AITAH for canceling my life insurance policy because my husband wont make a beneficiary on his?

In the tapestry of life, where threads of love and commitment are interwoven, financial security often serves as an unspoken yet crucial anchor. For one woman, the decision to intertwine her life with a man she’d cherished for years seemed a natural progression. She thoughtfully extended this security, ensuring that should the unexpected occur, her new husband wouldn’t face the daunting realities she had once navigated after losing her parents.

Yet, a shadow of doubt has fallen upon this carefully constructed picture, all stemming from a simple, yet profound, request regarding a life insurance beneficiary. The initial gesture of securing her husband’s future has morphed into a stark revelation, leaving her grappling with questions of partnership and preparedness.

As the implications of his steadfast refusal sink in, the comfortable rhythm of their shared life is disrupted, replaced by a disquieting imbalance that forces her to reconsider the very foundations of their financial and emotional bond. The air crackles with unspoken anxieties, a silent testament to the potential vulnerabilities that lurk beneath the surface of even the most loving unions.

‘AITAH for canceling my life insurance policy because my husband wont make a beneficiary on his?’

Letting your partner meet your family and intertwining your finances often signifies a deepening of commitment, yet ensuring mutual financial security through life insurance is a practical extension of this bond. In this scenario, the wife’s proactive approach to securing both her children’s and her husband’s future highlights a responsible and forward-thinking mindset.

However, the husband’s reluctance to reciprocate raises significant questions about his understanding of partnership and shared responsibility. His insistence on maintaining his mother, who is financially secure and geographically distant, as his sole beneficiary, despite his wife’s similar gesture towards him, appears to prioritize familial ties over the practical needs of his spouse.

This decision can be interpreted through various lenses, potentially indicating an emotional attachment that overrides logical financial planning or, as some Reddit commenters suggest, a less invested view of the marital partnership. As Dr. Gail Saltz, a clinical associate professor of psychiatry at the New York Presbyterian Hospital, aptly states,

“Money issues are one of the top stressors in a marriage, and disagreements about finances can often reflect deeper, unresolved conflicts about values, control, and security.” The wife’s reaction, canceling her policy for him and redirecting her assets to her children, is a direct consequence of feeling financially exposed and unacknowledged in the partnership.

Her past experience of managing her deceased parents’ affairs underscores her desire to shield her children from similar burdens, a desire that now extends to her own security in the face of her husband’s stance. This situation underscores the importance of open and honest communication about financial expectations and planning early in a marriage.

Ultimately, the impasse highlights a potential disconnect in how each partner views their financial obligations and responsibilities within the marriage. While individual financial autonomy is important, a refusal to consider the financial well-being of one’s spouse, especially when the other partner has demonstrated a commitment to mutual security.

Can erode trust and create significant tension. Addressing these underlying issues through open dialogue or even professional financial counseling might be necessary to bridge this divide and ensure a more equitable and secure future for both individuals.

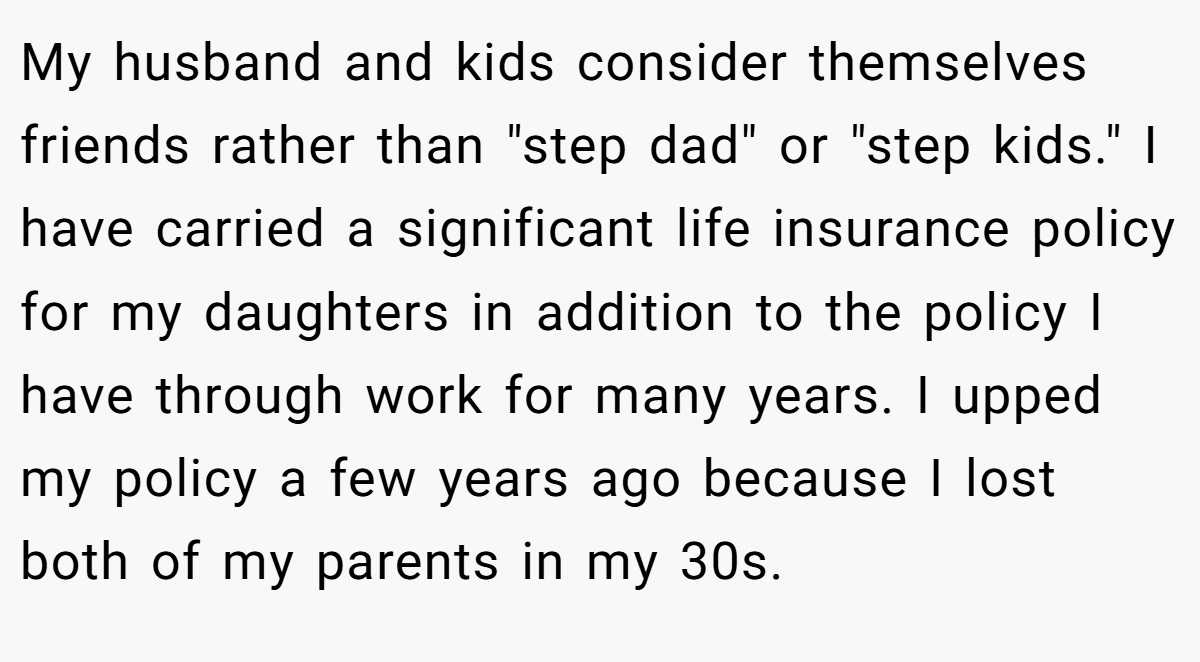

Here’s the feedback from the Reddit community:

Overall, the Reddit community largely agrees that the wife’s decision to protect her children’s future by canceling the policy was justified. Many feel that, when it comes to financial planning, prioritizing family security should always come first—even if it means challenging established marital expectations.

The common sentiment is one of support for proactive steps in financial planning, with readers noting that this decision reflects a broader need for clarity and responsibility in handling family assets.

In conclusion, this story offers a vivid glimpse into the complexities of blending finances and personal relationships. It prompts us to question traditional expectations about spousal responsibilities and to consider the critical importance of clear, up-to-date financial planning.

What would you do if you found yourself in a similar situation? Join the conversation and share your thoughts, experiences, and advice to help others navigate these delicate family and financial crossroads.

![[Reddit User] − I would not want to be married to this person anymore. I hope you had a good prenup](https://en.aubtu.biz/wp-content/uploads/2025/04/109955c-09.png)