My family expects me to spend all of this money on my sister because she is married with a baby?

In many families, the act of sharing financial burdens can feel like a warm display of support. However, when the expectation to contribute becomes relentless, it can turn into a suffocating demand that hinders personal ambitions. This story sheds light on one woman’s struggle to balance her commitment to family with her own dreams of financial independence.

The narrative unfolds around a young woman caught between her familial duties and her urgent need to secure her own future. As her family continues to lean heavily on her support for extravagant expenses tied to her sister’s life milestones, the tension grows—forcing her to confront the challenge of honoring family bonds while safeguarding her personal financial goals.

‘My family expects me to spend all of this money on my sister because she is married with a baby?’

Family obligations often blur the lines between genuine support and financial exploitation. In this case, the pressure to contribute is not only emotionally taxing but also compromises the OP’s ability to invest in her future. The situation forces a difficult balancing act—supporting a sibling while facing a mounting personal financial deficit. This common predicament calls for clear boundaries to maintain individual financial health.

Analyzing the OP’s predicament reveals that the family’s excessive spending demands stem from a long-standing cultural norm, where financial support is seen as an unconditional duty. The OP has been repeatedly asked to contribute to events and luxury expenses, regardless of her own plans for financial stability. This dynamic creates a space where her personal aspirations are sidelined in favor of family obligations, highlighting a significant conflict between duty and self-care.

Expanding beyond this individual case, the issue resonates with broader societal expectations that often pressure individuals to place family needs above their own. Recent discussions in financial wellness communities suggest that many young adults face similar situations.

According to various studies, nearly 40% of millennials report feeling obligated to provide financial support for family members even when it clashes with their personal savings goals. For further reading on establishing financial boundaries, reputable sources such as DaveRamsey.com offer insightful advice and resources.

Drawing upon widely respected financial guidance, expert Dave Ramsey once stated, “A budget is telling your money where to go instead of wondering where it went.” This quote underscores the importance of proactive financial planning. In this context, the OP may benefit from setting firm financial limits and discussing openly with her family about her current priorities. Embracing such measures could provide the balance needed between familial obligations and personal independence, ensuring that her financial well-being is not compromised.

