AITA for not agreeing with my husband to fund his brother’s trip from our joint savings?

A sunny afternoon turned tense when a wife caught wind of her husband’s plan to dip into their joint savings for his brother’s whimsy. Picture a cozy home, kids’ toys scattered across the rug, and a couple facing a financial crossroads. This wasn’t about groceries or school fees—it was about funding a transatlantic jaunt for a wedding. The wife, a practical soul juggling motherhood and work, felt her stomach knot at the thought of their hard-earned money vanishing for someone else’s party.

Her unease wasn’t just about dollars; it was about trust and boundaries in their nine-year marriage. Readers might wonder: should family loyalty trump shared agreements? The online buzz suggests she’s not alone in wrestling with this. As the story unfolds, it’s clear her stand stirred more than just her husband’s temper—it sparked a broader chat about money and family ties.

‘AITA for not agreeing with my husband to fund his brother’s trip from our joint savings?’

Money talks, but in this case, it screamed family drama. The wife’s clash with her husband over joint savings reveals a classic tug-of-war between personal loyalty and shared goals. She stood firm, insisting her brother-in-law’s wedding trip wasn’t their burden. Her husband, caught between sibling pressure and marital harmony, initially misstepped but later saw her point. This isn’t just about one couple—it’s a peek into how money can tangle family ties.

The wife’s stance highlights a key issue: financial boundaries in marriage. Both sides had valid feelings—her need to protect their nest egg versus his urge to support his brother. Yet, using joint funds without mutual consent risks trust. As financial expert Ramit Sethi notes in his blog, “Couples who align on money goals build stronger partnerships” (source: I Will Teach You to Be Rich). Sethi’s take underscores why the wife’s push for agreement mattered—she was safeguarding their shared vision.

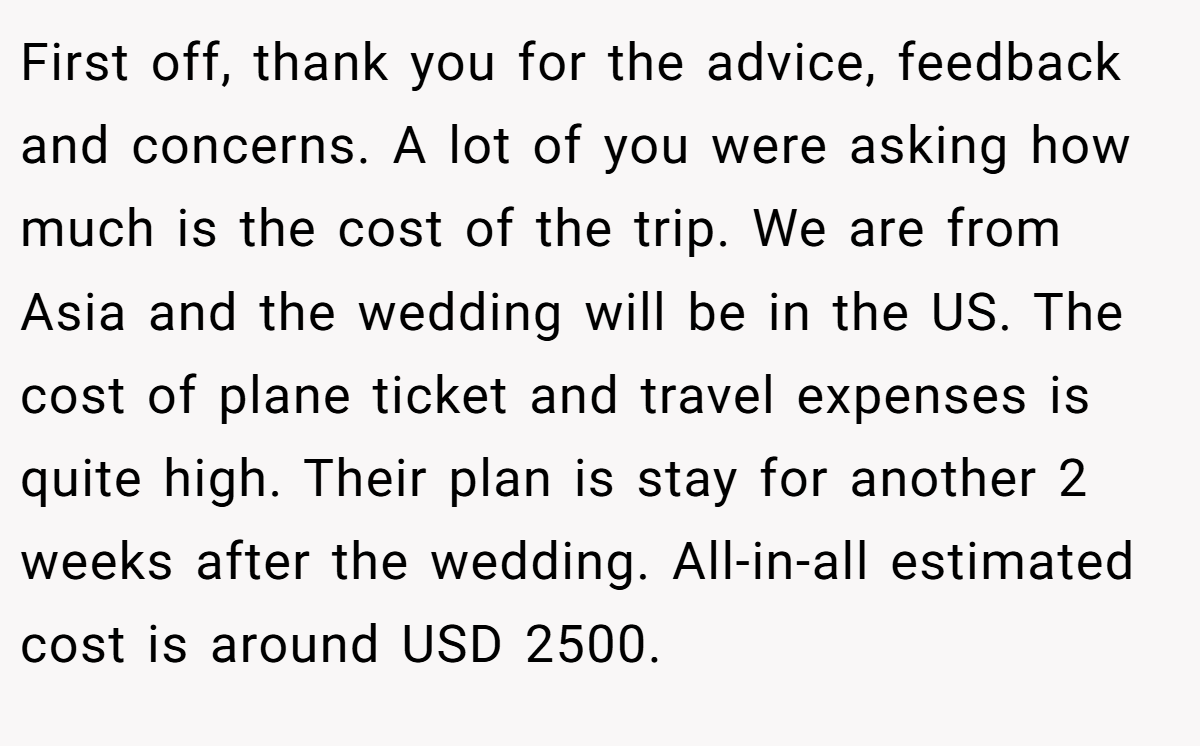

Zooming out, this story taps into a broader issue: family expectations around money. A 2021 survey by Fidelity found 34% of couples disagree on major financial decisions, often involving extended family (source: Fidelity Investments). The brother-in-law’s request, framed as a gift, not a loan, mirrors a cultural habit of leaning on relatives for non-emergencies. The wife’s suggestion that he skip the trip if he can’t afford it isn’t cold—it’s pragmatic. Not every want is a need.

For advice, Sethi’s wisdom applies: set clear rules for joint accounts. Couples could agree on a cap for family gifts or require both signatures for big withdrawals. Here, the husband’s apology and shift to using personal funds show growth, but they might still benefit from a formal budget chat. Readers, what’s your take? Ever had to draw a line with family over cash? Share below to keep this convo going.

Take a look at the comments from fellow users:

Let’s see what the ever-insightful (and often hilariously blunt) voices of the Reddit community had to say about this financial tug-of-war. The overwhelming consensus sided with the OP, with many commenters firmly stating “NTA” and applauding her for setting clear boundaries regarding their joint finances.

The sentiment is strong that a wedding trip for a brother-in-law is not a shared expense and should be funded from personal accounts, if at all. Many Redditors expressed concern over the husband’s initial inclination to dip into the joint savings without a prior agreement, highlighting the importance of mutual consent in financial matters within a marriage.

This story offers a relatable glimpse into the financial negotiations that often occur within a marriage, particularly when extended family needs arise. The OP’s initial hesitation to use joint savings for her brother-in-law’s trip sparked an important conversation about financial boundaries and the purpose of shared versus personal funds.

While the situation was ultimately resolved amicably, it raises a broader question: how should couples navigate requests for financial help from family members? What are some strategies for setting healthy boundaries while still maintaining supportive relationships? Share your experiences and advice in the comments below!