AITA for holding my son to a contract and making him pay me back from his education fund?

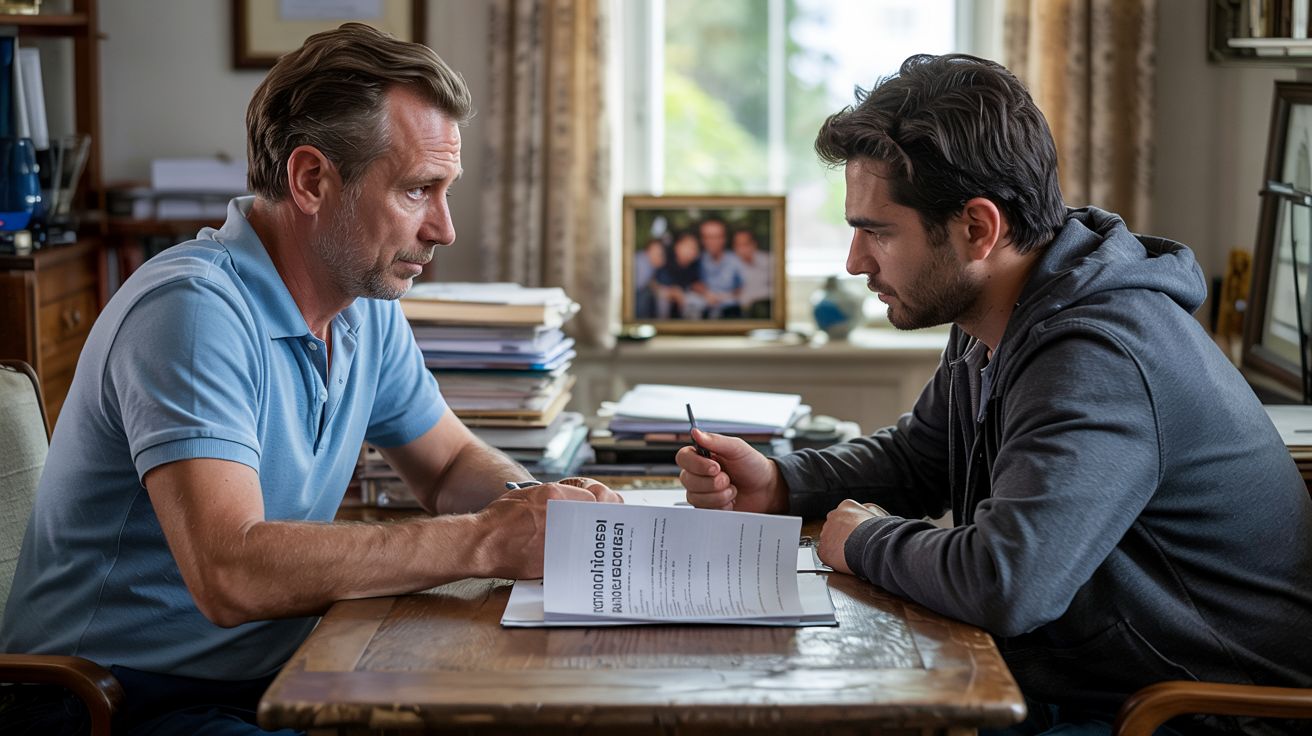

The kitchen table was strewn with old receipts and a crumpled contract, a silent witness to a father’s gamble on his son’s dreams. Two years ago, Tom, 45, watched his fresh-out-of-high-school son, Jake, pitch a “foolproof” investment with the starry-eyed confidence of youth. Against his better judgment, Tom loaned him the cash, tying it to a deal: if it tanked, Jake’s education fund would take the hit. Now, with the plan in ashes, that contract’s come due.

Jake’s back home, eyeing community college, but his wallet’s as empty as his promises to repay. Tom’s insistence on accountability has Jake fuming and his ex-wife seething, painting Tom as the bad guy. Readers might feel the sting of tough love, wondering if teaching a lesson is worth the family rift. This story dives into the messy clash of trust, money, and growing up—can a dad be firm and fair?

‘AITA for holding my son to a contract and making him pay me back from his education fund?’

Money and family mix like oil and water, and Tom’s story is a textbook case. Holding Jake to a contract might seem cold, but it’s rooted in a hard truth: actions have costs. Jake’s bravado led to a bust, and Tom’s insistence on repayment is less about cash and more about maturity. Still, the family’s backlash shows how tough love can spark more heat than light.

Financial psychologist Dr. Brad Klontz, in a 2023 Forbes article, says, “Teaching financial accountability early sets kids up for independence—shielding them from consequences breeds entitlement.” Tom’s loan, secured by Jake’s education fund, mirrors this, forcing Jake to face his choices. But the harsh delivery risks resentment, clouding the lesson.

Data backs this up: a 2022 Journal of Consumer Affairs study found 35% of young adults who dodge financial consequences repeat risky behaviors. Tom’s not wrong to enforce the deal, but he’s walking a tightrope—pushing accountability without alienating Jake.

What’s the fix? Dr. Klontz advises pairing consequences with guidance: Tom could offer a repayment plan tied to Jake’s new job, showing faith while keeping the lesson intact. It’s a chance to mend fences without caving. Readers, ever had to teach a costly lesson? How’d you balance love and limits?

Here’s how people reacted to the post:

Reddit’s crowd dove into Tom’s dilemma like it was a family reunion brawl, tossing out cheers, critiques, and a few head-shakes. It’s like overhearing a lively bar debate—everyone’s got a take, and they’re serving it hot. Here’s the unfiltered scoop from the masses, packed with sass and wisdom:

These Redditors aren’t holding back, hailing Tom as a tough-love champ or nudging him to ease up. Some see Jake’s pout as proof he needed the wake-up call; others wonder if Tom’s playing too hardball. But do their spicy opinions catch the whole picture, or are they just fanning the flames? One thing’s clear—this dad-son showdown’s got everyone talking. What’s your verdict on Tom’s stand?

Tom’s saga is a gritty snapshot of parenting at the crossroads of trust and tough choices. By holding Jake to the contract, he’s betting a hard lesson now will save bigger pain later—but at what cost to their bond? Jake’s got college ahead, and maybe this sting will sharpen his focus. Or maybe it’s just a wedge. What would you do if your kid’s big dream flopped and you held the bill? Share your take below!

![[Reddit User] − The fact that it was described as a 'foolproof investment' shows that he is either being disingenuous or has no idea what he is talking about.. A gamble with a positive expectation? Sure.. Foolproof? Lol no. Not sure about a judgement. How old was he when he accepted this offer? If an adult then probably not the a**hole. If not, then likely you are the AH. Enabling a minor to gamble is a bad idea. Thats a no-brainer.. Edit: NTA based on OPs comments below](https://en.aubtu.biz/wp-content/uploads/2025/04/120140cm-02.png)