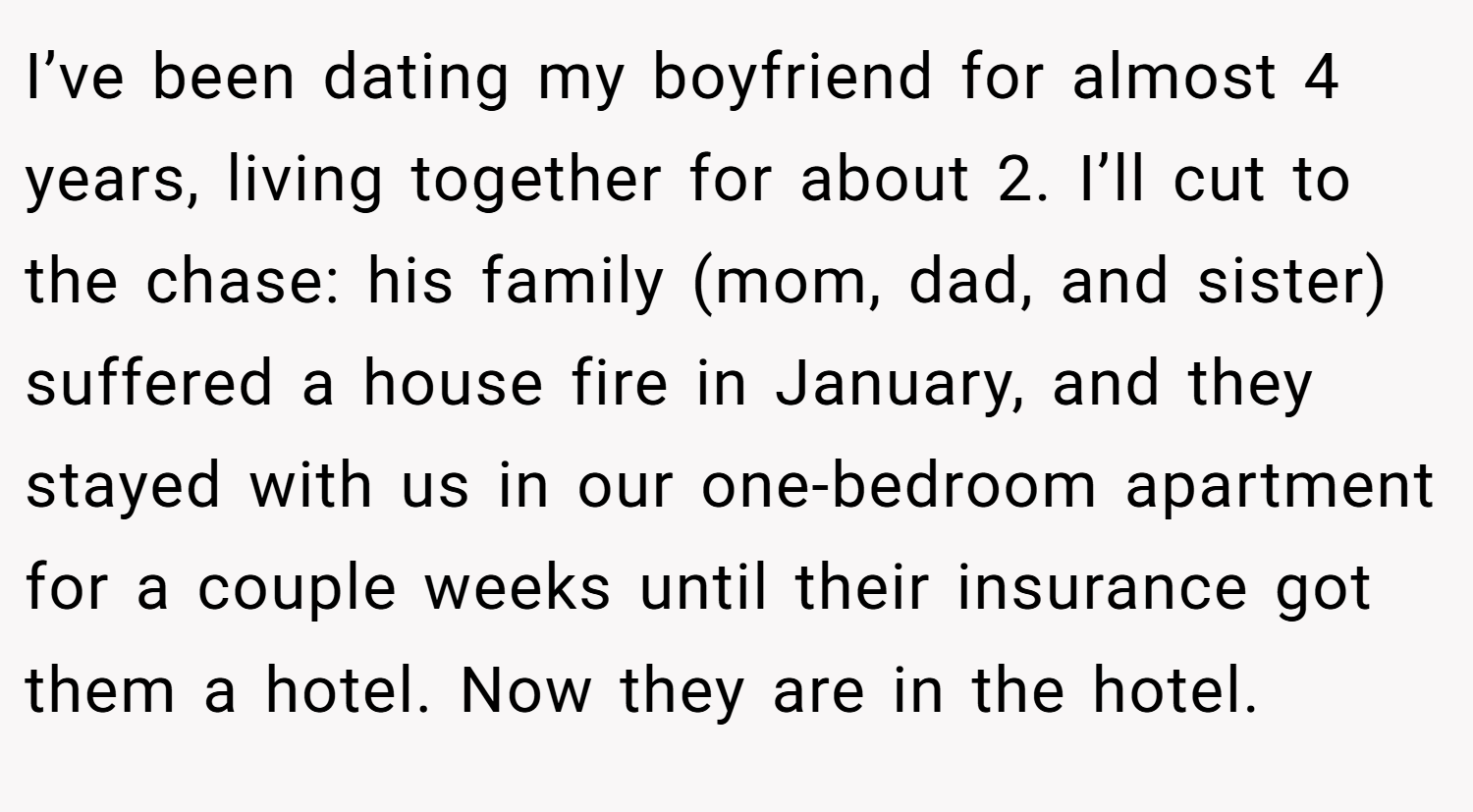

My (25f) boyfriend’s (26m) family lost their home in a fire, and are asking me to put my name on a mortgage loan so they can buy a new house. I’d love to be helpful, but is that too much to ask?

Picture a cramped one-bedroom apartment, where the air hums with the soft purrs of nine cats and the faint scent of litter. A young woman sits on a shredded couch, her laptop open, dreams of starting a business flickering amidst the chaos. Her boyfriend’s family, displaced by a devastating house fire, now leans on her to co-sign a 30-year mortgage for their new home. It’s a plea wrapped in love and desperation, but the weight of it presses hard on her heart.

This dilemma is a tug-of-war between loyalty and self-preservation. At 25, she’s caught in a whirlwind of guilt, love, and financial fear, with nine cats and a potential new housemate adding to the chaos. Readers can’t help but feel the squeeze—should she risk her future to save her boyfriend’s family, or draw a line in the sand? It’s a story that claws at the edges of family, duty, and personal dreams.

‘My (25f) boyfriend’s (26m) family lost their home in a fire, and are asking me to put my name on a mortgage loan so they can buy a new house. I’d love to be helpful, but is that too much to ask?’

