AITA for not letting my parents sell the house that is under my name to help them out with their financial hardship?

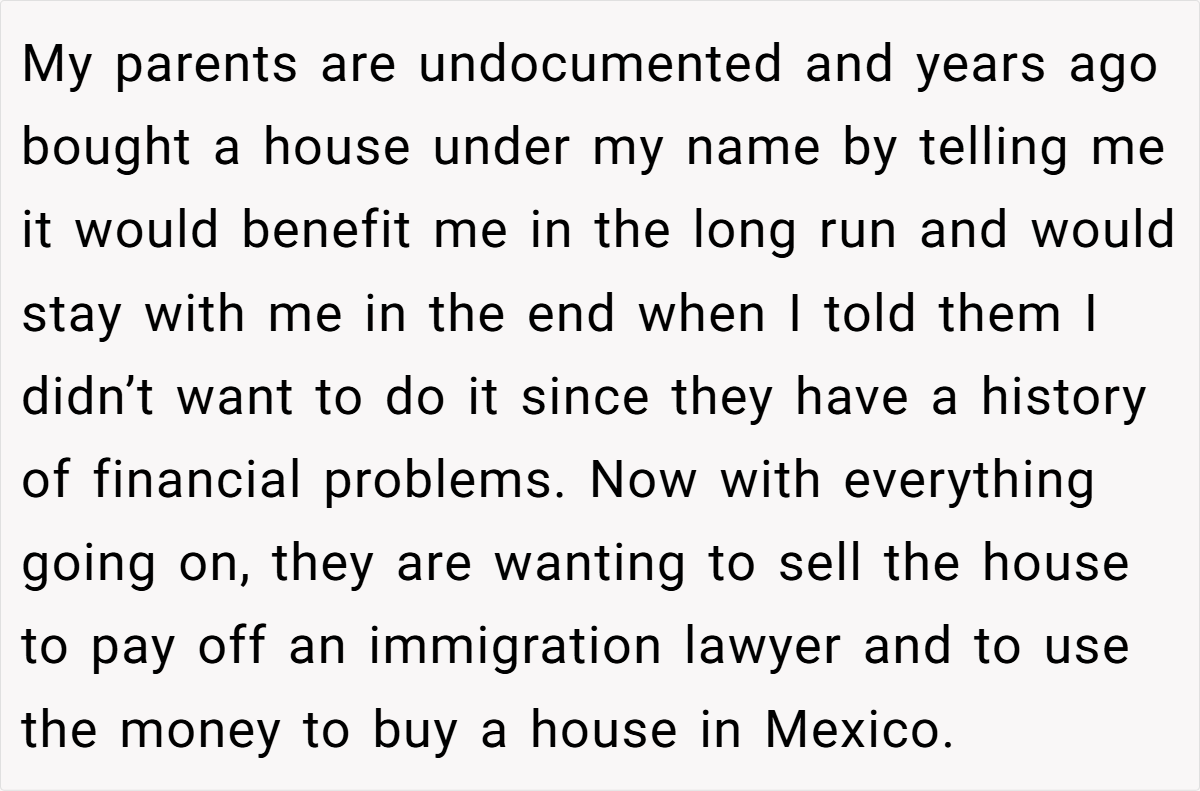

Family financial decisions can sometimes feel like navigating a minefield—especially when promises made years ago come back to haunt you. In this case, a 36-year-old woman recounts how her undocumented parents once convinced her to have a house put in her name, assuring her it would benefit her in the long run. Now, facing their financial hardships, they want to sell the house to pay for an immigration lawyer and fund a move back to Mexico.

Yet, despite their pleas, she refuses to let go of what she sees as her safety net for the future. The tension deepened when her father admitted he had lied about their financial needs, claiming he thought she’d never get married. With her husband and she living comfortably yet conscientiously saving for their own future, the disagreement has become a battle of values. Is it selfish to protect one’s hard-earned security, or should family always come first?

‘AITA for not letting my parents sell the house that is under my name to help them out with their financial hardship?’

When family and finances collide, emotions often run high and rationality can take a backseat. Financial therapist Dr. Lisa Raymond often notes, “Our financial decisions reflect our values and experiences; when past hurts are involved, they can cloud our judgment.” In this case, the house—once promised as a future inheritance—has become a symbol of both security and unresolved family dynamics.

The narrator’s refusal to sell it isn’t merely about money; it’s about protecting her future and rectifying past financial sacrifices. This decision, while understandably emotional, also underscores the challenge of balancing familial obligations with personal financial goals. Digging deeper, the situation touches on an important issue: transparency in family financial dealings.

Experts argue that when major assets are tied to family promises, it is crucial to have clear communication from the start. In our narrator’s case, her parents’ decision to place the house in her name was made under false pretenses. Over time, as she struggled financially to support them while trying to save for her own future, resentment naturally grew.

Dr. Raymond explains, “Financial deception, even if well-intentioned, can lead to long-term distrust and can jeopardize future financial stability.” The lack of honest dialogue here has left deep emotional scars. Another aspect to consider is the nature of intergenerational financial support. Often, families lean on each other during tough times, but this reliance can also create an unhealthy dependency.

Here, while the narrator does send a set amount of money to her mother, it is clear that she has learned from her own hardships. Her personal history of having to make sacrifices—even eating out of a trash can at work—has instilled a strong desire to secure her future. Experts suggest that establishing firm financial boundaries can help preserve one’s assets for personal goals while still offering support in a more sustainable way.

In this instance, holding on to the house symbolizes not only financial stability but also a break from repeating past struggles. Finally, the broader issue is about the responsibilities that come with financial independence. Dr. Raymond stresses that while helping family is admirable, it should not come at the expense of one’s own well-being.

The narrator’s stance reflects a cautious, long-term perspective: her future home and financial security should not be jeopardized by short-term family crises. Her decision to protect the house, despite her parents’ current hardship, is a manifestation of the need for self-preservation and responsible financial planning. In many cases, setting such boundaries might seem harsh, but it is essential when past patterns suggest that promises made will only lead to further financial instability.

Here’s what Redditors had to say:

The Reddit community has been equally divided, with some members advocating for compassion and others insisting that practicality must prevail. One commenter argued that selling the house could alleviate debt burdens and improve credit scores—a win-win for both parties.

Others countered, stating that since the house was promised to be a long-term asset for her, letting it go would be akin to relinquishing her future security for short-term relief. The general consensus, however, leaned toward understanding her hesitation, with many calling her actions a necessary measure to protect herself after years of financial sacrifice.

Ultimately, this story isn’t just about a house—it’s about the complex interplay of family loyalty, past financial struggles, and the need to secure a future. The narrator’s decision to not sell the house reflects a deep-seated need for stability and a break from a cycle of financial hardship. While some may see her refusal as selfish, others understand it as a hard-earned lesson in self-preservation.

We’d love to hear from you: Have you ever faced a situation where family obligations clashed with your own financial security? How did you navigate that delicate balance? Share your experiences and insights—your perspective might help others who are caught between love, loyalty, and financial prudence.

![[Update] The guy (29m) I’m (25f) dating and his friends “gatekeeped” me about my hobbies and career, I’m feeling embarrassed.](https://en.aubtu.biz/wp-content/uploads/2025/03/77865-768x403.jpg)