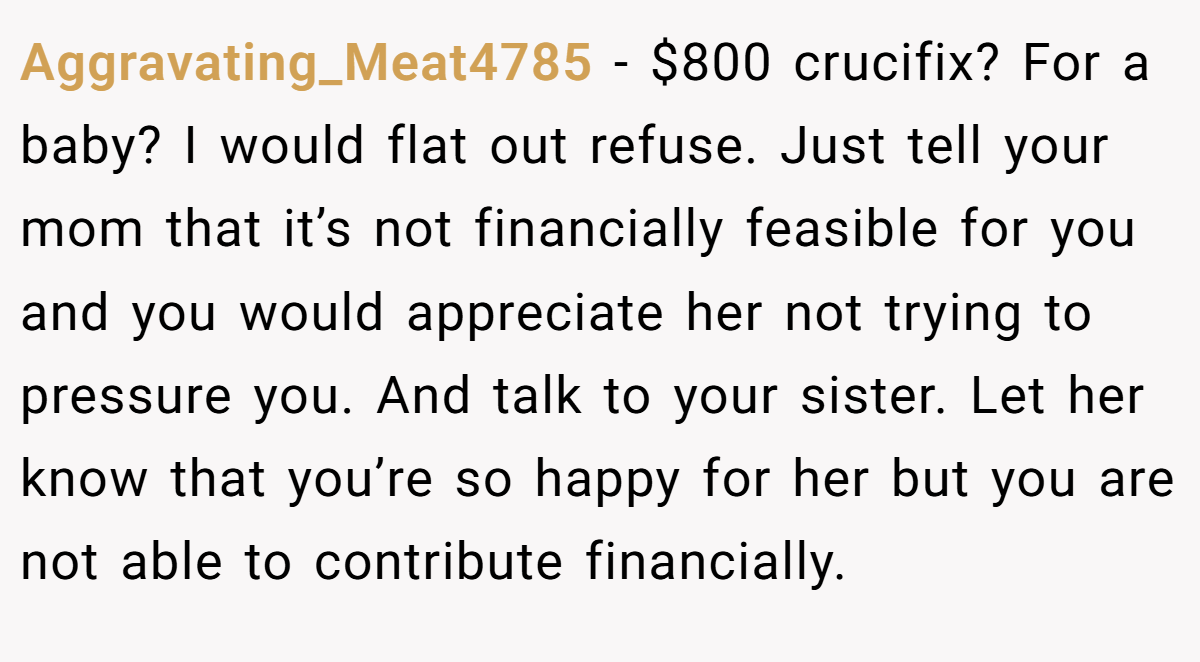

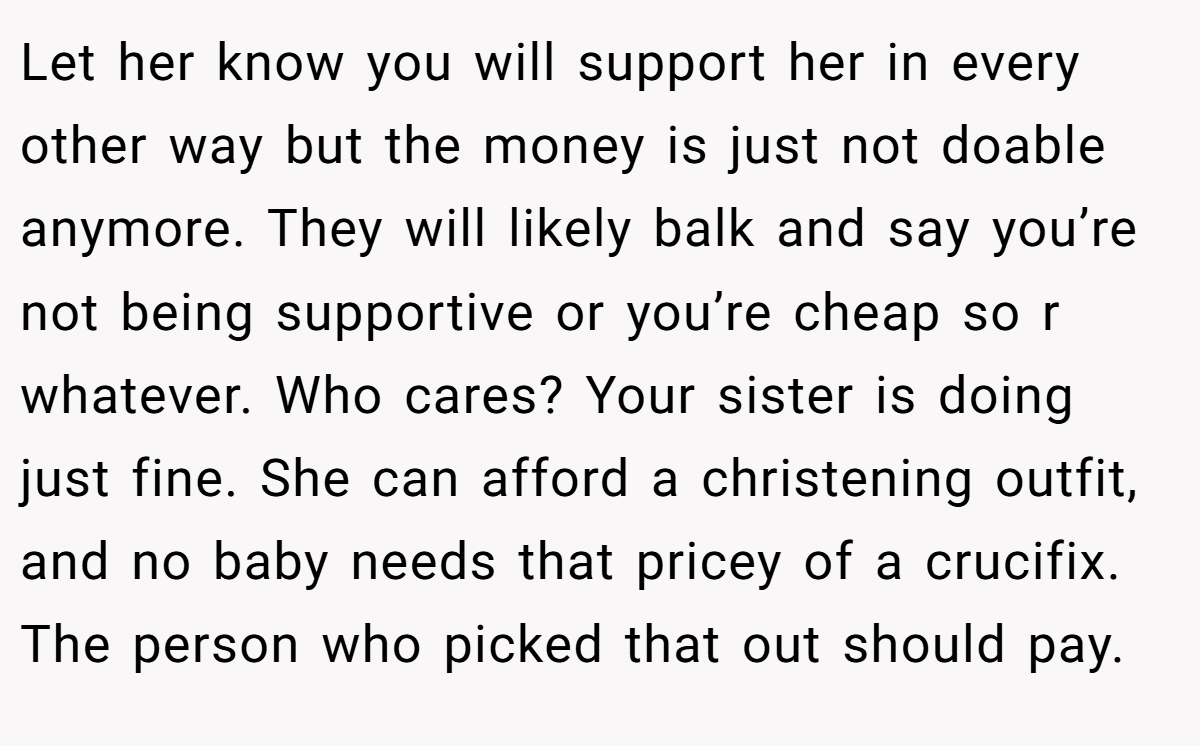

Here’s how people reacted to the post:

Here are some hot takes from the Reddit community—candid, humorous, and refreshingly blunt. These popular opinions reflect a mixture of empathy, practical advice, and wry humor from those who have encountered similar family dynamics. Do these views resonate with your experience, or do you see things differently?

In wrapping up the narrative, the tension between family expectations and personal financial priorities remains a relatable challenge. The OP’s experience serves as a reminder of the importance of setting clear boundaries while maintaining familial ties. Balancing support with self-care can empower individuals to pursue their dreams without undue pressure. What would you do if you found yourself in a similar situation? Share your thoughts and experiences below—let’s keep the conversation going!