Saying yes to a mortgage for someone else’s family is like jumping into a pool without checking the depth. This young woman’s hesitation is spot-on—co-signing a 30-year loan for her boyfriend’s family could tether her to a financial anchor.

Her boyfriend’s family, reeling from a fire, sees her as their ticket to stability, but the risks are glaring. If payments falter, her credit takes the hit. Per Experian, co-signers are equally liable for the debt (Experian). With her boyfriend’s income insufficient alone, the burden could fall on her, especially if their relationship sours. Financial advisor Suze Orman warns, “Co-signing a loan is like handing over your financial future” (CNBC).

This taps into a broader issue: young adults often face pressure to bail out loved ones. About 38% of Americans have taken on debt for family, per a 2023 LendingTree survey (LendingTree). Her fear of losing her relationship or gaining a new roommate (the sister) is real, but tying her name to this loan could derail her business dreams and homeownership plans.

Orman’s advice? “Say no with love.” She should politely decline, suggesting the family explore rentals or government aid for fire victims. If the sister moves in, set clear boundaries, like rent contributions. This preserves her financial independence while showing compassion.

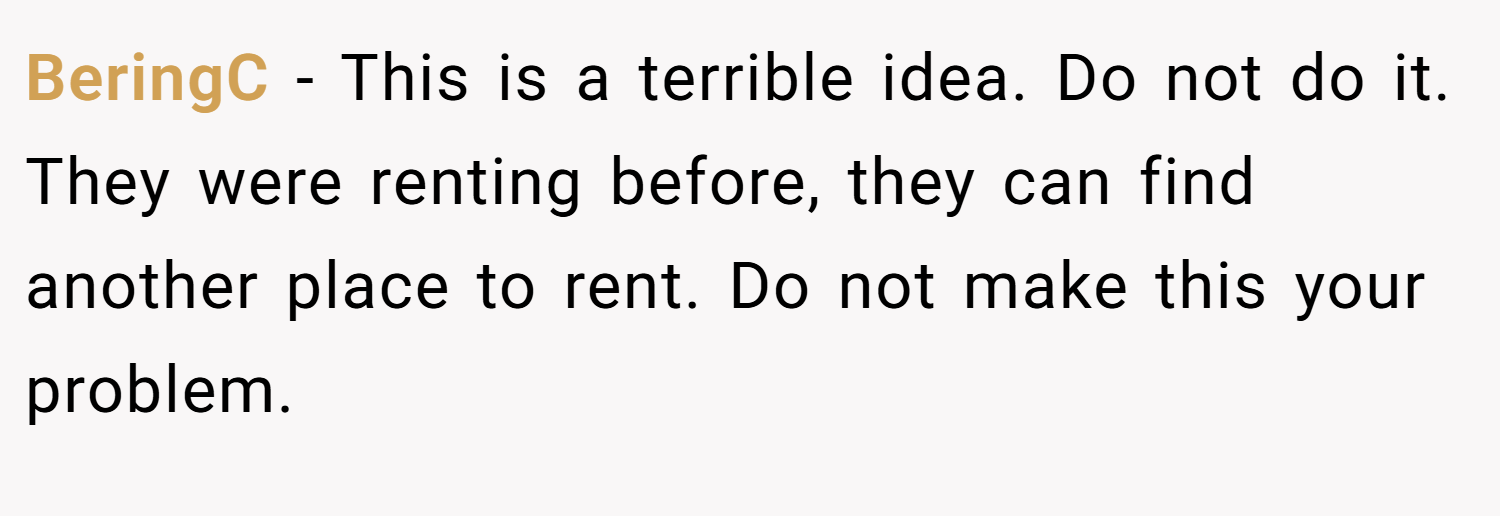

Let’s dive into the reactions from Reddit:

The Reddit squad came in hot, waving red flags like they’re at a bullfight. It’s a lively mix of “no way” and “run for the hills,” with a side of blunt humor. Here’s the unfiltered scoop:

These Redditors are screaming for her to dodge this financial bullet, warning of ruined credit and a lifetime of regret. Some smell manipulation; others just see desperate in-laws. But do their dire predictions miss the nuance of her loyalty to her boyfriend? One thing’s certain: this mortgage mess has sparked a firestorm of opinions.

