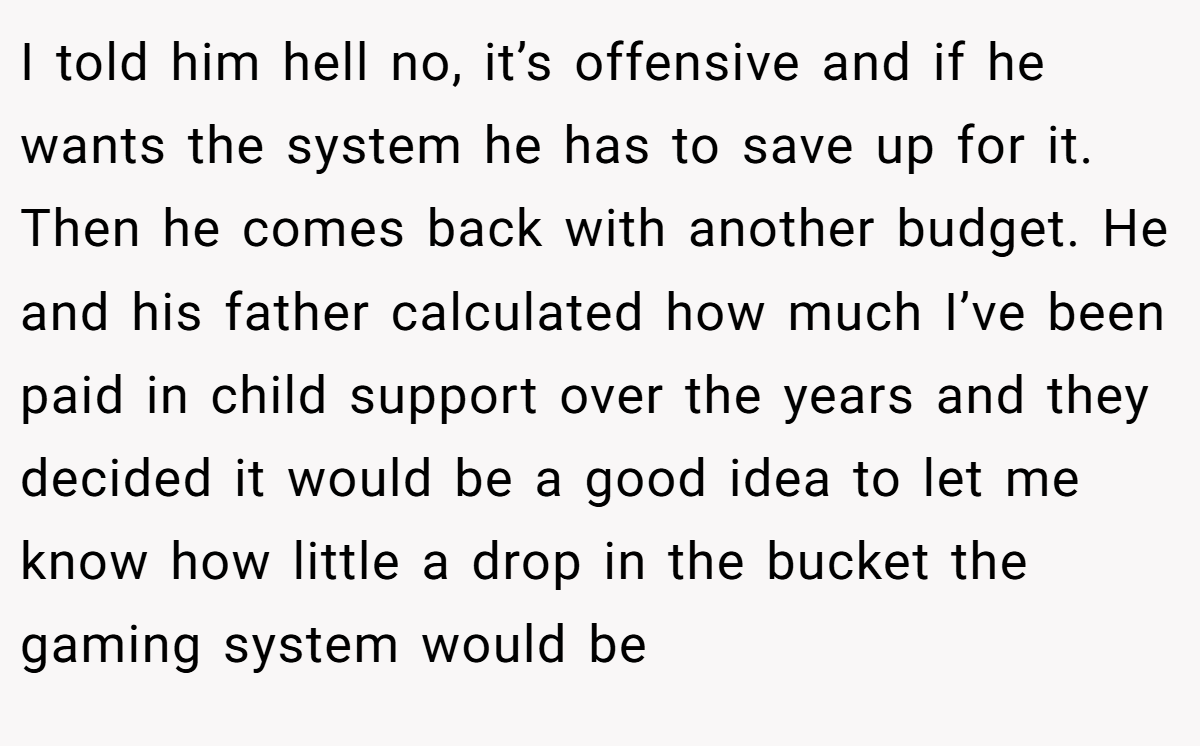

Letting a teenager’s creative budgeting scheme unravel family finances can feel like a wake-up call. In this case, the parent’s response to the gaming system request was more than just a rejection—it was a deliberate demonstration of the true expenses involved in raising a child. By challenging the notion that child support magically covers all costs, the parent exposed a hard financial reality with a mix of humor and practicality.

Analyzing the dynamics here, the child’s approach to calculating expenses highlights a common pitfall among teens: a disconnect from the full picture of daily costs. The parent’s counter by issuing a bill was not about shaming but clarifying that luxury items, like a new gaming system, come at a steep cost when compared with necessary monthly expenses. This act served as an unconventional lesson in accounting, aimed at preventing entitlement while fostering financial literacy.

Transitioning from the household to a broader perspective, many experts in personal finance stress the value of budgeting and transparency. According to financial expert Dave Ramsey, “A budget is telling your money where to go instead of wondering where it went.” This quote resonates strongly in the current scenario, as it reinforces that every expense has a purpose and must be balanced against essential costs. Ramsey’s advice, widely available in public discussions on budgeting and money management, underscores the significance of planning and realistic expectations.

Further dissecting the situation, the parent’s method is a reminder that effective communication about money can demystify financial challenges. Instead of accepting entitlement, this approach prompts young adults to consider the full spectrum of costs involved in living independently. It also sparks a conversation on the societal expectations placed on parental support versus self-reliance, urging all parties to rethink traditional roles. A balanced view of responsibility encourages teens to explore part-time work and savings strategies, which could foster a stronger appreciation for money management in the long run.

In wrapping up this analysis, the lesson is clear: understanding finances early on is paramount. The parent’s bold move to present a bill wasn’t an act of disdain; it was a teaching moment aimed at equipping a young mind with the practical skills needed for adulthood. Ultimately, fostering transparency about money matters benefits everyone in the family dynamic.

Here’s how people reacted to the post:

Here are some hot takes from the Reddit community – candid and humorous. Many Redditors agreed that the son’s calculated approach was misguided and that his budget failed to grasp the full picture of family expenses. The comments, summarized as, reveal that while some found the parent’s response refreshingly direct, others stressed the importance of reassuring a teen that he isn’t a burden. Do these opinions really capture the complexities of family finances?

In conclusion, the interaction between the parent and the teenager is a modern parable about money, entitlement, and the education that happens outside traditional classrooms. This story invites us to reflect on what it takes to manage household finances and the importance of clear communication about expenses. What would you do if you found yourself in a similar situation? Share your experiences and thoughts in the discussion below!