AITAH for divorcing my wife after she went into massive debt again?

In relationships, trust and transparency are essential—especially when it comes to finances. In this story, a 34-year-old man details his painful decision to divorce his wife after she once again plunged them into massive debt. Five years ago, when they first got serious, he even helped her consolidate and pay off a whopping $60K in debt.

But just as life seemed to be settling into a comfortable routine—marriage, a new home—a hidden storm emerged. He started noticing secretive behavior, mysterious packages, and hidden bills. After confronting her, he learned that she had racked up an additional $45K in debt on seven different cards, even going so far as to open a credit card in his name.

Despite attempts at counseling for both their finances and their marriage, her reckless spending continued. Left with no other choice, he filed for divorce, only to face backlash from her family, who accuse him of abandoning her in a time of need. This raises a crucial question: when does helping someone cross the line into self-destruction, and is walking away ever justified?

‘AITAH for divorcing my wife after she went into massive debt again?’

The decision to divorce in this scenario isn’t made lightly—it stems from a deep betrayal of trust and financial irresponsibility. When financial decisions are made in secret, especially ones that involve incurring massive debt and even identity misuse, it signifies more than just poor money management. It reveals a pattern of deception and a disregard for the well-being of both partners. Financial infidelity, as many relationship experts term it, is a serious violation. As Dave Ramsey often emphasizes, “You aren’t a bank.”

Helping a partner in times of need is one thing, but continually bailing someone out of debt, especially when they’re hiding their actions, creates an unsustainable dynamic. In relationships, the merging of finances is a mutual responsibility. The recurring nature of the debt and the breach of trust—evidenced by the unauthorized credit card—indicates that counseling and financial planning were not enough to correct the behavior.

Experts suggest that when one partner repeatedly undermines the financial stability of the relationship, it isn’t just about money—it’s about respect, honesty, and the shared commitment to a secure future. In such cases, divorcing may be the only way to protect one’s financial health and personal well-being, even if it feels like an abandonment to some. For those in similar situations, the advice is to establish clear financial boundaries from the very beginning.

Open communication about money, regular financial check-ins, and transparency are essential. If you find that your partner is consistently secretive about expenses or incurring debt without your knowledge, it’s important to address these issues immediately.

And if attempts at mediation or counseling fail to resolve the problem, prioritizing your own stability—both financially and emotionally—may be the most responsible decision. Protecting yourself isn’t just about preserving your bank account; it’s about maintaining trust and self-respect in the relationship.

Check out how the community responded:

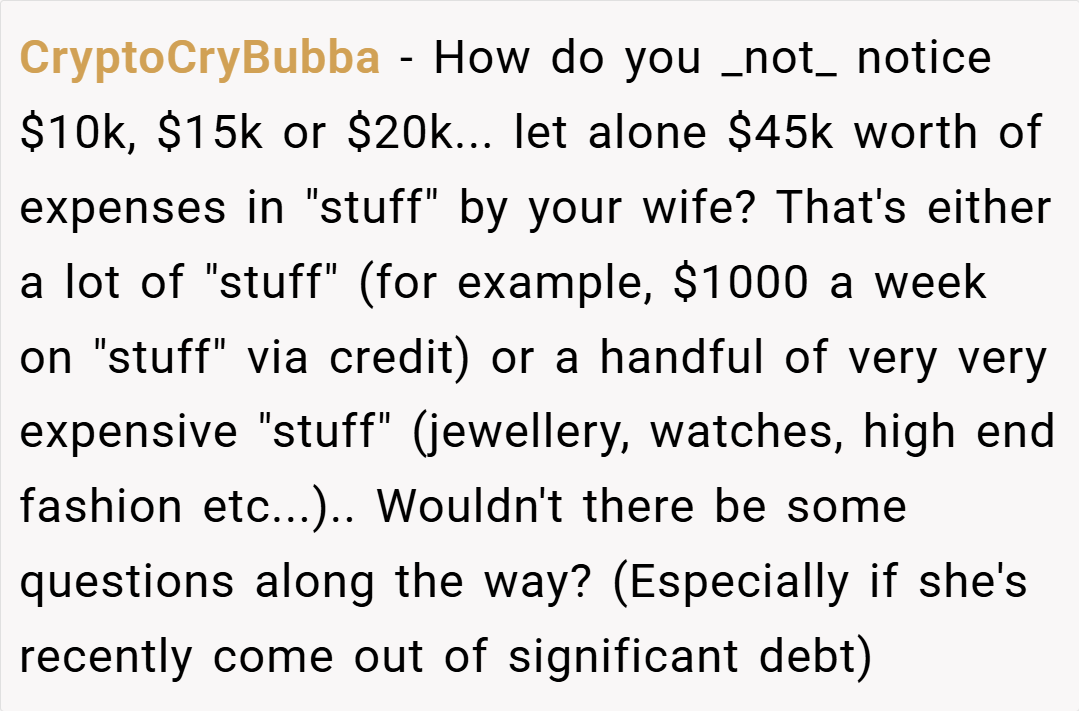

The Reddit community has largely sided with the OP, offering strong support for his decision. Many users pointed out that he is not a bank, and his wife’s continuous deceitful spending, despite his efforts to help, left him with no other option. Commenters stressed that financial infidelity is a major breach of trust and that her behavior not only jeopardized their joint future but also put his personal credit at risk by opening an account in his name.

Some even shared personal anecdotes about similar experiences, emphasizing that divorcing someone who repeatedly disregards financial responsibility is a necessary step towards reclaiming stability and self-respect. The overall sentiment was clear: if your partner won’t take responsibility for their actions, you owe it to yourself to walk away.

Ultimately, this story serves as a cautionary tale about the importance of mutual trust and accountability in a relationship. When financial irresponsibility becomes a recurring pattern, and when one partner repeatedly undermines the other’s financial security, it forces a hard decision. While it’s natural to want to help those we love, there comes a point when enabling destructive behavior can no longer be justified. The OP’s decision to divorce his wife—despite her family’s protests—underscores the importance of protecting one’s future, both financially and emotionally.

What would you do if you were in a similar situation? Have you ever faced financial betrayal in your relationship, and how did you handle it? We invite you to share your experiences, thoughts, and advice on navigating these difficult decisions. Let’s start a conversation about financial boundaries, trust, and the sometimes painful choices we must make for our own well-being.