Inheritance Drama: When $4 Million Creates Relationship Tension

The Unexpected Windfall That Changed Everything

In a quiet apartment somewhere, a young woman sits staring at her bank account balance, still in disbelief. The numbers on the screen – representing over $4 million – feel surreal, like watching someone else’s life unfold. Just months ago, she was trudging to a job she despised, counting down hours until freedom. Now, with her grandfather’s unexpected inheritance, that freedom has arrived in spectacular fashion. But as the initial shock fades, a different tension emerges – one she never anticipated with the boyfriend who now eyes her newfound wealth with expectations.

The apartment they share has never looked better – professional cleaners ensure everything sparkles, a luxury she’s happy to provide from her inheritance. Yet beneath this polished surface, an uncomfortable conversation simmers. He believes her windfall should benefit them both immediately – covering their rent, utilities, and building a joint savings fund. She hesitates, protective of boundaries in a relationship still measuring its timeline in months rather than years. As voices rise over financial expectations, she wonders: does inheriting wealth obligate her to share it with a partner she’s not yet married to?

‘AITA for telling my boyfriend he isn’t entitled to my inheritance?’

Money Reveals What Time Conceals

Sudden wealth has an uncanny ability to expose relationship dynamics that might otherwise remain hidden for years. This couple’s situation highlights how quickly financial windfalls can test the foundations of even seemingly stable partnerships.

“Money conversations often reveal our true values faster than almost anything else,” notes Dr. Amanda Johnson, relationship therapist and author of “Wealth Boundaries.” “When someone immediately shifts from seeing themselves as an equal partner to feeling entitled to their partner’s resources, it signals potential issues with respect and boundaries that extend beyond finances.”

The girlfriend’s approach – maintaining her half of expenses while adding luxuries they both enjoy – demonstrates healthy boundary-setting. Meanwhile, her boyfriend’s immediate push for complete financial support suggests he views her inheritance as partly his, despite their relatively brief relationship history of just 18 months.

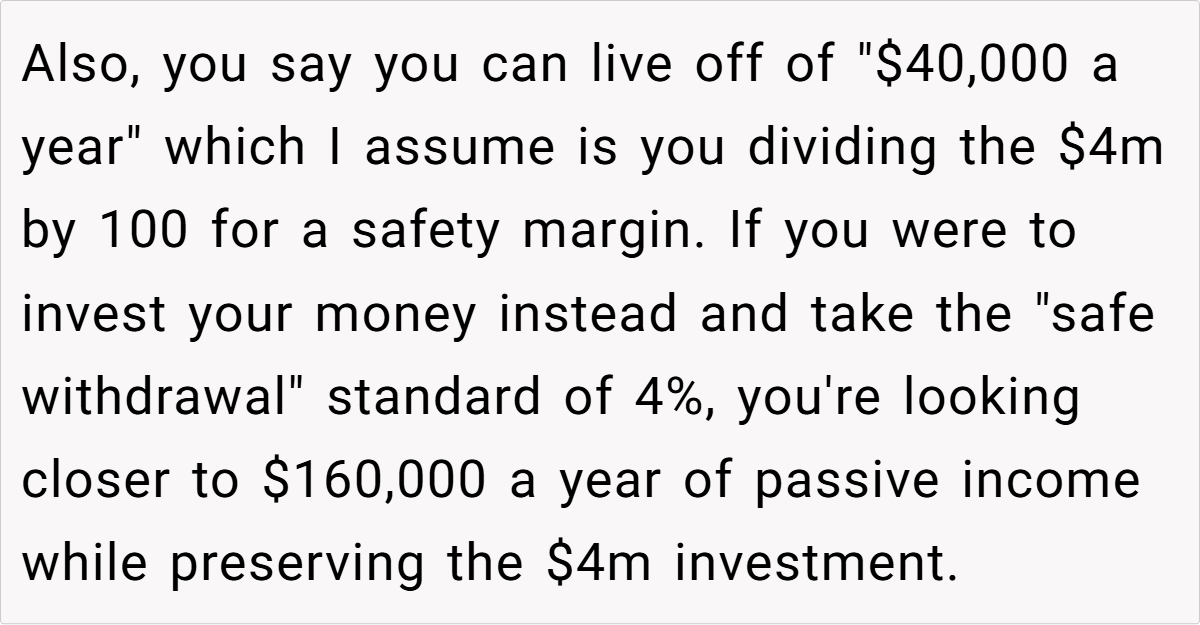

This case exemplifies a common issue: the confusion between sharing a life and merging finances. While the former may be happening, the latter requires explicit agreements and commitments that haven’t been established. Without marriage or formal financial agreements, maintaining separate finances represents prudent self-protection rather than selfishness.

For this couple, the inheritance hasn’t created new problems so much as accelerated the timeline for discovering compatibility issues that would eventually surface. Her desire for financial independence versus his expectation of immediate sharing reveals fundamentally different approaches to partnership that require honest conversation before any deeper commitments are made.

Here’s what Redditors had to say:

These are popular opinions on Reddit, but do they really reflect reality?

Inheritance can be both blessing and challenge, especially when it arrives unexpectedly in a developing relationship. The line between generosity and boundaries becomes critically important, as does the distinction between partnership and entitlement. While financial support within relationships is normal and healthy, the timing, expectations, and delivery of those conversations reveal much about character and intentions.

What would you do if you suddenly received a life-changing inheritance? Would you immediately share it with a partner of eighteen months, or would you establish protective boundaries? How would you balance enjoying your newfound freedom while maintaining healthy relationship dynamics? Share your thoughts and experiences in the comments below.

Yep. YTA, I don’t think it’s too much to ask for you to handle the rent and i agree with another person who thought it rather shallow to not work at all and only focus on yourself. Not even volunteer work? There’s no reason for a joint savings fund. But he could at least have a little extra to put back for himself since you clearly have no intention of this being a long term relationship. Also sounds like you lost interest in him once you had money.

Just curious, if the situation were reversed, and the man had 4 million dollars and was still asking her to pay for half the utilities would the answer be the same.