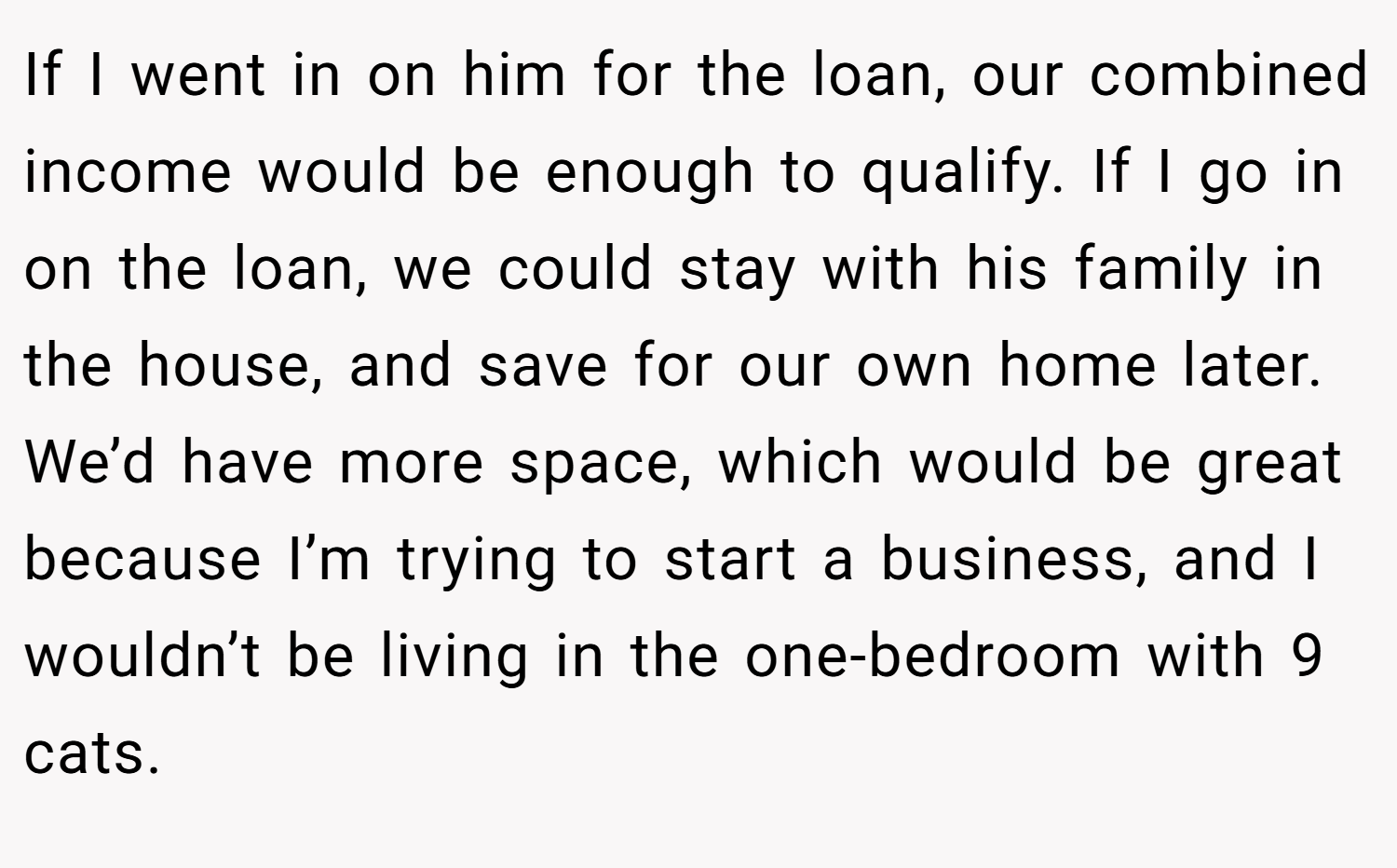

This tale is a stark reminder that love doesn’t mean signing your future away. The young woman’s instinct to pause before co-signing a mortgage reflects a savvy grasp of her worth, even as guilt gnaws at her. With nine cats and a crowded apartment already stretching her limits, saying no might just save her dreams. But the heart aches to help—where’s the line? Have you ever faced a family plea that tested your boundaries? Share your stories below!

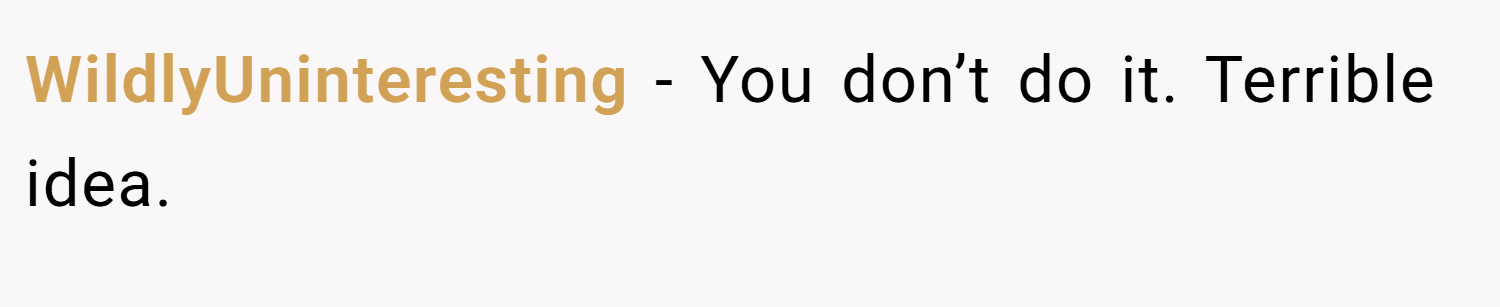

![[Reddit User] − If I go in on the loan, we could stay with his family in the house, and save for our own home later. **If you go in on the loan, and they do not, then THEY would be staying in YOUR house, and you would *already* own your own home — that one.**.](https://en.aubtu.biz/wp-content/uploads/2025/05/170824cm-15.png)